Rare Coin Prices over the past 40 Years -- (Are coins a good investment?)

WingedLiberty1957

Posts: 2,992 ✭✭✭✭✭

WingedLiberty1957

Posts: 2,992 ✭✭✭✭✭

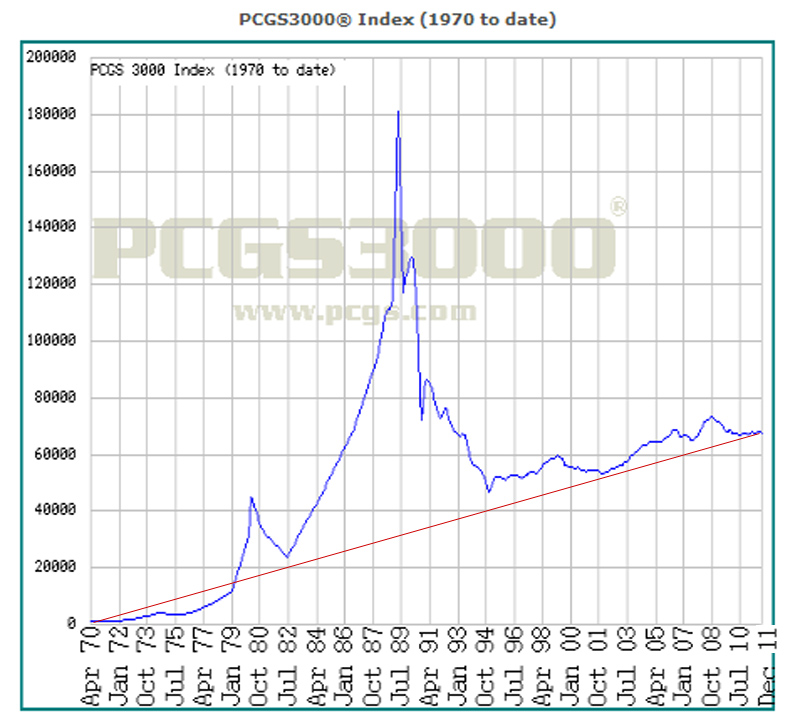

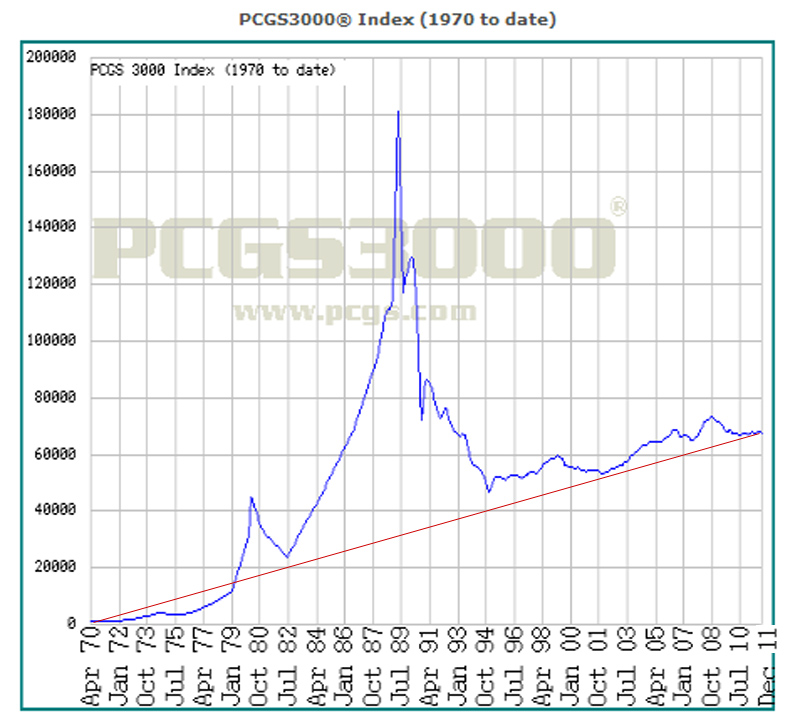

The PCGS3000 index is based on the prices of a sample of 3,000 rare and semi-rare coins and generally shows the peaks and valleys of the rare coin market. What interested me was the HUGE spike in prices right around 1989.

Does anyone know what caused this huge price spike?

The gold & silver bullion spike was in 1980 but that only shows up on the PCGS3000 index as a much smaller bump in that era.

It's kind of interesting to me but if you throw out that spike, rare and semi-rare coins have basically been on a slow upward climb for the past 40 years (shown by the red line, which connects the beginning and end of the index. A rise that amounts to a roughly 2.5% increase per year over the past 40 years.

I still would love to know any theories on the coin bubble of the 80's.

The parabolic move actually started in 1982 and ended in 1989 where coin prices increased 9x or 900% in 7 years.

Then prices proceeded to crash back down to earth bottoming out in 1994, where most coins lost 70% of their value from the 1989 peak.

Does anyone know what caused this huge price spike?

The gold & silver bullion spike was in 1980 but that only shows up on the PCGS3000 index as a much smaller bump in that era.

It's kind of interesting to me but if you throw out that spike, rare and semi-rare coins have basically been on a slow upward climb for the past 40 years (shown by the red line, which connects the beginning and end of the index. A rise that amounts to a roughly 2.5% increase per year over the past 40 years.

I still would love to know any theories on the coin bubble of the 80's.

The parabolic move actually started in 1982 and ended in 1989 where coin prices increased 9x or 900% in 7 years.

Then prices proceeded to crash back down to earth bottoming out in 1994, where most coins lost 70% of their value from the 1989 peak.

0

Comments

Could it be due to the recent openings of renown Third Party Grading and it's effect on the market of rare coins?

Too many positive BST transactions with too many members to list.

<< <i>Could it be due to the recent openings of renown Third Party Grading and it's effect on the market of rare coins? >>

Add an influx of serious investment dollars. The problem was that most of the slabbed coins were not rare---they were what we call generics (common Walkers, Mercs, Morgans, etc.) today. Prices for these kinds of coins haven't recovered since sharply falling from their highs.

RMR: 'Wer, wenn ich schriee, hörte mich denn aus der Engel Ordnungen?'

CJ: 'No one!' [Ain't no angels in the coin biz]

<< <i>...

It's kind of interesting to me but if you throw out that spike, rare and semi-rare coins have basically been on a slow upward climb for the past 40 years (shown by the red line, which connects the beginning and end of the index. A rise that amounts to a roughly 2.5% increase per year over the past 40 years.

...

Except, of course, that neither the 2.5% or the above graph are indexed to inflation -- and they don't include transaction costs (which are exorbitant compared to more traditional investments).

Coins, on average, are a terrible investment.

IMO, of course....Mike

The 1989 spike in that graph reflects rampant speculation in coins that were not rare, such as MS65 Morgans. It was only a few months lived, and was fueled by the (erronous, it turned out) belief that with the advent of third party grading, rare coins would become fungible and sight-unseen trading would allow Wall Street coin funds to invest in rare coins in a manner similar to investing in stocks and bonds. This lasted for an incredibly short time untill everyone realized that one MS65 Saint (or Morgan, or whathaveyou) is NOT the same as every other MS65 Saint.

There was no similar artifical spike in the truly rare coins. Look up the best coins from Heritage's Platinum sale next week, and very few (if any) of them are worth less than in 1989. Common date MS65 Morgans did go for over $500 BID at the peak in 1989.

-D

-Aristotle

Dum loquimur fugerit invida aetas. Carpe diem quam minimum credula postero.

-Horace

it is, just like any investment, our inability to actually DO this in real time..that results in most of us never making a killing.

Of course the reality that the dollar of 40 years ago had a far different purchasing power than today, this skews the whole thing in many ways.

its a hobby plain and simple, whatever happens will happen.

<< <i>If you bought the classic rarities, such as mint state chain cents, early dollars, flowing hair half dollars, etc, you would have done well. Very well.

The 1989 spike in that graph reflects rampant speculation in coins that were not rare, such as MS65 Morgans. It was only a few months lived, and was fueled by the (erronous, it turned out) belief that with the advent of third party grading, rare coins would become fungible and sight-unseen trading would allow Wall Street coin funds to invest in rare coins in a manner similar to investing in stocks and bonds. This lasted for an incredibly short time untill everyone realized that one MS65 Saint (or Morgan, or whathaveyou) is NOT the same as every other MS65 Saint.

There was no similar artifical spike in the truly rare coins. Look up the best coins from Heritage's Platinum sale next week, and very few (if any) of them are worth less than in 1989. Common date MS65 Morgans did go for over $500 BID at the peak in 1989. >>

I mostly agree with the above. The bubble was caused by rumors of big Wall Street money forming pools to buy generic certified coins, such as MS65 Morgans.

As for investment, keep in mind that a lot of investment motivated folks buy some of the worst possible items. While early type coins and key dates have appreciated mightily, most coin investors back in the day, were much more interested in hoarding generic and common proof sets, and rolls of 1950-D nickels and other poor long term price performers.

As always, a person's grading skill, access to coins, and market knowledge will tend to predict future coin investment results. Be above average in all three areas, and that person will tend to do well financially. Be below average in all three areas, and the person will almost surely lose money. For average coin collectors that purchase numismatic coins at retail venues, break even after five years is about an average result. Bullion investors and part time dealers are different animals.

100% Positive BST transactions

Doggedly collecting coins of the Central American Republic.

Visit the Society of US Pattern Collectors at USPatterns.com.

<< <i>

<< <i>If you bought the classic rarities, such as mint state chain cents, early dollars, flowing hair half dollars, etc, you would have done well. Very well.

The 1989 spike in that graph reflects rampant speculation in coins that were not rare, such as MS65 Morgans. It was only a few months lived, and was fueled by the (erronous, it turned out) belief that with the advent of third party grading, rare coins would become fungible and sight-unseen trading would allow Wall Street coin funds to invest in rare coins in a manner similar to investing in stocks and bonds. This lasted for an incredibly short time untill everyone realized that one MS65 Saint (or Morgan, or whathaveyou) is NOT the same as every other MS65 Saint.

There was no similar artifical spike in the truly rare coins. Look up the best coins from Heritage's Platinum sale next week, and very few (if any) of them are worth less than in 1989. Common date MS65 Morgans did go for over $500 BID at the peak in 1989. >>

I mostly agree with the above. The bubble was caused by rumors of big Wall Street money forming pools to buy generic certified coins, such as MS65 Morgans.

As for investment, keep in mind that a lot of investment motivated folks buy some of the worst possible items. While early type coins and key dates have appreciated mightily, most coin investors back in the day, were much more interested in hoarding generic and common proof sets, and rolls of 1950-D nickels and other poor long term price performers.

As always, a person's grading skill, access to coins, and market knowledge will tend to predict future coin investment results. Be above average in all three areas, and that person will tend to do well financially. Be below average in all three areas, and the person will almost surely lose money. For average coin collectors that purchase numismatic coins at retail venues, break even after five years is about an average result. Bullion investors and part time dealers are different animals. >>

That reasoning could also be considered "investment" as well. Even with today's economy, half of investing for me is putting money into something that I can basically forget about. So if you put away $10k in coins and (theoretically) forget about it...and then in 10 years you have $10k...well, I think that's a form of investing either way.

There are ways to ramp that up though:

1. Buy for less than retail

2. Sell for close to retail

3. Select your collectible of choice intelligently and in consideration of price resistance and demographics.

Negotiating your way through items 1 through 3 above is the hard part.

Steve

<< <i>I don't see how we cqn ever agree on this subject. There are just too many variables that get added to the mix. We really need to get our defintiions susinct, for instance what is really a rare coin, what grade(s)/condition(s) are we speaking about for the subject matter, and how are valuations established. If you bought so-called rare coins in 1989, your individual prices may still differ with what the chart represents. I can only take individual case by case basis and extrapolate from there. >>

It's hard to narrow it down that much though...that's like saying you can't call an RIA an investment unless you tear apart every single stock that the RIA is invested in...

I think the point of this thread and a lot of the "coin investment" threads is a much more broader one.

"Would coins that [most people] would consider rare tend to have an upward price trend or a downward one."

Sure someone could say "is a 3 legged buffalo a good investment" and that would be more narrowed down...but the chart and the question in this thread cover more ground.

You either sell them all below wholesale to a dealer (probably less then you paid for them) or take your chances at auction. Even at auction you will be lucky to get what you paid for a coin meaning with your seller fees, you now lost money. Selling a collection onesey twosey just isn't practical for mediocre coins (widgets). And as someone pointed out, the fees to get out of your "investment" are exorbitant.

You can pay really high fees (HA) and get maximum exposure. Lower fees (eBay) and take your chances losing money or go to some other lesser (medium fee) venue and get limited exposure.

When I am done (sold) with all of them, it will truly be a great day for me.

Bottom line: Collect what you like and not for investment unless you can afford to buy truly rare coins.

And that factors in the grade inflation as well. Don't let anyone fool you that really rare coins didn't get crushed following this peak. Even 1804 silver dollars fell in price.

Even the finest known 1794 MS66 SP flowing hair dollar fell about 60% in price from 1989 to the mid-1990's. The thumbrule for most gem 19th silver, gold, and nickel type

coins is that they fell by 65% from 1989-1996. The better ones only fell by 40-50%. The more promoted type coins like gem PF 3C nickels and Lib nickels fell by 75%.

That market really didn't accelerate on MS65 Morgans as they peaked in price in 1986/1987 at around $500-$700 and were falling ever since as supply increased. By spring

1990 they were $300 each and would eventually bottom at $74 around 2003-2004. But then again a 2003 MS65 Morgan wasn't of the same quality as those 1986 MS65's.

Better date Morgans, gem classic commems, dated and common gem mercs-walkers-slq's-buffs, and gem 18th to early 20th century type and gold were the most touted coins

of that period. I'd bet that 95% of those have not yet made it back to 1989 prices for the same quality coin. An MS65 seated quarter back then fetched $4,000 or so. That

same coin today is probably MS66 and worth $2,000-$2,500. If it was lucky to bump to MS67 then it might be worth $4,000 today...though with 20 yrs of dollar depreciation you're

still deep in the loss column. What has come out of the 1990 market intact was choice circ type, red choice/gem copper, moderns, rare dates, rare types, rare varieties, the

best of the best pop tops and finest knowns, and bullion related coins.

Here's one coin I've tracked over the years and how it faired during the post-1989 crunch. And this is an exceptional coin that has far out-performed the general market over a long

period. But the other 95-98% of coins in the market have not done anywhere near as well.

1867-s seated quarter gem unc:

1975 auction - $1850 (raw)

1977 sale -$5000

1980 auction - $30,000

1986 auction - $9750 (PCGS MS66)

(est 1990 value - $45,000 - $50,000)

(est 1997 value - $20,000 - $25,000) (NGC MS67)

2004 auction - $74,500 (NGC MS67)

(est 2008 value at market peak: $100K to $125K)

today's value? Haven't a clue other than it's probably in a wide possible range of $60K to $125K)....it only takes 2 motivated and interested buyers to make a high price.

roadrunner

Since individual companies (and sectors), houses (and areas), and rare coins (and series) have their own attributes, they get diluted when Averaged

So, my answer is the same as always: Don't "invest" in "the stock market", or "real estate" or "rare coins", invest (if you must) in individually picked assets

Liberty: Parent of Science & Industry