Well, there goes the value of MS 1889-CC Morgan Silver Dollars

ProofCollection

Posts: 7,332 ✭✭✭✭✭

ProofCollection

Posts: 7,332 ✭✭✭✭✭

I was awestruck by the deluge of MS 1889-CC Morgan Dollars in Heritage's upcoming auction.

By my account there are approximately 45 89-CC Morgans mostly MS62 and better being auctioned on Aug 28, 2025. There are even some DMPL and PLs.

Does anyone know if there's a story behind these? Did someone find an original bank roll? Perhaps a mystery Morgan roll bought on ebay? ![]()

I think this link may return the search results.

https://coins.ha.com/c/search/results.zx?term=1889-cc&si=2&dept=1909&dept_child=4421&live_state=5318~5319~5320~5322~5321~5324&coin_category=3838&coin_category_child=4722&auction_name=1385&mode=live&page=200~1&ic=KeywordSearch-A-K-071316

8

Comments

Looks like someone discovered an oasis in the “desert find”.

Looks like all the same submission from the few I looked at. Congrats to that seller.

``https://ebay.us/m/KxolR5

I don’t think it will hurt prices…. This is one of the more sought after Morgan Dollars

``https://ebay.us/m/KxolR5

Wow. Call it $30K each for 35 pieces = $1 million. Heck of a score. I hope the rest of the story comes out!

I think it will have an effect on 1889 Morgan's. Not to say they will be like 1885-O or 1879-S but when that many of the same date hits the market it has to have some kind of effect. Could be 10 to 20%.

We will have to wait and see.

Student of numismatics and collector of Morgan dollars

Successful BST transactions with: Namvet Justindan Mattniss RWW olah_in_MA

Dantheman984 Toyz4geo SurfinxHI greencopper RWW bigjpst bretsan MWallace logger7

Interesting. Take care...CC

Never know, high-end Registry collectors could bid them up. So few in MS grade, may be golden opportunity to acquire that which was not available before.

Is there anyone doing statistical analysis on certified coins? It would certainly be in demand.

Printed catalogs often have more info than just the online listings,

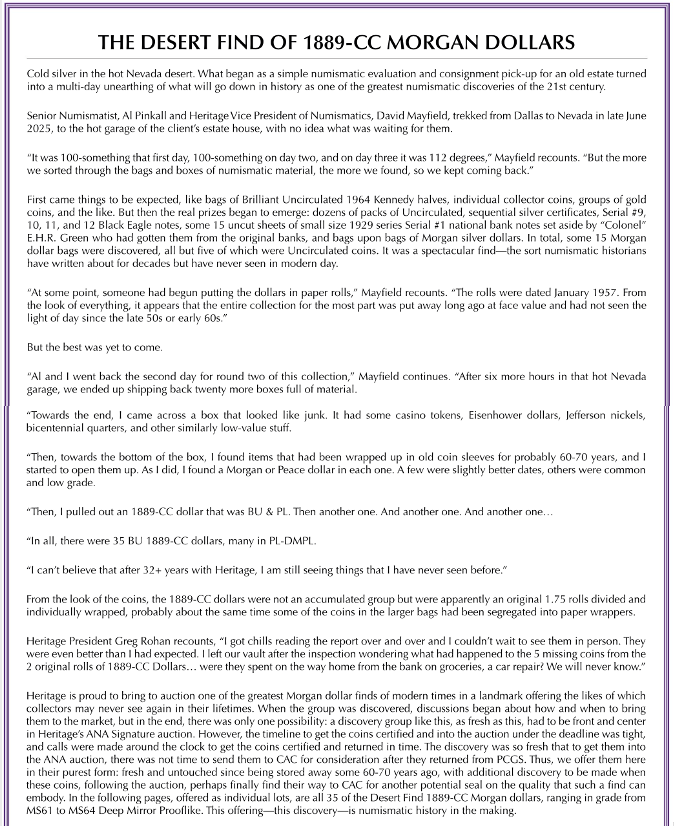

Heritage has the printed format of this catalog viewable online. Linked below, but it doesn't look like you can link directly to the intro with the story found on page 157. It seems to require flipping pages online until you get there.

The story is quite interesting with a lot more than the 35 Unc 1889-CC's found.

.

.

https://coins.ha.com/c/ecatalog.zx?saleNo=1385&ic5=CatalogHome-AucType-PrintedCatalogViewer-071515

"To Be Esteemed Be Useful" - 1792 Birch Cent --- "I personally think we developed language because of our deep need to complain." - Lily Tomlin

I took a shot at combining two screenshots.

Source: Page #157 @ https://coins.ha.com/c/ecatalog.zx?saleNo=1385&ic5=CatalogHome-AucType-PrintedCatalogViewer-071515

Amazing story. You never know what may be sitting in someone's garage!

Wow, cool!

I’ll never have this “problem” but wouldn’t it make more sense for the estate to slowly release the coins?

I think I knew the owner and his daughter. The 5 missing CC's were traded for a new pickup truck. This was about 20 years ago. He was a patient of mine and a great gentleman. Daughter is sharp and knows what she/he had. But, perhaps it's just another hoard still out there waiting to be "discovered"?

bob

Sounds crazy to me, If I found 35 1893-s Morgan's I wouldn't send they all in for grading at the same time and I wouldn't be putting them all up for auction at the same time

Doesn't make sense

JMO

Mike

My Indians

Dansco Set

It's a dealer and they know very well that they want to unload their lot

Yeah, I really don't understand flooding the market with them all at once. It seems to me that it would make a lot more sense to put them up one or two at a time.

I'm sure there's an explanation, but I don't know it.

I disagree I think it is best to get them all going. This way the others that are owned don't get first shot or spoil the market. You will also get people that would not normally look for one and try to pick one up. None of them are stickered so you know none of them have been to CAC so there is upside to buying a good one.

I've been watching this date closely for a few years. Major auctions tend to have 2 or maybe 3 MS examples max in a given auction, and it seemed like I would encounter 4-5 PL or DMPL versions in retail or at auction per year. Not that I know every dealer's inventory, but probably the bigger ones that I keep an eye on.

Anyway, you have to figure that current pricing is supported by a demand for the quantities I just mentioned above coming on the market in a given year. This is 7-8x that. There's certainly more demand at lower prices. If you're a dealer, I don't think you can pay anywhere near greysheet bid for these knowing you'll be competing with a glut of other dealers for the next couple of years. I already have one (see my avatar), but I'm relieved I don't have to stress about how much to pay, although I probably and most certainly could have saved some money as I expect these will sell for less than what I paid for mine. And as Clackamas1 suggested, I bet these are all strong candidates for CAC. I don't know if mine has been or not.

To add to that, in my experience estates aren't usually patient enough to maximize every dollar especially with multiple beneficiaries involved.

http://ProofCollection.Net

I would normally be in camp that says piece em out a little at a time on a find of this magnitude, but hype and publicity on the find, might create a once in an opportunity so called buzz / excitement for buyers. Seems to have worked lately.

I have a nice au-58 that i bought couple years ago OTC, it may drop back a few bucks going forward, not that worried about it honestly. Funny thing, I had bought a really nice XF45 raw over the counter from a fresh deal about 2 months ago, sold it to a customer couple weeks ago. He called yesterday and said he had gotten two cold calls from larger firms on 89-cc In MS 62 63 range. I found it funny after reading this last night, might now know why?

I thought about telling him after this story broke, sell me back the 45, and Ill sell him the 58, ( the 45 is that nice!)

Very interesting. At first I was in the spread it out camp but we are talking Morgan dollars here. If there isn't a glut of buyers for rare date Morgans then there really is a fall off in coin collecting. Personally, I would not show up wearing my bargain buyer hat. just my opinion. James

What would be interesting to know is when & how the estate originally acquired. Being the 35 coins encompassed 3 different VAMs, and with only 5 obverse & 5 reverse dies used, seems unlikely they originally came from 1 Mint bag. I would think someone, maybe a bank, acquired these at different times from different source and then put together as 1 3/4 or 2 wrapped rolls. Doesn't distract from story or marketability, but the comment 'not an accumulated group' can have different meanings.

I'm not sure there's been a lot of hype and publicity yet.

http://ProofCollection.Net

Such a cool find! I think the market is big enough for these that the value isn't going to be hurt by "ripping off the Band-Aid" and selling them all at once. If there are a couple that go "cheap", the consignor will probably more than make up for it with the favorable terms given to that size of consignment.

Keeper of the VAM Catalog • Professional Coin Imaging • Prime Number Set • World Coins in Early America • British Trade Dollars • Variety Attribution

What did he do for a living?

Keep in mind who got first dibs on the estate. Thats why they’re all going in the same auction together. Heritage, YOU SUCK.

``https://ebay.us/m/KxolR5

The 62s have a solid mint state look to them and with the backstory they will do OK.

Wonder if HA is selling the 10 full Mint bags of uncirculated coins also. With the 1957 wrapped dollar rolls, these bags were acquired before the 1960's Treasury release. Wow, someone acquired and saved this neat hoard. But in Nevada with the casinos guess it was easier to acquire then elsewhere.

He was retired. I was an Audiologist and dealt with a lot off old age hearing problems. He sure had a need for aids. Told me many stories of his Unc bags, CC's and silver bars. Daughter brought him to appointments and she lived with Dad. As to what he did for work, I have no idea. She was the one that related that he wanted a new pickup truck and traded the dealer with Unc CC's. Probably not this fellow but it may be. I suspect he has passed and daughter is taking care of business.

bob

It could have been that they won a big Jackpot one night. Casinos pay in cash and these were used heavily at the time. If you never got into a position to need to sell they are an asset. If that was an option I could totally see myself taking BU bags home from a big Jackpot win.

Yeah and back in the 40's & 50's they were only worth $1.

As you know, auctions work best when there are two or more seriou bidders for an item.

In this case, are there really going to be enough bidders ready to pay that kind of money for that many coins?

I don't know, but I have my doubts.

I would rather have many bidders biding on a few coins than a few bidders biding on many coins

Mike

My Indians

Dansco Set

Perhaps an apples to oranges comparison, but it seemed there werno shortage of buyers on the gold flowing hair w/privy mark which all 300+ went for big money in a single sale.

Great find, thread , and opportunity.

Interesting to note that none of them got beaned, or so it seems.

They rushed it for the big Heritage auction, no time to bean. Opportunity for beans awaits the winning bidders.

If you read the posted report, none of them were sent to CAC. This creates a Schrodinger's cat situation, and often brings in as much or more revenue than if they did send them. There's not a big CAC spread for this issue in UNC, so I think it's a good strategy in this context. I also think that transparently letting them rip all at once is the way to go, rather than releasing them slowly, which might raise questions as the Fairmont hoard did. Whoever is making the decisions at HA knows exactly what they're doing, I think they're going to make out well.

Founder- Peak Rarities

Website

Instagram

Facebook

And this is why I go to garage sales. Ya nevah no! Peace Roy

BST: endeavor1967, synchr, kliao, Outhaul, Donttellthewife, U1Chicago, ajaan, mCarney1173, SurfinHi, MWallace, Sandman70gt, mustanggt, Pittstate03, Lazybones, Walkerguy21D, coinandcurrency242 , thebigeng, Collectorcoins, JimTyler, USMarine6, Elkevvo, Coll3ctor, Yorkshireman, CUKevin, ranshdow, CoinHunter4, bennybravo, Centsearcher, braddick, Windycity, ZoidMeister, mirabela, JJM, RichURich, Bullsitter, jmski52, LukeMarshall, coinsarefun, MichaelDixon, NickPatton, ProfLiz, Twobitcollector,Jesbroken oih82w8, DCW

@Rc5280 , @PeakRarities Thanks, I did not get that far to read it all, interesting info.

It's quite possible that they have a need to sell quickly to settle the estate. A bit presumptive to make such a statement without knowing the situation.

All comments reflect the opinion of the author, even when irrefutably accurate.

Yes, but he wasn't always retired. I assume you don't know what he did before he retired?

That's assuming HA got to make the decision. Doesn't the consignor's directive carry any weight?

That's my guess.

http://ProofCollection.Net

Or not really care that much to get every last dime. I mean this is just part of it and it is $1M dollars.

Years ago a coin dealer I bought from told me about a purchase he made of a large number of gold coins from the executor of a decedent's estate that has been filed in a court back in the eastern part of the USA. The opportunity to purchase the coins presented itself to the dealer. He agreed with the executor to purchase the gold coins based upon their then current market value.

After the agreement was reached, the executor had to obtain court approval of the sale. That turned out to take years, because of extended litigation taking place within the probate case among multiple heirs. Faced with a delay in closing the sale the attorney for the executor (with the consent of the other interested parties and their counsel) hired the coin dealer to store the gold coins at his place of business (in a locked safe). The executor paid the coin dealer a monthly fee for his services as the custodian who would hold possession of the coins.

When the litigation in the probate case was finally resolved a request was made to obtain a court order approving the sale of the coins to the dealer. When the dealer was told about the executor seeking the court order the dealer looked at the coins and checked the current market value of same. The market value had gone up substantially (like due to increase in the spot price of gold). The dealer suggested to the executor and the attorneys involved in the probate case that the purchase price be modified and increased.

The executor and the attorneys all told the dealer that the purchase price could not be changed (even if the price would be higher). They said that trying to change the purchase price for the sale of the gold coins would trigger a new round of legal disputes in the probate case because the heirs were not getting along at all (and were looking for any excuse to resume litigation).

As a result of the above the coin dealer received monthly income for years to store the gold coins that he ended up purchasing for less than the market value of the coins at the time he paid the purchase price.

Nice result for the coin dealer.

Estate litigation, like divorce litigation, real estate litigation, business break up litigation, etc. can go into a black hole for years and years.

I have expressed reservations about the wisdom of putting all the coins in one auction. But I readily acknowledge that Heritage Auctions knows more about putting expensive coins up for auction than I do.

I fail to understand why you (@TwoSides2aCoin) condemn HA, as if it's serving up some sort of underhanded self-dealing. The reality, of course, is that HA makes more money for selling coins at a higher price. The further reality, of course, is that HA is a highly-reputable firm. While I don't understand why they're doing it this way, it is in their own best interest to maximize the aggregate hammer price, so I'm sure they have good reasons for doing it this way. For my own edification, I would like to know those reasons, but I think it's (at best) presumptuous for anyone to condemn HA for this, without knowing the business as well as they do.

Sure, assuming the coins are still owned by the consignors and they didn't decide to sell them outright. Consignors will often lean on the suggestions of the auction house, however, if they made the decision to see it through until the auction, that indicates some type of desire to maximize potential returns imo. I'm sure HA either made or could have given an option for an outright sale if they were in that much of a hurry to sell. If the coins were discovered in late June, though, that would still leave 2 months to grade, sticker, and catalogue the listings. I assume that while it might have made things more difficult and constrained the amount of time left over for photography and descriptions, it was possible to get these through CAC in time if they wanted to. Additionally, CACG could have been utilized to expedite the process.

I also tend to believe that even if HA owned these outright, the same strategy would be used to liquidate them. As I mentioned, the CAC differential for the issue isn't substantial, so I wouldn't doubt that the marketing, cataloging, and buzz generated from the story and the lack of CAC could have been a better use of time than a trip to NJ. If they were slowly released into the market, the realized prices could gradually diminish and as a result, the price guides and market bids could come down, This way, they all are sold while the guides are intact, and like someone else said, they may have opportunistic bidders that otherwise might not have been seeking out an 89-cc.

Founder- Peak Rarities

Website

Instagram

Facebook

Well then...I may just have to upgrade my 89-CC

A few thoughts, guesses and opinions regarding this just to exercise my brain:

_ When reading the original post, my first reaction was that it would surely make more sense to auction them in smaller amounts spread over time.

_ The more I learned my view changed and would likely handle it the same way it is being done. This amount being fresh to the market is an advantage over say a similar sized hoard if relatively recently acquired from the market then being dumped back on the market at once.

_ After finding the intro about the Desert Find hoard in the catalog saw that the hoard was 35 total rather than the 45 total in the auction search.

_ The 35 is only 5 to 10 percent of Uncs going by PCGS population. And that is assuming all non-PCGS Uncs are duplicates of PCGS to account for resubmissions over the years.

_ The coin market and dollar market is big enough to absorb what may be no more than $1 to $2 million in value for the 89-CC's. It is a question of how will it affect price results. If the hoard was larger, it would make sense to split it up. At what number that would be who knows, though I think 35 is getting close to the limit.

_ The grades are spread out from 61 to 64+ without greatly distorting any particular grade.

_ All at once removes any doubt what is in the 89-CC hoard and what the grades are. No risk of more overhanging the market.

_ All at once allowed them to get into one of the most attention getting auctions of the year.

_ All at once is going to grab more attention of dealers and collectors looking for undergrades and those who may have been going to get one eventually but will instead try now hoping to get one cheaper than recent market. Maybe it could work out that way for some, though I doubt more than a 10 to 20 percent discount from current market at most if any. With the likely increased number of potential buyers creating more demand than usual, the market will find its level and probably be the same or even better than spreading them out.

_ The way the sale of these is being handled can not be against the will of the consignor or it would not happen. While it's possible for it to be against the advice of Heritage, I'm guessing there was agreement this was the best way by both parties.

The results will be interesting.

"To Be Esteemed Be Useful" - 1792 Birch Cent --- "I personally think we developed language because of our deep need to complain." - Lily Tomlin

I agree with this insight. In today's world, hype sells ! Can't get Sydney Sweeney to pose with the haul so the Nevada garage treasure story is good hype. Just like Redfield Hoard etc... These 1889 CC samples can get special labels for the 2025 Nevada garage Hoard and fetch even more lettuce. It is indeed an great story !! Barn Find 100%

Yea wb interesting see how CPG reacts. Greater pops are like gravity right? Think CDN bid will drop / interesting. Can’t keep them ultra low pop forever.

They were never, even remotely, "ultra low pop". Coinfacts estimates there are an estimated 25,000+ survivors, 4,250 in MS grades, ultimately this find is just a drop in the bucket.

Founder- Peak Rarities

Website

Instagram

Facebook

I’m sorry ….. maybe you’re too much a newbie to understand what a “YOU SUCK” is, or represents. In the old days it was a complimentary award for such finds. I’d like to say “you suck”, but I haven’t seen a reason to award you one.

``https://ebay.us/m/KxolR5