Last hurrah for awhile?

Here's my latest purchase. I've collected Peyton Manning since his days at UT and I've always wanted this card. Considering that I gave around the going rate for this in a PSA 9 that a raw sales for, I was well pleased:

I mention last hurrah because my wife and I have decided that it might be the time for us to buy own first home. We found a beautiful home that would be a great blessing. We're currently looking over the numbers to see if we can actually "afford" it or not without sacrificing anything essential or getting in over our heads and/or becoming another housing market casualty. Needless to say, it is an exciting yet intimidating time to say the least looking over the various loan offers.

I have to be honest though in that I hope it works out. It would bless not only our lives but the young people that I work with. Either way, we should know by Sunday night if the money situation works or not and could possibly make an offer on Monday morning.

I mention last hurrah because my wife and I have decided that it might be the time for us to buy own first home. We found a beautiful home that would be a great blessing. We're currently looking over the numbers to see if we can actually "afford" it or not without sacrificing anything essential or getting in over our heads and/or becoming another housing market casualty. Needless to say, it is an exciting yet intimidating time to say the least looking over the various loan offers.

I have to be honest though in that I hope it works out. It would bless not only our lives but the young people that I work with. Either way, we should know by Sunday night if the money situation works or not and could possibly make an offer on Monday morning.

0

Comments

Nice card BTW..

FINISHED 12/8/2008!!!

And yes, that's a great card!

Seeking primarily PSA graded pre-war "type" cards

My PSA Registry Sets

34 Goudey, 75 Topps Mini, Hall of Fame Complete Set, 1985 Topps Tiffany, Hall of Fame Players Complete Set

Also, listen to your own instincts on what you can afford and not what the mortgage person or Realtor tell you that you can afford. No offense to either but that's why so many people are having to lose their homes to foreclosure; they listened to BAD advice. You know what you can afford! Also, home ownership costs more than you think it will!

Good luck!

Good luck with the house. And when you come to learn (assuming you don't already know) of itemized deductions, you can take that refund and resume your card purchasing ways.

/s/ JackWESQ

Best of luck!

good luck

We bought a new home in a new development, so working with them was pretty easy, as they wanted to get that house off their hands ASAP with the housing market slumping like it is. They ended up giving us something that was better than what we said we wanted.

Anyways, one thing that my wife and I did when we first got married was save 40% of our income every month. We wanted to get used to not having that money around, and it worked. My wife and I aren't really extravagant people, and found that our combined income (minus 40%) was actually MORE than we needed, and found that we could live a pretty care-free life style. Anyways, when the time came to get a house, we adjusted the 40% to absorb the increase from rent to a mortgage, and we've been fine.

Yes, having your own house is pretty awesome. I'm still not totally used to it yet, and feel like I'm visiting someone sometimes.

WTB: 2001 Leaf Rookies & Stars Longevity: Ryan Jensen #/25

Between the uncertainty of our economy, 5 year ARMs maturing without appreciation, and a glut of empty homes eating in the developers' pockets, A LOT of opportunites will be available to cherry pick.

/ $0.02

And that Manning card is awesome! The way Manning is pictured it has a nice vintage style to it!

Sorry, I couldn't resist. I respect the guy as a player, just not a fan of the dude.

ebay i.d. clydecoolidge - Lots of vintage stars and HOFers, raw, condition fully disclosed.

<< <i>good luck with this big decision. Surprisingly, a lot of people find that their free cash flow actually increases somethimes when they make the purchase since they now have deductions (mortgage interest and property taxes) they didn't have before. Hopefully you'll be able to continue collecting and enjoy the benefits of home ownership at the same time. >>

I wish this was the case for me. Just ran my preliminary taxes last night and I owe the government money (about $250) this year. I guess me and the wife made too much this year, which isn't necessarily a bad thing.

J

the housing market is still declining in most areas, you might hold off for a bit and save some scratch on this new home your interested in if you have the patience.

<< <i>Here's my latest purchase. I've collected Peyton Manning since his days at UT and I've always wanted this card. Considering that I gave around the going rate for this in a PSA 9 that a raw sales for, I was well pleased:

I mention last hurrah because my wife and I have decided that it might be the time for us to buy own first home. We found a beautiful home that would be a great blessing. We're currently looking over the numbers to see if we can actually "afford" it or not without sacrificing anything essential or getting in over our heads and/or becoming another housing market casualty. Needless to say, it is an exciting yet intimidating time to say the least looking over the various loan offers.

I have to be honest though in that I hope it works out. It would bless not only our lives but the young people that I work with. Either way, we should know by Sunday night if the money situation works or not and could possibly make an offer on Monday morning. >>

All I can say is that if you decide to buy please spend a few bucks and hire a lawyer. I can't believe how many people enter into such a big purchase and sign papers they most likely don't understand. Don't be penny wise and dollar foolish!

I've been listening to banks and learning a lot. We have no clue as to what the cost would be, but we have been running loans on a "worse case scenario" outline while checking in on insurance and estimated utility expenses based on 12 month averages.

One of the big issues here is whether we want to pay a big down payment 3-5% or take a different loan that doesn't require a down payment. Granted, it's a small fraction higher in regards to the APR, but it has a much lower closing cost and doesn't require the down payment. In addition, I learned that this loan has an accelerated payment program which means that we are allowed to pay the principle off faster if we ever have extra cash. I was stunned to learn that one of the fixed rate loans would not so much as allow us to pay a large chunk in the event that we were to receive something like an inheritance. That would screw us over, especially once we get our car and student loans paid off and have the extra money every month. In addition, I learned the loan that doesn't require the down payment drops off the Mortgage Insurance a lot sooner, thus dropping the overall payment some 10-12% as soon as 3 years into the agreement.

It may be dumb on my part, but I really want to keep my savings as a safety net.

<< <i>just curious what area of the country your in? >>

We're in middle Tennessee. The housing market is as bad here as anywhere else. According to the local loan reps, the recent Fed cut has not taken shape in the local rates. The rates are already as low as 5.5% on a 100% loan, which is pretty good IMHO. I know a lot of families in the area with mortgages over 7% on a 30 year note.

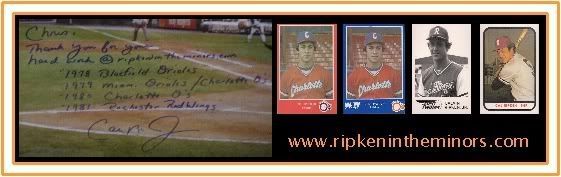

Ripken in the Minors * Ripken in the Minors Facebook Page

In my scenario, putting more money down meant paying way less money later, as it brings your monthly minimum payment down, and allows you to pay more twards principle each month. Just a little extra each month can delete years off of your mortgage.

WTB: 2001 Leaf Rookies & Stars Longevity: Ryan Jensen #/25

We really never planned on buying our own home until the opportunity happened.

Ripken in the Minors * Ripken in the Minors Facebook Page

- Through 15 years of a 30 year-loan, you still owe over 70% of your loan.

- You don't even pay off one-half of your loan until like year 22.

<< <i>Here's some mortgage information I found interesting...

- Through 15 years of a 30 year-loan, you still owe over 70% of your loan.

- You don't even pay off one-half of your loan until like year 22. >>

Yeah, it's nuts. Again, the good thing about the loan I am leaning towards is that you can make additional payments toward the principle over the life of the loan. If we can just pay a little extra here and there it will really pay off long term.

Ripken in the Minors * Ripken in the Minors Facebook Page

Seeking primarily PSA graded pre-war "type" cards

My PSA Registry Sets

34 Goudey, 75 Topps Mini, Hall of Fame Complete Set, 1985 Topps Tiffany, Hall of Fame Players Complete Set

Collecting 1970s Topps baseball wax, rack and cello packs, as well as PCGS graded Half Cents, Large Cents, Two Cent pieces and Three Cent Silver pieces.

30 year fixed will allow you to keep your payment stable as your income rises over the years, essentially making your payment "cheaper". And you can always pay additional principal if you desire with your monthly payment.

Stay away from creative financing, especially with 100% financing. It signals you may be buying more house than you can afford.

Don't forget to figure in property tax and homeowners insurance.

"Molon Labe"

<< <i>Stay away from creative financing, especially with 100% financing. >>

In all honesty, the loan we're looking at is a 100% loan at a 30 year fixed APR. My wife is a teacher and it is a special loan set up just for full time teachers in public or private schools. The APR is just a fraction above the FHA loan although the loan is still under the national average. It prevents us from paying a big down payment while at the same time dimishes closing costs which may help us get a better price.

Ripken in the Minors * Ripken in the Minors Facebook Page

is good, since you have not had much experience dealing

with the subject.

If I recall, TN uses lawyers to close; and, they also use

escrow companies to close. YOUR lawyer should look over

all of the docs before you close, and he can attend the

closing.

To get an idea of how bad RE is in TN, try this google ST:

tennessee real estate foreclosures news

It is entirely possible that for the next 10-years, there

will be little/no equity to be built in most residential

RE. That makes it even more important that you STEAL

the property; if you cannot find a property for less

than 20% of 2005/06' retail price, don't buy it.

The "equity" - in this market - has to be captured on the

front-end of the deal.

BUT, a house is not ONLY an investment. It is OK to

pay a little more for something that REALLY appeals

to you. Especially if you plan to be there for awhile.

In THIS residential market:

NEVER accept a loan with ANY prepayment penalty.

NEVER accept an adjustable-rate mortgage.

Look for a loan that can be easily assumed by a qualified

third-party.

NEVER agree to any kind of balloon payment.

Interest-Only loans are the BEST, if you can get the

same/lower rate you could get on an amortized loan.

Take the money you would have spent on amortizing

the loan and invest it in CDs or stocks. (There is NO

point in paying-off something that will not increase

in value rapidly. As I said, you MUST get your "equity"

on the buy-end. Sort of like in cards, "You make your

money when you buy, NOT when you sell;" in this market.)

Countrywide (CFC) has $1+ billion in foreclosed property (REO)

on their books. They are making GREAT deals on NICE

properties. 25% off of 2005 retail is the WORST deal

I have seen.

Buy the worst house in the BEST neighborhood.

If you use a real estate agent, retain one to represent

YOU. The listing agent represents the seller, NOT you.

There is no fee charged to you for a buyer's agent; they

take half of the listing agent's cut.

Cash is KING and it is about to be GOD. Just because

your cash is borrowed, does NOT make it any less

powerful.

LOW OFFERS are the best offers.

Read, study, and get legal advice BEFORE you act.

After you win on your first deal, you will know how to

do many more. Those deals are the source of all wealth.

gl

NOTE: The only reason I took the liberty of offering advice

was because other posters were.

Zero down, 30-year fixed; as you described.

Other lenders have good ones, too.,

"Molon Labe"

<< <i>The BofA (BAC) "teachers loans" are excellent.

Zero down, 30-year fixed; as you described.

Other lenders have good ones, too., >>

Thanks for all of the help. That was some great information. I'll have to look at the retail notes on the home in 05/06. In defense of the seller, a lot of work has gone in the residence. The only area yet to be updated is the flooring. The deck will need to be rebuilt at some point as well but we'll worry about that later. For the amount of space and the small amount of work to be done it really looks like a great situation. It also looks like the seller is agressively looking to sell. Apparently they already have a new home and are ready to sell it.

FWIW I do already have an agent representing me through the process that has been more than helpful.

Ripken in the Minors * Ripken in the Minors Facebook Page

Our tentative payment does inlude the house payment (priniple/interest), home insurance, and the property taxes. I think the property taxes were not more than $65 per month. The current rate on the sheet is around 5.8 but I think we can get it lower. They said that we can buy the deduction in the rate but given the market I don't see the average going up.

Ripken in the Minors * Ripken in the Minors Facebook Page

<< <i>yikes on the property tax increase.

Our tentative payment does inlude the house payment (priniple/interest), home insurance, and the property taxes. I think the property taxes were not more than $65 per month. The current rate on the sheet is around 5.8 but I think we can get it lower. They said that we can buy the deduction in the rate but given the market I don't see the average going up. >>

That is pretty good on the property tax. I happen to live in the worst state(NJ), when it comes to taxes. I hate NJ...lol

Long Island must be a close second, then--I have a one-family 90x195 lot and I'm paying 7K!! LOL!

Collecting 1970s Topps baseball wax, rack and cello packs, as well as PCGS graded Half Cents, Large Cents, Two Cent pieces and Three Cent Silver pieces.

We're still in discussions in regards to the possibility of making a deal for a house happen. There has been a new offer on the table which would be nothing short of amazing. If it works out it would be a great blessing for our family. Hopefully I'll know something in the next week or two. Thanks again for all of the help!

Ripken in the Minors * Ripken in the Minors Facebook Page

Lou

Good luck,

Mark

Raw: Tony Gonzalez (low #'d cards, and especially 1/1's) and Steve Young.

Not long after we couldn't work out a deal, we started up talks about our current residence, where we live rent/utility free. It's been well taken care of and is a nice place to live. We could use more space, but we can get through that at this point in our lives. Either way, we love this town and owning a home could be the difference between staying or going elsewhere for more stability. Given the commitment a deal looks to have been reached. The price allows everyone to have a solid hope of stability. I'm really fortunate to work with/for people that truly have the best interest of my family at heart. I don't want to get too detailed in the specifics, but we're getting the house a little under 30% off the appraisal and the agreed price includes some pretty nice renovations. Again, we're fortunate and blessed.

Now it's a matter of what deal works best for the family. Of course my biggest requirement of the banks is to present a 30 year fixed APR that does not include any penalty for advanced payments on the principle. I'm not ruling out the FHA loans, but considering that the agreement calls for me to pay 50% of the closing costs, I'm not sure that I like taking a lot of money out of the bank and not having that money for a "just in case". Of course the teacher loan is still on the table. Other options include a urban development (HUD) loan that doesn't require money up front as well as a different 100% loan with down payment assistance. Like the urban development loan it doesn't require any money on the table but the loan is a higher amount due to the fact that I'm not out the 3% + 50% of the closing costs while at the same time having a lower interest rate. Of course any opinions are welcomed as my head is spinning from all of the calls/offers throughout the day.

Ripken in the Minors * Ripken in the Minors Facebook Page

a good way to go is to use lendingtree.com you could at least get quotes from them and then compare to a local bank. or if lending tree is providing better rates/fees ask a local bank to match the fees/rates from lending tree. I used them last year for a purchase and they were cheaper than the local companies.

Joe

Ripken in the Minors * Ripken in the Minors Facebook Page