Trading PM futures

TopographicOceans

Posts: 6,535 ✭✭✭✭

TopographicOceans

Posts: 6,535 ✭✭✭✭

I posted this in US Coin Forum in response to a thread

Sime it applies to PMs I though it be of little interest.

Not only do I believe you, I've seen it happen myself.

On May 4th, 2006 to be exact.

I used to trade commodities futures and I got some of Warren Buffets money from him when silver took off.

They used to let him trade contracts based on the 100 million ounces of silver he owned.

When silver rose, he would sell short and when prices fell, he'd buy it back again pocketing the difference. Until one day even he couldn't control it and lost all his silver. He controlled the silver market for years. Now they say the Chinese are doing the same thing with gold.

A silver contract is for 5,000 ounces. Futures work by putting a deposit down on a contract to either buy of sell 5,000 oz. for future delivery from days to months away.

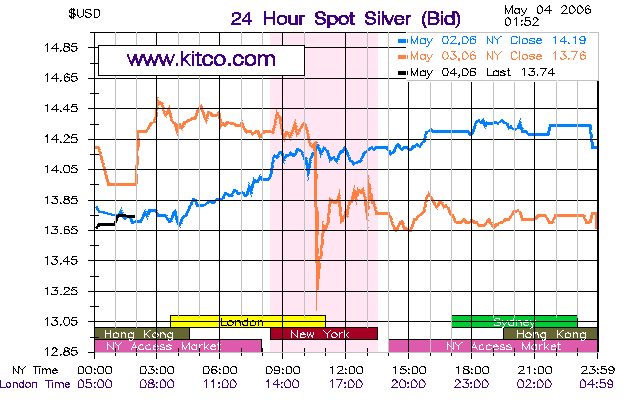

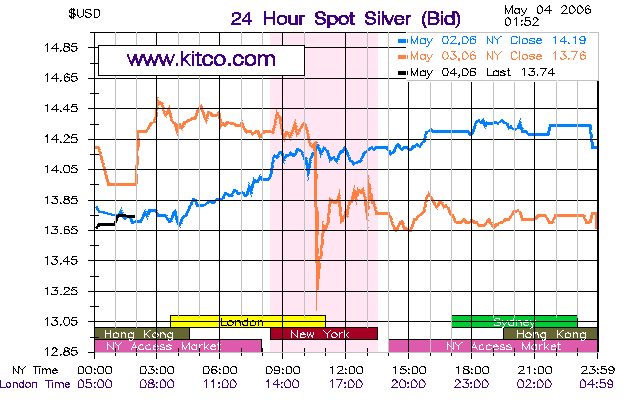

What happened today is the same thing that happened back in 2006 from this chart.

Somebody dumped a lot silver on the market, sending the price way down. Here it dropped from $14.25 to $13.10 in a matter of minutes. A stop loss order would have done nothing, since it just goes to the market and if there are no buyers you just have to wait until they come back in - at a much lower price.

Here each 5,000 oz contract would have lost $5,750 per contract.

You can make and lose fortunes in the futures market very quickly.

I keep this chart as a reminder that I should stay away from futures markets (at least I try to.)

You can read about Buffet losing his silver here

Sime it applies to PMs I though it be of little interest.

Not only do I believe you, I've seen it happen myself.

On May 4th, 2006 to be exact.

I used to trade commodities futures and I got some of Warren Buffets money from him when silver took off.

They used to let him trade contracts based on the 100 million ounces of silver he owned.

When silver rose, he would sell short and when prices fell, he'd buy it back again pocketing the difference. Until one day even he couldn't control it and lost all his silver. He controlled the silver market for years. Now they say the Chinese are doing the same thing with gold.

A silver contract is for 5,000 ounces. Futures work by putting a deposit down on a contract to either buy of sell 5,000 oz. for future delivery from days to months away.

What happened today is the same thing that happened back in 2006 from this chart.

Somebody dumped a lot silver on the market, sending the price way down. Here it dropped from $14.25 to $13.10 in a matter of minutes. A stop loss order would have done nothing, since it just goes to the market and if there are no buyers you just have to wait until they come back in - at a much lower price.

Here each 5,000 oz contract would have lost $5,750 per contract.

You can make and lose fortunes in the futures market very quickly.

I keep this chart as a reminder that I should stay away from futures markets (at least I try to.)

You can read about Buffet losing his silver here

0

Comments

Knowledge is the enemy of fear

Lost decade? Not for those who knew when to buy and when to sell.

No Way Out: Stimulus and Money Printing Are the Only Path Left

Somebody dumped a lot silver on the market, sending the price way down.

Nobody dumped any silver on the market. They dumped promises to sell silver. If the actual flow of physical silver controlled the price of silver there would be a completely different spot price. Growing physical premiums tell us this.

No Way Out: Stimulus and Money Printing Are the Only Path Left

Somebody dumped a lot silver on the market, sending the price way down.

Nobody dumped any silver on the market. They dumped promises to sell silver. If the actual flow of physical silver controlled the price of silver there would be a completely different spot price. Growing physical premiums tell us this.

Silver is a market like anything else... corn, sugar coffee, iron ore, OJ. stocks ect. why would it's market price discovery be anything different?

Somebody dumped a lot silver on the market, sending the price way down.

Nobody dumped any silver on the market. They dumped promises to sell silver. If the actual flow of physical silver controlled the price of silver there would be a completely different spot price. Growing physical premiums tell us this.

Silver is a market like anything else... corn, sugar coffee, iron ore, OJ. stocks ect. why would it's market price discovery be anything different?

No different - price is controlled by promises that may reach maturity but in most cases do not live long enough to be kept. Promises that are allowed to be unfulfilled create price distortion - in all futures markets. Delivery is a vital part of the price equilibrium equation. Without it prices can be manipulated up or down. In many futures markets it helps protect the major players from price volatility. In reality, preventing the volatility that a free market creates is nothing short of intended price manipulation. Good or bad, it is what it is.

No Way Out: Stimulus and Money Printing Are the Only Path Left

Does one really think "real" supply and demand caused the following declines in 2015? Or were they "paper-pushed" over the cliff as needed? Please justify why JPM "needed" to increase their otc commodity derivs from $260 BILL to $4.1 TRILL in early 2015. If this is so common, find another major market sector (bonds, currencies, stock indexes, etc.) where a single entity increased their stake by 17X in one reporting period and cornered 93% of that particular US market segment. These are only the "reported" positions. We have no way to know what they don't report.

WTI Crude oil $60 to $34

Nat Gas from $3.50 to $1.80

Silver $16 to $14

Plat $1200 to $850

Copper $2.80 to $2.00

Sugar $16 to $11

Coffee $200 to $120.

I don't believe for a second that Buffet "lost" his 130 mill oz of physical silver to the market. What probably happened was that by 2005-2006 this position was an embarrassment to both Buffet, the banks, and the US govt. This was the country's poster child for capitalism and buying big companies. What's he doing with a PM's stash? So I believe they made him a deal he couldn't refuse in order to get him out of the market. And with his stash they could better handle the swings in silver pricing. Within a year of that time the SLV silver trust was formed....which incidentally would have needed 50-100 MILL ounces of physical silver to get started...without upsetting the market. Any idea where such a stash could have come from on short notice?...lol. And you do you really think as connected as Buffet was that he would have sold out on silver in 2005-2006 just as the party was getting ready to go nuclear (ie from $6-$9 to $21?). What, Buffet didn't have analysts, chartists, and insiders to clue him in on where metals were headed? Heck, he could have just read the CU Forum from 2005-2008 and been way ahead of the game....lol.

The silver market made very normal corrections from spring 2004-summer 2005, and spring 2006 into August 2007. Those were needed to burn off all the euphoria in those quick run ups. I don't believe Buffet cashing out or being relieved of his silver had much to do with it. The silver market was far bigger than his 130 MILL ounces. The paper markets trade 100X the physical that actually trades hands. Buffet got his pay back 2 years later during the 2008-2009 financial crisis when he was given some sweet heart deals in floundering TBTF banks/corporations. That's what happens when you're a Team Player...rather than a silver speculator.

One counter-argument, which is a very similar argument to yours actually, is that the prices had been paper-pushed artificially high, and now the prices are exactly what supply & demand would dictate. Oil for example - the high winter temps are leading to low demand for diesel and heating oil. I read a story that there were tankers that were 2/3 of the way across the Atlantic shipping diesel to Europe, that then turned around because the prices had dropped too much. Other tankers staying anchored off the coast waiting for prices to rise to make it worth selling. Clearly is a supply glut. Did the supply/demand equation change? Or had it always been this way with some artificial pressure to get the prices high? Or is there some artificial pressure now keeping prices low?

Personally - I think it's easier to create false scarcity and push prices high arbitrarily than it is to create false supply and push prices low. My gut says the manipulation was on the way up. But, my gut is totally worthless.

Successful BST (me as buyer) with: Collectorcoins, PipestonePete, JasonRiffeRareCoins

Knowledge is the enemy of fear

The speculators have set up tent in the FOREX casino.

No Way Out: Stimulus and Money Printing Are the Only Path Left

Fred, your gut is better than many brains.

Regardless of Fred's gut or Cohodk's love of fiat and debt, what's irrefutable is that JPM took on gargantuan positions this year in the commodity markets, 4 years into a massive decline. And then took 75% of them off....though still holding the 2nd highest positioning seen since 2005. Note that such positions were never even approached during the 2006-2011 run up.

The FED learned their lesson from 2009-2011 when they allowed their QE to pump up the commodity and PM markets....at a much faster rate than stock markets. Oops. Following the QE's of 2012-2014 they "adjusted" their play book to ensure commodities saw none of that. I see JPM's positioning as just another brick in their wall.....a temporary wall though. Regression to the mean is what follows.

My Adolph A. Weinman signature

LOL. 10 years on this board and Roadrunner still doesn't know me.

Roadrunner blames JPM for commodities falling when some predicted commodity weakness years before. Roadrunner would be a trial lawyers best friend as he is so easily persuaded see things that don't exist or to draw conclusion to match what he wants to see, rather than what is.

Knowledge is the enemy of fear