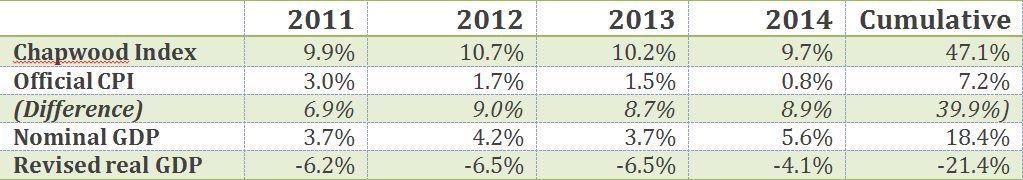

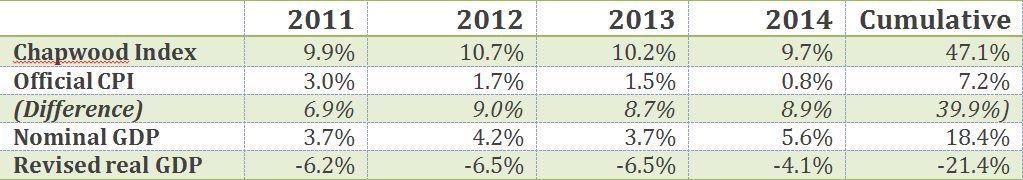

The real cost of living

http://www.chapwoodindex.com/

Take a look at this to see the real cost of living in a city near you

Does not look so good

Take a look at this to see the real cost of living in a city near you

Does not look so good

Pilgrim Clock and Gift Shop.. Expert clock repair since 1844

Menomonee Falls Wisconsin USA

http://www.pcgs.com/SetRegistr...dset.aspx?s=68269&ac=1">Musky 1861 Mint Set

Menomonee Falls Wisconsin USA

http://www.pcgs.com/SetRegistr...dset.aspx?s=68269&ac=1">Musky 1861 Mint Set

0

Comments

Chapwood linky

We did a similar exercise to this 4-6 years ago. Another company was tracking 2,000 and 5,000 consumer items in their CPI basket. And even when prices were rising across the board I don't think the index was more than double the CPI....something like 3-4% vs. 1.5-2%.

The Chapwood 500

Most of the those 500 items should already be in the CPI. But what the BLS CPI has that the others don't have are geometric weightings, quality effects, substitution effects, etc. Do the Chapwood people adjust those 500 items for the amount that they are used in a typical year (ie weightings?).....not an easy exercise. I haven't bought a refrigerator in 24 years, but pay a monthly cable bill that far exceeds any appliance cost. I never buy a filet at a steakhouse....I long ago substituted a burger for steak when I eat out.....lol. It's patriotic to "assist" the CPI.

The pre-manipulated BLS CPI models show approx 3.7% inflation using the 1990 model and 7.5% per year using the 1980 model. The 2015 model isn't so good....

BLS CPI models

BST Transactions (as the seller): Collectall, GRANDAM, epcjimi1, wondercoin, jmski52, wheathoarder, jay1187, jdsueu, grote15, airplanenut, bigole

<< <i>Where do I find Baleyville in this data?

Chapwood linky

We did a similar exercise to this 4-6 years ago. Another company was tracking 2,000 and 5,000 consumer items in their CPI basket. And even when prices were rising across the board I don't think the index was more than double the CPI....something like 3-4% vs. 1.5-2%.

The Chapwood 500

Most of the those 500 items should already be in the CPI. But what the BLS CPI has that the others don't have are geometric weightings, quality effects, substitution effects, etc. Do the Chapwood people adjust those 500 items for the amount that they are used in a typical year (ie weightings?).....not an easy exercise. I haven't bought a refrigerator in 24 years, but pay a monthly cable bill that far exceeds any appliance cost. I never buy a filet at a steakhouse....I long ago substituted a burger for steak when I eat out.....lol. It's patriotic to "assist" the CPI.

The pre-manipulated BLS CPI models show approx 3.7% inflation using the 1990 model and 7.5% per year using the 1980 model. The 2015 model isn't so good....

BLS CPI models >>

LoL, you make a great point: You do NOT find Baleyville anywhere. You, by definition, find roadrunnerville.

The similarity is that we both make our choices, as does everyone else, about what to spend our money on..

Just like you, some of those 500 items, I've never purchased, or purchased just once, others I buy just about every week or month (or continuously, such as some of the services).

These indicies, just like stock market averages, are just that, averages, a lot of folks then move from the general to the specific and then back to the general, usually to support beliefs they already hold, rather than seek new information or insight.

Think about this: if those 500 things were the ONLY things available to spend money on, would you be able to have a satisfying and fulfilling life in your 'ville?

Liberty: Parent of Science & Industry

The REAL Method of living well:

1. Don’t smoke cigarettes.

2. Drive old Japanese cars. Easy and cheap to fix & they run forever.

3. Buy most of your groceries from the produce section. Most of that other is not actually food. You don’t need it.

4. Ride your bike instead of driving as much as you can. You need the exercise and gas is expensive.

5. Don’t have kids. They’re not miracles, they’re people. 7 billion is too many. Find some other way to give your dull existence some meaning. BTW they’re expensive.

6. Get your clothes from thrift stores. With the physique you’ll have from riding your bike, you’ll look hot wearing anything.

7. Learn to fix things. Tons of great books and youtube vids on fixing anything. Or ask an old dude. People used to fix things.

8. Learn a trade – Carpentry, plumbing, electrical, auto mechanics, tailoring, computer/electronics repair, something They can’t outsource. No one gives a about your Masters in Dostoyevsky…., fix something!

9. If you like booze, drink at home with your neighbors. Drunk driving is for, rich ones with lawyers.

10. Do people favors. It’s called Cooperation. It’s how the world worked before money. They will return the favor, or someone will. This really works.

11. Make things – Look around you. What do you see? Yah, stuff made by impoverished enslaved people far away. Pick anything. Make a better one. People want good. You won’t get rich, but you’ll get by.

12. If you live in America – don’t get sick and avoid injury. Wear your helmet and put lights on your bike.

13. Find work you love. If you can’t do that, then find a job where you love the people.

14. Junkies and addicts are like toddlers. They just want to all over you and everything. The messes they make can get expensive. Avoid them if you can.

15. Don’t buy stuff on credit, remember what happened to America? Cash only. Can’t afford it? Don’t buy it!

16. Preventable expenses - STD’s, abortions, DWI’s, lung cancer, head injuries, speeding tickets, cirrhosis of the liver.

17. Don’t go on fancy dates if you’re not fancy. Most people kind of despise the rich anyway.

18. When you go see shows, bring a flask in. That way you can afford to buy a record.

19. If you had told me 15 years ago that Coca Cola would put tap water in plastic bottles and would BUY IT …… No way.

20. Don’t get cable. There is nothing on. I promise. $100 a month ? no!

<< <i>

What's even more important is that rising prices are occuring in the face of heavily reduced consumer spending. Imagine what inflation would be if there were more demand:

Repetition of ignorance is ignorance raised to the power two.

<< <i>The Fed will not raise rates as inflation is not high enough, and his inflation rate is over 10 percent on average. Where is all the money from this inflation?? GDP is just bumping along, so where is the growth and money from all this?? Not worth even investigating. Yet another site saying the sky is falling yet again. Just MHO. >>

Price inflation is the result of money supply inflation. Because many areas, particularly coomdities, are experiencing a serious bout of deflation (due to reduced world demand) look for the FED to stimulate with even more new money. While they may raise their interest rates a very small percentage to save face after so much talk, they know that higher rates will actually make things worse. More QE is in the tool box and scuttlebutt is they will put it directly in consumers' hands the next time. The money velocity chart should be the FED's greatest concern, should have been since at least 2008. If it is, then they are failing with their measures to stimulate. Time for a new game plan, if there are any that remain.

Repetition of ignorance is ignorance raised to the power two.

<< <i>Think about this: if those 500 things were the ONLY things available to spend money on, would you be able to have a satisfying and fulfilling life in your 'ville? >>

Emphatically yes. In fact, other than rare coins, which I could jettison at any time and not lose a wink of slip, everything I buy and use is probably on that list. In fact, I could probably live most comfortably in my "ville" with a lot less than 500 items. My simple gas powered push lawn mower is now 5 years old....been on 3 wheels (orig 4) for the past 3 years....lol. The engine refuses to die but the body is rusting apart and flexing too much. After this season it finally goes and I'll "slurge" for a new one at $159. Lawn mower is on Chappy's list too.

Well said Braddick.

Agree with quite a lot of Braddick's list, and actually employ many of those tactics most of the time. In fact recently spent some time in semi- remote Oregon, where it is possible to live very inexpensively by cutting your own firewood, growing and catching your own food, getting your own water from natural sources, and pretty much living like a pioneer, only "going to town" every once in a while for some coffee and bacon. Not saying we did those things the whole time, but people surely do, and they seem pretty happy about it.

Liberty: Parent of Science & Industry

<< <i>The Fed will not raise rates as inflation is not high enough, and his inflation rate is over 10 percent on average. Where is all the money from this inflation?? GDP is just bumping along, so where is the growth and money from all this?? Not worth even investigating. Yet another site saying the sky is falling yet again. Just MHO. >>

think again.

while it was only an internal staff generated report that was accidentally posted to the Fed. Res. public website, the underling staff had them raising rates as inflation stayed in the 2% area and GDP stayed in the 2% area.

The Federal Reserve cautioned that this was a staffers report and the actual board reviews a whole host of data to make their calls. I just can´t help but notice the staffers didn't seem disinclined to signal a set of steady rate increases over the years, starting in 2015, in the face of projected on-going 2%/2% numbers.

I personally think the Fed Res. need to gun the economy more and get GDP up well past 2%. The headline numbers on jobs are a nice view, but we all know more jobs need to be created to get those long-term unemployed back in jobs. 2% GDP is not going to get us there.

I hope this is the reason they don't raise rates this year

As for the 'where is all the money going' question.... I do not think inflation is that high either, but you can't say that for a long time commodities were not very expensive. I see a lot of the money off inflation going to corporate bottom lines -- if not the seller of goods, then those providing the raw materials. Oil? Copper? Lots of base materials were going nuts. We are finally seeing they are 'transitory' in a years and years sort of way. (like 7 and counting?) Considering how the boom-bust cycles have gone, 7 and counting isn't transitory enough for me to say the Fed. need not act upon it.

Knowledge is the enemy of fear

The drinks I buy from walmart were rolled up slightly recently.

The rest of the food is about the same to "I don't notice because I stock up when some foods are heavily discounted." I can only note the discounts are less lately.

The PO insurance went up huge

Gold, silver and platnum are way down

I don't write the checks to comment on the rest

I scoff at your alleged frugality. My gas lawn mower is 11 years old, my car is 16, and my mountain bike is 25 years old now and on its umpteenth set of tires but the frame is still straight and the wheels true.

Liberty: Parent of Science & Industry

<< <i>Derryb, do not show a graph of velocity of money and compare it to reduced consumer spending. The two are not the same. >>

According to your beloved FED, MV is "the rate of turnover in the money supply--that is, the number of times one dollar is used to purchase final goods and services included in GDP."

Please explain how MV can be at it's lowest point since at least 1960 without a reduction in consumer spending. I strive to benefit from your tutelage.

Logic dictates that if money is not exchanging hands as much as it was then spending has been reduced.

Repetition of ignorance is ignorance raised to the power two.

<< <i> My simple gas powered push lawn mower is now 5 years old....

I scoff at your alleged frugality. My gas lawn mower is 11 years old, my car is 16, and my mountain bike is 25 years old now and on its umpteenth set of tires but the frame is still straight and the wheels true. >>

My wife has you all beat.

Repetition of ignorance is ignorance raised to the power two.

<< <i>

<< <i> My simple gas powered push lawn mower is now 5 years old....

I scoff at your alleged frugality. My gas lawn mower is 11 years old, my car is 16, and my mountain bike is 25 years old now and on its umpteenth set of tires but the frame is still straight and the wheels true. >>

My wife has you all beat. >>

Is the punchline that you arent married?

BST Transactions (as the seller): Collectall, GRANDAM, epcjimi1, wondercoin, jmski52, wheathoarder, jay1187, jdsueu, grote15, airplanenut, bigole

<< <i>

<< <i>Derryb, do not show a graph of velocity of money and compare it to reduced consumer spending. The two are not the same. >>

According to your beloved FED, MV is "the rate of turnover in the money supply--that is, the number of times one dollar is used to purchase final goods and services included in GDP."

Please explain how MV can be at it's lowest point since at least 1960 without a reduction in consumer spending. I strive to benefit from your tutelage.

Logic dictates that if money is not exchanging hands as much as it was then spending has been reduced. >>

Be careful with the interpretation, as simply converting stocks to cash would increase M2 and draw down that ratio.

I note the rate of increase in M2 has increased over the past few years.

I think to understand the meaning behind the MV chart would require understanding what is behind the changes in the M2

Oh, new fridge is on my list to buy....but only once this one bites the dust. The compressor has been clunking for the last 2 years, it came with the house...

<< <i> My simple gas powered push lawn mower is now 5 years old....

I scoff at your alleged frugality. My gas lawn mower is 11 years old, my car is 16, and my mountain bike is 25 years old now and on its umpteenth set of tires but the frame is still straight and the wheels true. >>

Doesn't sound like you're abiding by the Baleyville by-laws. I take your "scoff" and "pooh-pooh" you right back....en garde.

Did your 11 year old gas push mower cost $125 new? My point was that I bought a disposable, lowest end, push mower, that has somehow managed to last 5 years. Considering a simple blade sharpening/tune up costs $75+, it's cheaper to run them into the ground and buy new or used. But if you're mowing on 3 wheels, mountain biking on 1, or driving your car on 2-3 wheels, I salute you. I certainly like to think I live frugally here in Baleylessville. The 2 family cars are 13 and 16 years old (2002 and 1999). Never bought a new car in my life....3 yrs old is the closest I ever got. My current 2002 was bought in 2009 with 22K miles. Not a big fan of gps tracking and NAV systems in cars, never mind TV's and internet. I doubt I'll ever own a car with such systems. I do my own oil changes and routine maintenance. Take the fluids up to the local recycling center. It doesn't save a lot of money but at least I know the right type and right amount of fluids went into the vehicle. These days, you can't be sure of anything at local shops. I'm not the most "handy" person but the cost of auto repairs and parts never relents so the more I can do the better. Anyone pay less for auto repairs today than 3-8 yrs ago?

The house is 55 years old with plenty to do. I skipped the big house stage and bought a 1000 sq ft "retirement" sized house on 1/3 acre right off the bat. It never made sense to me to go big. My washer is from my brother's old apartment rental from the early 1990's....those Maytags last. We don't own a dishwasher, never have. Same goes for air conditioning. Fans work fine, just like they did in the 1960's. The other appliances are all from the 1990's too. No snow blower or plows. Shovel 1500 sq ft of driveway every storm by myself....which includes my neighbor's which I do for free. One of my brothers already has the Ariens 1960's snow blower...lol. I've only bought one new bike in my entire life, it's 10 years old and has 10,000 miles on it. Needs more in parts than it's worth...it's not getting fixed. Only good for local errands now. Looking for another one at the moment. Of the other half dozen bikes I've had over the past 20 years, they've all been yard sale purchases at $5-$20....or given to me for free.

My golf clubs are 1978 Lynx Masters. The only new set I purposely bought. 10 yrs ago my brother made me a set of higher end, knock-off irons and metal "woods." I gave him $125 though I don't think he ever cashed that checked. The new clubs never really worked better than the old ones. Back issues have allowed only 2 or 3 rounds in the past 5 years. At least it saves me $25 on the greens fees. My early years of dead lifts, cleans, and tossing the hammer around eventually come back to get you. The weights, bars and stands I use in my basement date back from the early 1960's and 1970's. The newest addition to the exercise gear was a leg extension/curl bench that my brother gave me 15 years ago when his knees gave out. I've got a pair of 50 lb plates from the 1970's that I've been looking to pass on. Too heavy these days. One's health, is the real cost of living. The shovels and tools in my garden shed mostly date from the 1950's and 1960's....things I used as a kid. The "family" 1950's wooden extension ladder finally gave out 10 years back and I was forced to buy a new aluminum one for $50-$75. When I dropped some weight 4 years ago I found that all those 1980's suits and clothing came in handy again. It was only 3 years ago that I shifted from dial up internet/Windows 98 platform to a more current Windows 7. No digital HD, flat screen TV here, still working on the old 26" tube type until it breaks. I have a $100/yr flip up, "go phone" w/o internet or text that I first got in 2008. We wouldn't even have a modern I-phone except my son pays for it on his plan....a freebie for my wife. No way we'd pay $500/yr for that stuff. Next step is entirely divorcing from the TV as it's just too expensive. During the winter the house is kept at 56-62 degrees.

You still drink Schlitz?

Knowledge is the enemy of fear

Please explain how MV can be at it's lowest point since at least 1960 without a reduction in consumer spending. I strive to benefit from your tutelage.

Logic dictates that if money is not exchanging hands as much as it was then spending has been reduced8

Do I have a willing student?

Knowledge is the enemy of fear

<< <i>Text

Please explain how MV can be at it's lowest point since at least 1960 without a reduction in consumer spending. I strive to benefit from your tutelage.

Logic dictates that if money is not exchanging hands as much as it was then spending has been reduced8

Do I have a willing student? >>

<raises hand>

Does it have something to do with a general reducing of middlemen in this new internet economy, such that more direct producer-to consumer spending has the effect of reducing money velocity?

-or-

What about the trend toward a more service-based economy, where, similarly, the velocity of the long chain of supply chain transactions with value added each step is replaced by one-time service spending.

it seems that in these ways, maybe both, consumer spending can stay steady and increase, and still result in reduced "money velocity" because the dollars don't multiply in the measure the same way?

Liberty: Parent of Science & Industry

I knew it would happen.

Life is to enjoy, including the material items which can bring enjoyment if you can afford it.

Nothing wrong with either way of life....glad I can afford the choices I make.

<< <i>

<< <i>Text

Please explain how MV can be at it's lowest point since at least 1960 without a reduction in consumer spending. I strive to benefit from your tutelage.

Logic dictates that if money is not exchanging hands as much as it was then spending has been reduced8

Do I have a willing student? >>

<raises hand>

Does it have something to do with a general reducing of middlemen in this new internet economy, such that more direct producer-to consumer spending has the effect of reducing money velocity?

-or-

What about the trend toward a more service-based economy, where, similarly, the velocity of the long chain of supply chain transactions with value added each step is replaced by one-time service spending.

it seems that in these ways, maybe both, consumer spending can stay steady and increase, and still result in reduced "money velocity" because the dollars don't multiply in the measure the same way? >>

The whole graph is based upon GDP/M2

1) the ideas proposed would show up as decreased GDP then. That's debatable in the don't trust the numbers arena, but GDP would have to be off ~14% over that time frame.

But, as noted, the M2 has been increasing at an increasing rate over the past few years. So, there is more to the story than just a GDP change.

2) GDP is GDP. M2 is M2. Neither is strictly consumer oriented.

There is a separate report for consumer expenditures

St. Louis fed graph of pce

<< <i>No wonder some of you guys talk about the good old days.....you still live there. Lol

You still drink Schlitz? >>

Prolly gennee cream ale... Or Narragansett ... Lol

Labor participation rate

atl fed jobs calculator

The 110k is the number needed each month for net new workers.

You can change the participation rate from 62.6% to 66%

The change months to 24. Calculate.

Change to 48 months and calculate

We need more jobs created than even this "good jobs report" every month for 4 years straight to get the participation rate back up to 66% & 5.3% unemp.

Do we need any tightening in the face of this? I don't think so.

I feel like a the fed will risk lower participation and raise due to their perceived inflation risk. I see raw materials finally falling and think, at least for a couple of years, we are safe from inflation. I think we can risk it to get more people employed.

<< <i>No wonder some of you guys talk about the good old days.....you still live there. Lol

You still drink Schlitz? >>

Only when i light up a Raleigh.

Repetition of ignorance is ignorance raised to the power two.

Please explain how MV can be at it's lowest point since at least 1960 without a reduction in consumer spending. I strive to benefit from your tutelage.

Logic dictates that if money is not exchanging hands as much as it was then spending has been reduced8

Do I have a willing student?

I couldn't resist taking the professorial role:

If money supply doubles, and velocity drop by half, then spending hasn't changed. So, it is easy for velocity to drop while spending stays level or increases. (velocity is a useful but somewhat artificial concept; in fact, money and money supply are getting harder to define or measure)

<< <i>If money supply doubles, and velocity drop by half, then spending hasn't changed. So, it is easy for velocity to drop while spending stays level or increases. (velocity is a useful but somewhat artificial concept; in fact, money and money supply are getting harder to define or measure) >>

Understood. Explained in simple terms by the FED.. However, in the same link they also explain the result of recent "money demand" (lack of spending) at the same time.

"So why did the monetary base increase not cause a proportionate increase in either the general price level or GDP? The answer lies in the private sector’s dramatic increase in their willingness to hoard money instead of spend it. Such an unprecedented increase in money demand has slowed down the velocity of money. "

Repetition of ignorance is ignorance raised to the power two.

People have not decided to hoard money. Rather, by purchasing bonds (QE) the Fed has created money that is simply not needed. When the Fed buys a bond that is held in the private sector, that increases cash in the private sector and puts a bond on the asset side of the Fed balance sheet. When that happens, there's not a particular reason to expect that money to be spent. In fact, if the Fed doubles money supply in a very short period (as they did) it seems almost inevitable that the velocity of money will decrease. If cash were being injected into the bottom half of the economy (ie, middle income and poor), you would expect a substantial portion to be spent. But, if wealthy individuals and corporations (especially banks and insurers) are selling bonds and putting more cash or short term stuff on their balance sheets, there's no reason to expect a sudden uptick in spending. It is probably better to think of what is happening as a shortening of the asset duration of private sector holdings than as in increase in money. And, it is certainly not hoarding, in the sense that the Fed suggest.

Now, that's a bad thing too? I guess in this strange, brave new world we have here, everything is bad news, and somehow, that's good news for the smart folks who have special insight and "get it"

Liberty: Parent of Science & Industry

<< <i>And even if ordinary consumers were "hoarding" cash, isn't that what they used to call "saving"?

Now, that's a bad thing too? I guess in this strange, brave new world we have here, everything is bad news, and somehow, that's good news for the smart folks who have special insight and "get it" >>

Or everyone could reverse the psychology and believe like some that we are not being lied to? Surely, deep down, even the fiat supporting deniers aren't ignorant enough to think this ends well with what we face economically. It's certainly never worked before, but maybe this time it's going to be different?

<< <i>

<< <i> My simple gas powered push lawn mower is now 5 years old....

I scoff at your alleged frugality. My gas lawn mower is 11 years old, my car is 16, and my mountain bike is 25 years old now and on its umpteenth set of tires but the frame is still straight and the wheels true. >>

Doesn't sound like you're abiding by the Baleyville by-laws. I take your "scoff" and "pooh-pooh" you right back....en garde.

Did your 11 year old gas push mower cost $125 new? My point was that I bought a disposable, lowest end, push mower, that has somehow managed to last 5 years. Considering a simple blade sharpening/tune up costs $75+, it's cheaper to run them into the ground and buy new or used. But if you're mowing on 3 wheels, mountain biking on 1, or driving your car on 2-3 wheels, I salute you. I certainly like to think I live frugally here in Baleylessville. The 2 family cars are 13 and 16 years old (2002 and 1999). Never bought a new car in my life....3 yrs old is the closest I ever got. My current 2002 was bought in 2009 with 22K miles. Not a big fan of gps tracking and NAV systems in cars, never mind TV's and internet. I doubt I'll ever own a car with such systems. I do my own oil changes and routine maintenance. Take the fluids up to the local recycling center. It doesn't save a lot of money but at least I know the right type and right amount of fluids went into the vehicle. These days, you can't be sure of anything at local shops. I'm not the most "handy" person but the cost of auto repairs and parts never relents so the more I can do the better. Anyone pay less for auto repairs today than 3-8 yrs ago?

The house is 55 years old with plenty to do. I skipped the big house stage and bought a 1000 sq ft "retirement" sized house on 1/3 acre right off the bat. It never made sense to me to go big. My washer is from my brother's old apartment rental from the early 1990's....those Maytags last. We don't own a dishwasher, never have. Same goes for air conditioning. Fans work fine, just like they did in the 1960's. The other appliances are all from the 1990's too. No snow blower or plows. Shovel 1500 sq ft of driveway every storm by myself....which includes my neighbor's which I do for free. One of my brothers already has the Ariens 1960's snow blower...lol. I've only bought one new bike in my entire life, it's 10 years old and has 10,000 miles on it. Needs more in parts than it's worth...it's not getting fixed. Only good for local errands now. Looking for another one at the moment. Of the other half dozen bikes I've had over the past 20 years, they've all been yard sale purchases at $5-$20....or given to me for free.

My golf clubs are 1978 Lynx Masters. The only new set I purposely bought. 10 yrs ago my brother made me a set of higher end, knock-off irons and metal "woods." I gave him $125 though I don't think he ever cashed that checked. The new clubs never really worked better than the old ones. Back issues have allowed only 2 or 3 rounds in the past 5 years. At least it saves me $25 on the greens fees. My early years of dead lifts, cleans, and tossing the hammer around eventually come back to get you. The weights, bars and stands I use in my basement date back from the early 1960's and 1970's. The newest addition to the exercise gear was a leg extension/curl bench that my brother gave me 15 years ago when his knees gave out. I've got a pair of 50 lb plates from the 1970's that I've been looking to pass on. Too heavy these days. One's health, is the real cost of living. The shovels and tools in my garden shed mostly date from the 1950's and 1960's....things I used as a kid. The "family" 1950's wooden extension ladder finally gave out 10 years back and I was forced to buy a new aluminum one for $50-$75. When I dropped some weight 4 years ago I found that all those 1980's suits and clothing came in handy again. It was only 3 years ago that I shifted from dial up internet/Windows 98 platform to a more current Windows 7. No digital HD, flat screen TV here, still working on the old 26" tube type until it breaks. I have a $100/yr flip up, "go phone" w/o internet or text that I first got in 2008. We wouldn't even have a modern I-phone except my son pays for it on his plan....a freebie for my wife. No way we'd pay $500/yr for that stuff. Next step is entirely divorcing from the TV as it's just too expensive. During the winter the house is kept at 56-62 degrees. >>

I'd say you have a good deal of this living thing figured out. I believe there are some wise words in your post if a person wants to learn something.

<< <i>No wonder some of you guys talk about the good old days.....you still live there. Lol

You still drink Schlitz? >>

Was out on a farm the other day when the old boy asked: "You want a beer ? "

I thought of this thread, QE, corn and cow____, when he brought me a can of Hamm's.

<< <i> My simple gas powered push lawn mower is now 5 years old....

I scoff at your alleged frugality. My gas lawn mower is 11 years old, my car is 16, and my mountain bike is 25 years old now and on its umpteenth set of tires but the frame is still straight and the wheels true. >>

Luxury! My lawn is higher than the roof of my house (no mower), I recently upgraded my Model T with an inexpensive GPS, and I borrow the neighbor's bike whenever he's feeling generous (or isn't looking).

My Adolph A. Weinman signature

Aye, very passable, that, very passable bit of risotto.

Nothing like a good glass of Château de Chasselas, eh, Josiah?

You're right there, Obadiah.

Who'd have thought thirty year ago we'd all be sittin' here drinking Château de Chasselas, eh?

In them days we was glad to have the price of a cup o' tea.

A cup o' cold tea.

Without milk or sugar.

Or tea.

In a cracked cup, an' all.

Oh, we never had a cup. We used to have to drink out of a rolled up newspaper.

The best we could manage was to suck on a piece of damp cloth.

But you know, we were happy in those days, though we were poor.

Because we were poor. My old Dad used to say to me, "Money doesn't buy you happiness, son".

Aye, 'e was right.

Aye, 'e was.

I was happier then and I had nothin'. We used to live in this tiny old house with great big holes in the roof.

House! You were lucky to live in a house! We used to live in one room, all twenty-six of us, no furniture, 'alf the floor was missing, and we were all 'uddled together in one corner for fear of falling.

Eh, you were lucky to have a room! We used to have to live in t' corridor!

Oh, we used to dream of livin' in a corridor! Would ha' been a palace to us. We used to live in an old water tank on a rubbish tip. We got woke up every morning by having a load of rotting fish dumped all over us! House? Huh.

Well, when I say 'house' it was only a hole in the ground covered by a sheet of tarpaulin, but it was a house to us.

We were evicted from our 'ole in the ground; we 'ad to go and live in a lake.

You were lucky to have a lake! There were a hundred and fifty of us living in t' shoebox in t' middle o' road.

Cardboard box?

Aye.

You were lucky. We lived for three months in a paper bag in a septic tank. We used to have to get up at six in the morning, clean the paper bag, eat a crust of stale bread, go to work down t' mill, fourteen hours a day, week-in week-out, for sixpence a week, and when we got home our Dad would thrash us to sleep wi' his belt.

Luxury. We used to have to get out of the lake at six o'clock in the morning, clean the lake, eat a handful of 'ot gravel, work twenty hour day at mill for tuppence a month, come home, and Dad would thrash us to sleep with a broken bottle, if we were lucky!

Well, of course, we had it tough. We used to 'ave to get up out of shoebox at twelve o'clock at night and lick road clean wit' tongue. We had two bits of cold gravel, worked twenty-four hours a day at mill for sixpence every four years, and when we got home our Dad would slice us in two wit' bread knife.

Right. I had to get up in the morning at ten o'clock at night half an hour before I went to bed, drink a cup of sulphuric acid, work twenty-nine hours a day down mill, and pay mill owner for permission to come to work, and when we got home, our Dad and our mother would kill us and dance about on our graves singing Hallelujah.

And you try and tell the young people of today that ..... they won't believe you.

They won't!

Liberty: Parent of Science & Industry

The homeless man with ten dollars in his pocket is better off than someone upside down in thier mortgage

Menomonee Falls Wisconsin USA

http://www.pcgs.com/SetRegistr...dset.aspx?s=68269&ac=1">Musky 1861 Mint Set

No, he isn't.

Liberty: Parent of Science & Industry

<< <i>The Fed article is very interesting, but shows that in a fundamental way, the Fed doesn't understand money. (I apologize if that statement seems incredibly arrogant!)

People have not decided to hoard money. Rather, by purchasing bonds (QE) the Fed has created money that is simply not needed. When the Fed buys a bond that is held in the private sector, that increases cash in the private sector and puts a bond on the asset side of the Fed balance sheet. When that happens, there's not a particular reason to expect that money to be spent. In fact, if the Fed doubles money supply in a very short period (as they did) it seems almost inevitable that the velocity of money will decrease. If cash were being injected into the bottom half of the economy (ie, middle income and poor), you would expect a substantial portion to be spent. But, if wealthy individuals and corporations (especially banks and insurers) are selling bonds and putting more cash or short term stuff on their balance sheets, there's no reason to expect a sudden uptick in spending. It is probably better to think of what is happening as a shortening of the asset duration of private sector holdings than as in increase in money. And, it is certainly not hoarding, in the sense that the Fed suggest. >>

QE money went to financial institutions in the Fed Res system under "excess reserve balances."

M2 is cash, money markets, CDs, etc.

The QE money never shows up in M2 as it is "not that type of money class."

<< <i>And even if ordinary consumers were "hoarding" cash, isn't that what they used to call "saving"?

Now, that's a bad thing too? I guess in this strange, brave new world we have here, everything is bad news, and somehow, that's good news for the smart folks who have special insight and "get it" >>

Alan Greenspan in the immediate aftermath of 2008 mused incredulously about people considering liquidity as having access to loans.

This is not the classic definition as it was and should be cash and cash equivalents. Certainly a loan can provide liquidity but 1) at a cost and 2) if you get it. The latter part is the biggest crux, no? That "if" is why it is cash and equivalents (money market) that are true liquidity. (Faith in the FDIC another topic)

I keep coming back to this - there can be decreased spending to explain it, but one must also consider asset conversion as well. Perhaps people and businesses woke up to the need of true liquidity and "made some adjustments."

<< <i>QE money went to financial institutions in the Fed Res system under "excess reserve balances."

M2 is cash, money markets, CDs, etc.

The QE money never shows up in M2 as it is "not that type of money class." >>

I think some of the QE leaked into the economy via M1 (it increased +$1.6 TRILL since the 2008 financial crisis). Other QE in more opaque or subtle forms probably has leaked in as well. When the FED/USTreasury paid off the loser's otc derivatives bets in 2008/2009 some of that "estimated" $5-$15 TRILL had to leak into the world's economy. But the +$3.2 TRILL increase in US Monetary Base (MB) since fall of 2008 is mostly still kept separated from consumers.

Never been much of a drinker. But I do miss an occasional Erhlanger (early Busch?) from the 1980's. A dozen drinks a year is about the norm for me....which is probably a health "risk" based on reports I've read.

Repetition of ignorance is ignorance raised to the power two.

<< <i>The average American has not been hoarding cash. He has been using it to pay off debt from all of his Pre-2008 spending on credit binge. >>

this is a flash based graph. I'll have to speak to someone about that one day

Never Fear, the debt machine is here

Here is the June consumer credit report data.(released in August) Note home loans are not included in the data.

Hurray! An annualized 7.25% increase! Higher than CPI.........

W

O

W

an if you are uncertain if that holds for a year, the yearly numbers are on the left of the table: 7% in 2014. ~6% for 2012 and 2013.

Yeow.

<< <i>QE might have juiced M2 in a roundabout way. >>

which QE? 1 , 2, 3 or the pending 4?