When opening bid is full-estimate...

brg5658

Posts: 2,399 ✭✭✭✭✭

brg5658

Posts: 2,399 ✭✭✭✭✭

It seems that Heritage is listing more coins with reserves that are full-estimate (or even over estimate once BP is added). Does this "contradiction of logic" not imply that either:

1) their estimate is too low

or

2) their reserve is too high?

========================================

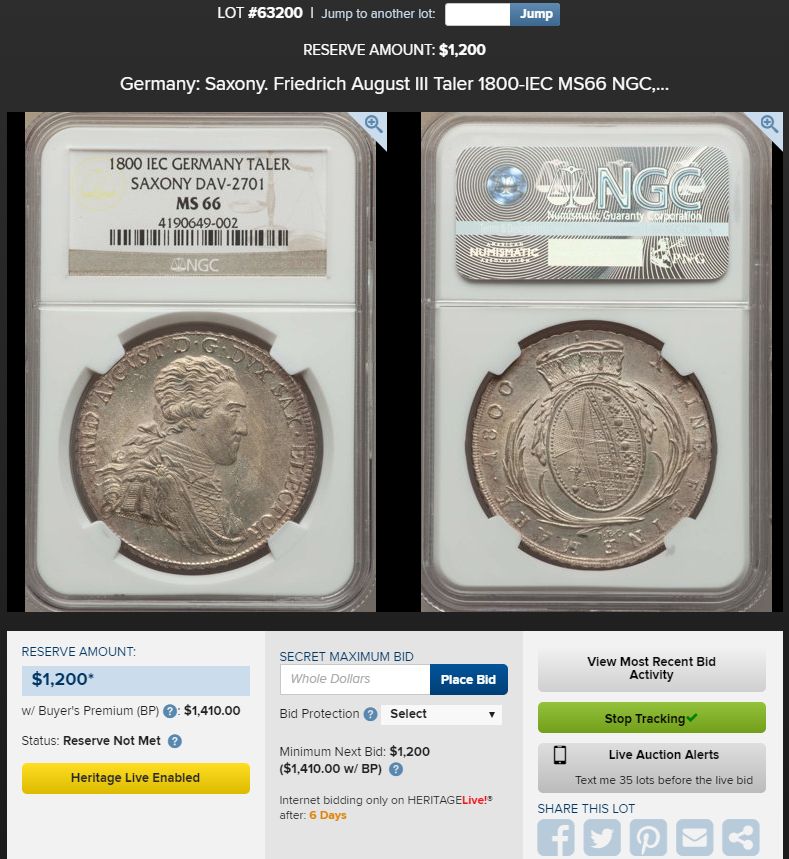

Here's the coin I'm referring to.

So, reserve is $1200 ($1,410 w/ BP) yet the estimate is $1200-$1400.

1) their estimate is too low

or

2) their reserve is too high?

========================================

Here's the coin I'm referring to.

So, reserve is $1200 ($1,410 w/ BP) yet the estimate is $1200-$1400.

-Brandon

-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-

My sets: [280+ horse coins] :: [France Sowers] :: [Colorful world copper] :: [Beautiful world coins]

-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-

-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-

My sets: [280+ horse coins] :: [France Sowers] :: [Colorful world copper] :: [Beautiful world coins]

-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-

0

Comments

NumisTip Coin Values

If the coin is reserved for full estimate or even beyond estimate, then why doesn't Heritage move the estimates?

The counter-intuitive conflicting information is what I find odd. An auction or seller can reserve a coin for whatever they want, but then why list the estimate for less than the opening bid?

-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-

My sets: [280+ horse coins] :: [France Sowers] :: [Colorful world copper] :: [Beautiful world coins]

-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-

Relax Brandon, these estimates are ALWAYS before the BP

It still doesn't make sense that the opening bid should be the bottom "estimate"...it seems more natural to start the opening bid at 60% of the bottom estimate (or something like that). Otherwise why don't they just list these kinds of coins as But It Now...(?)

Just an oddity I've noticed more and more from HA...seems they have moved to "full retail" reserves on many more coins than they used to. So much for "auctions"...

-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-

My sets: [280+ horse coins] :: [France Sowers] :: [Colorful world copper] :: [Beautiful world coins]

-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-

There are many factors into equation: imagine the case of a coin previously sold by HA.com at X price, that is now worth less, say X-30%. Heritage has always encouraged and given incentives to buyers to resell their winnings via them, so if the consignor insists to place a reserve X (his buyprice) on a coin whose value has decreased, all that Heritage can do is match the low or high estimate to the reserves accordingly. Because of this, I tend to disagree with pruebas and I believe that some cooperation between the cataloguer's estimates and coins with high reserves is needed.

Besides "hot items" at every auction, major or weekly,(that sell for multiples of their estimates) there's a multitude of unreserved lower value items with absurdly high estimates. Having won quite a few of these, and knowing what they were really worth,(a fraction of their estimates) I never congratulated myself on getting a bargain.But these estimates fulfill their purpose with too many uninformed bidders in every auction, who end up paying twice the price of a common and readily available item on eBay. Cataloguers are often wrong too. But it's up to the bidders to know the most recent prices and prove them wrong or right.

In the end, cataloguers dread to be dead right too:"total realized prices in our recent NYINC auction exceeded high estimates by 54.68%"

Finally, I can only imagine the disagreements over various items' values, but in the end, the auction house won't refuse the consignement of a customer with unrealistic expectations, that are based on his buyprice sometime ago from the same company, partly because the customer's always right and partly because there's always a chance that the item sells again at reserve, making everybody happy.

myEbay

DPOTD 3

Have noticed in Europe with nearly all houses that the opening price is set fairly low and the estimate is often a multiple of that.. IMO this is to make the sale as the promise to the seller is low.

surprise surprise when the results are 5 x or more the estimate. makes for excellent "shoulder patting and touting their own horns".

As such the majority of lots sell at starting bid, some do not sell and a few hot items sell for a few more bids, usually breaking records. It is these record breaking raw coins that usually go straight to the slab factory and reappear at another auction in less than 8 months.

The most recent example that comes to mind was a 1876 Greek crown, alleged choice unc (with an image that really did not do justice to it) that sold for 4000 euros at Kuenker (hammer), a (starting) high price for even a certified MS64, although we're talking about a very rare coin in these grades. A few months later, the same coin appears in the RARITAT Sincona sale, certified PCGS MS64+, and the only top pop at that grade with none other in sight.

The starting price was CHF 10000 this time, which to the consignor' immense luck, had just gained a 20% over the euro those days. At this price, and with such an expensive franc, it could have easily gone unsold.

But there's vanity in the world and the coin sold for 13K or 14K CHF, -hammer- so the seller made a nice 350% profit by flipping a coin that he's unlikely to ever see again.

myEbay

DPOTD 3

Experience the World through Numismatics...it's more than you can imagine.

It seems that Heritage is listing more coins with reserves that are full-estimate (or even over estimate once BP is added). Does this "contradiction of logic" not imply that either:

1) their estimate is too low

or

2) their reserve is too high?

Assuming "estimate" means "estimated hammer prices for this lot," then, yes.

It could also mean that "estimate" doesn't mean that.

Keeper of the VAM Catalog • Professional Coin Imaging • Prime Number Set • World Coins in Early America • British Trade Dollars • Variety Attribution

The first thing is that a book price (assumed value) will depend on the reference you are using. The only things with a recommended retail price are the Chinese copies. In the UK there are three or four commonly used volumes all with different prices for the same nominal item. These are the writer's considered opinion of the current value in the market place for typically the most commonly available variety, but none of them can hope to cover all the varieties for each type, so there is the first unquantifiable variable. Compilation of such a volume would be impractical, and certainly not financially rewarding.

Secondly, no two coins of nominally the same grade are equal. Some have better aesthethics than others. Two as struck coins might be perfect in one case and flawed in the other, but both would be mint state. Introduce wear and tear into the equation and the pros and cons multiply. Nobody here would claim that any coin of a nominal grade is worth a fixed amount as even within the slabbed world no two MS65 or whatever coins are equal. So having established that the assumed value of a coin is variable, how does that impact on auctions?

Estimates will depend on several factors. If you start with the impossible 'perfect in whatever grade coin', a high estimate of 80% book will, after premiums are added (typically 20% + VAT of 20% in the UK) approximately total the book price. So a low of 60% book and a high of 80% is a reasonable range. But, no two coins are equal. A problem free coin might fit the 60-80 estimates, but what if it has a striking crack, or is more heavily bagmarked than others? What if the toning is unattractive or the strike poor? These will not attract many bidders and may only sell if the estimates are reduced. A competitive auction requires two bidders chasing the same piece. An estimate at or around perceived retail will inevitably result in an opening and final bid, if any. As has been said, this might as well be a fixed price sale.

A particular generic type of coin will have a price range which reflects what the majority of collectors are willing to pay. It is very difficult to break out of that range, which may in turn be at odds with the variable numbers found in the price references.

Another consideration is the vendor's expectations. When one coin sells for £x, there is often an assumption that theirs will sell for the same amount, but we all know that some sales are more successful than others. If the vendor wants to recoup the cost of the coin he will have to set a reserve that is inclusive of the seller's premium as well. This can lead to unreasonably high estimates resulting in no bids. The important thing to get a coin sold is to price it at a level that people will bid, and for a successful auction, to price at a level which gives competitive bidding. It is therefore desirable for all interested parties to have slightly low estimates because not only does it encourage the lot to sell, but also means the prospective bidder can get things more cheaply than might otherwise be the case. Virtually every sale has something that gets under the radar.

An unsold coin costs the same to process as a sold one, except that in the former case an auction house receives no buyer's premium and the vendor has a fixed charge for an unsold lot. Contrary to what people might think, it is possible to have consignments rejected if the demanded returns are too high. Cataloguing and other preparatory work is quite time consuming, and is a cost whether a coin sells or not.

50 years ago all charges were taken from the hammer price with buyer's premium being introduced around 1980 in the UK at 5%. The burden of premiums has gradually shifted in the ensuing years to reflect the greater demand from buyers and the relatively harder job of getting people to consign, hence Heritage's offerings of 105% hammer to selected sellers.

Every area of numismatics has a group of specialists willing to chase the rarer varieties, which can result in some unexepectedly high prices. This shouldn't surprise people. A person cataloguing cannot hope to be fully conversant with the minutiae of every coin type, so will tend to price with a view to the commoner varieties, making allowances for some of the more obvious rarities. But they will never exceed the knowledge base of the specialists who regularly write volumes on their own niche interest.

A bit long winded, but I think you have to accept that no system will ever be perfect, and the best protection for the individual is knowledge. That way the only surprises are pleasant ones when you pick up the bargain that you recognised, but others didn't.