CLCT Qualified Dividend vs. Non-dividend Distribution

CLCT had a revision on characterization of its dividend. Previously entire amount was characterized as qualified dividend, and now a small portion (about 1/6th) re-characterized as non-dividend distribution. Figured there are a few financial guys who might explain what, if any, significance.

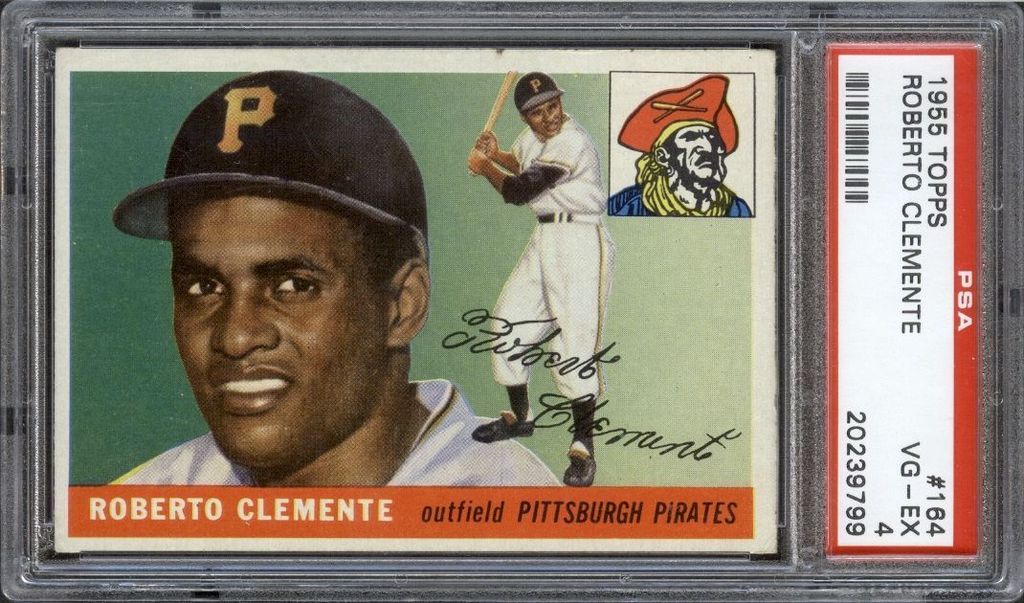

To keep it card related - just got this today! :-)

[/URL]

[/URL]

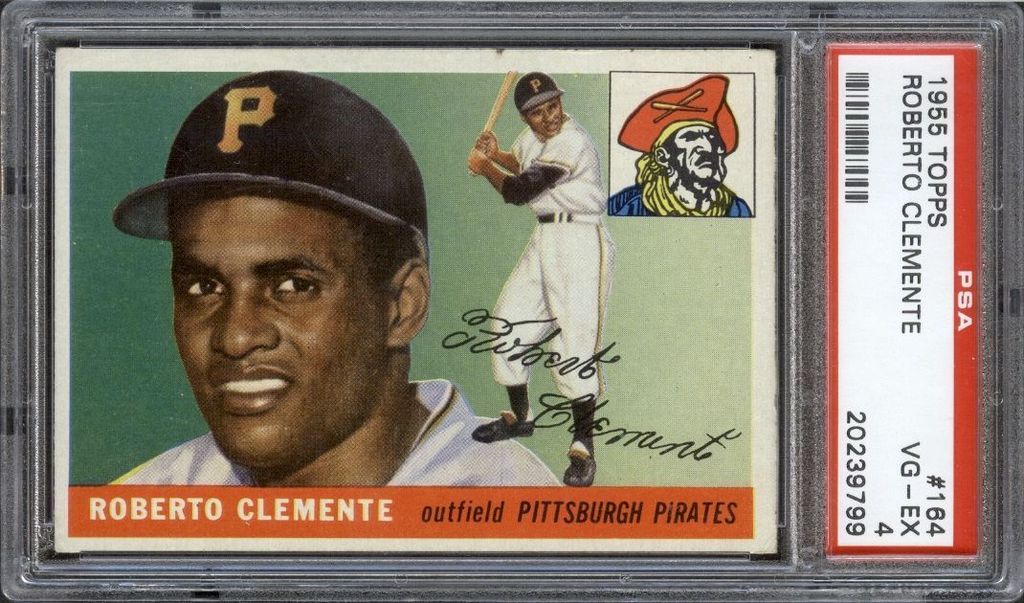

To keep it card related - just got this today! :-)

[/URL]

[/URL] My Green Bay Packers Hall of Fame Registry Set

"The Packers are kinda like your kids. You dont love them because they are good, you love them because they are yours"

"The Packers are kinda like your kids. You dont love them because they are good, you love them because they are yours"

0

Comments

"From Pub 17 a nondivided distribution is a Basis adjustment. A nondividend distribution reduces the basis of your stock. It is not taxed until your basis in the stock is fully recovered. This nontaxable portion is also called a return of capital; it is a return of your investment in the stock of the company. If you buy stock in a corporation in different lots at different times, and you cannot definitely identify the shares subject to the nondividend distribution, reduce the basis of your earliest purchases first.

When the basis of your stock has been reduced to zero, report any additional nondividend distribution you receive as a capital gain. Whether you report it as a long-term or short-term capital gain depends on how long you have held the stock."

Edited to add: I just checked my 2014 end of year statement and all of my 2014 CLCT dividends were Qualified dividends and looking at my Feb 2015 statement my dividends paid on 2/27/15 were all qualified dividends.

It has been this way for the past few years. I use Fidelity. They don't have the updated basis and 1099's available until around first week of March every year.

Example using round numbers: say you bought the stock for $10. The total dividend is $1. 80c is a qualified dividend and 20c is return of capital. You pay tax on the 80c and now your cost basis is reduced by 20c to $9.80. When you sell the stock, you say that you paid $9.80/sh, not the $10 you actually paid. Your brokerage house should do all this automatically for you when they send you your 1099's