Silver Triple Top coming soon???

HalfDime

Posts: 655 ✭✭✭✭

HalfDime

Posts: 655 ✭✭✭✭

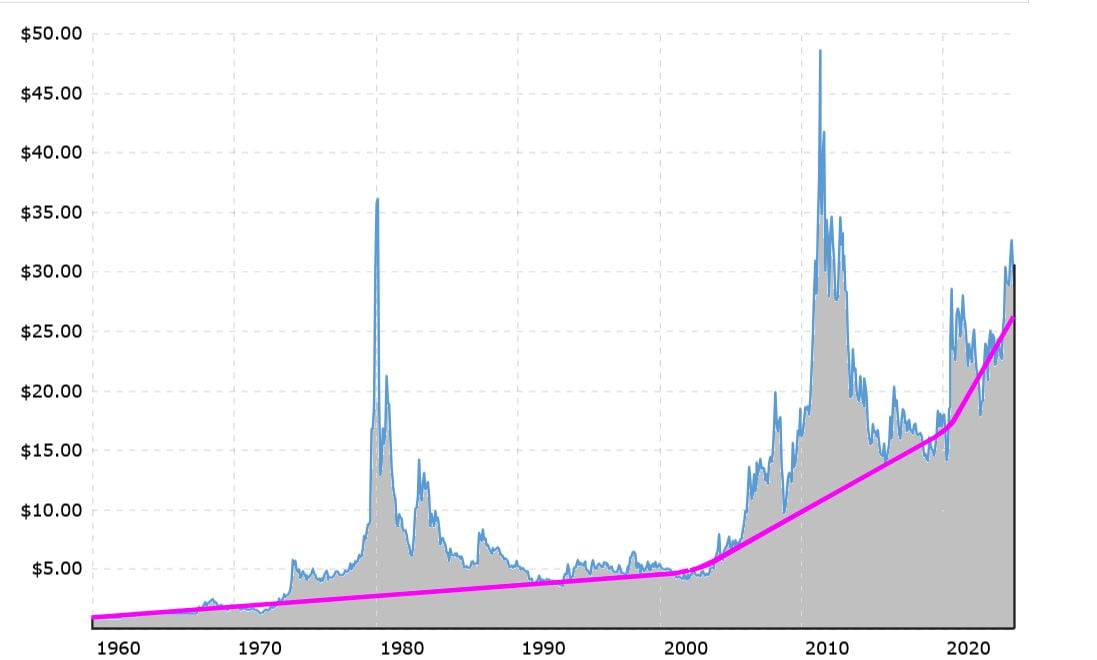

If we look at the long-term chart for the price of silver, there is an interesting formation happening. Usually major price spikes can top out and retrace to lower levels, and that has happened twice with silver in the past 45 years. This appears to now be setting up for a triple top for silver.

Silver will need to break above these levels to continue higher obviously. But there is also the chance it spikes to a triple top, and sells off dramatically.

0

Comments

The two $50 spikes were very short in duration.

The current trend is more gradual.

I posted this last year. Ignoring the spikes, the general trend seems to be this line:

And both were anomalies: Hunt brothers and great financial crisis

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

Okay, But you didn't give us your insight into where it may be going from here to say end of year.

up?

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

Yup!

Many would call that a cup and handle, a bullish chart.

"They" sure don't want that triple top.

I knew it would happen.

Pretty sure whoever "they" are, "They" could care less. THKS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

"They" run SLV, and "they" are running out of silver to lend. When they do run out, they will settle your account in cash and you won't be able to get back into the silver market at anywhere the price that silver is right now. Good luck.

I knew it would happen.

You can forget the past. The charts are useful in telling how much more it is today.

``https://ebay.us/m/KxolR5

They and Me are doing just fine at the moment. I used to think it was all luck but these days it's appears all that's necessary is just a little common cents. Plan accordingly. RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

Someday blitz is going to have to teach class.

Past performance is no guarantee of future performance.

If we assume it to be true the market is rigged and short sellers are to blame for the last few decades, then I'd venture a guess they are going to gradually close these out but over a long period of time. That way we don't see a squeeze situation or even any margin calls.

My guess is the long game plan is to hold physical assets as the government prints more money and ride this out until bread costs a wheelbarrow full of money.

Then they're not technically losing anything at when they close their short positions since it's all in property and precious metals and the dollar means nothing. This will pass the consequences from malicious short sellers to working people who can't afford any assets at all.

Actually if one has a strong and disciplined process then performance can and usually is consistent and repeatable.

Knowledge is the enemy of fear

No one is preventing anyone from buying the physical metal. In all other instances where the price is fixed (that's what price suppression means) which has never happened for 5+ decades (I've heard this claim since the 80's), supply disappears. That hasn't happened because this claim isn't true.

Gold has also supposedly been suppressed, and it's been a smashing success, hasn't it? Rising 10+X up to the 1980 peak and now about 50X at current prices since August 1971 when Nixon ended the last element of convertibility. It's also a mystery to me why anyone would care about a systemically financially irrelevant metal like silver while completely failing to suppress the one that really matters, gold. (No, gold is not relatively cheap. The ultimate purpose of money isn't to acquire other forms of money, whether silver or fiat. Compare gold to the prices of other commodities.)

The better explanation is that there aren't enough metal advocates who want the physical metal. They lack sufficient market relevancy as buyers of last resort.

>

This isn't going to work in the US like most metal buyers think. It's not going to be BAU where everything else essentially remains unchanged.

American society will completely fall apart and there will be far less to buy, with any money. Credit availability will virtually disappear with hyperinflation and without it, most consumers and businesses can't function economically. In a just-in-time economy with inadequate supply chain resiliency, supply will collapse with likely mass social disorder.

From 1980 until 2000 gold and silver were in a Bear market, and yes, the prices were suppressed by the miners. They all heavily hedged mine production to get the loans to start the mines.

"Prior to 2000, mine hedging in gold and silver did play a significant role in limiting price increases. Gold miners would hedge future production by selling gold forward at fixed prices, which effectively capped their downside but also kept prices from rising sharply since a substantial volume of future supply was pre-sold at lower prices. This was particularly evident in the 1990s when many miners hedged heavily, locking in prices below what later became market levels. As a result, these hedges acted as a restraint on upward price movements because miners were forced to deliver gold at the lower hedge prices even as market prices climbed"

Right around 2000 the miners started to remove the hedges, and that allowed the prices to stabilize and rise as a result.

No, this doesn't explain the price. Its that physical buyers were not relevant enough as a buyer of last resort. Price fixing = no supply. If the price were actually below the "real" value, there would have been no supply.

That's how markets actually work. There is no exception for silver.

"Because the hedgers were getting gold and silver below market rates through forward sales, they had little reason to buy on the open market—doing so would mean buying at higher prices than their hedged contracts.

This dynamic changed as miners began stopping or significantly reducing hedging. Without hedging, miners retain full exposure to higher market prices, and the supply pressure from forward sales diminishes, which helped to drive prices higher. This shift away from hedging has been identified as a catalyst for rising gold and silver prices because it removes the downward price pressure exerted by miners’ hedging activities."

So yes, this helps to explain the price. The Bear market happened under hedging, and once removed, it turned into a Bull market.

Miners (aka, commercials) hedge all the time. The level of hedging varies. To my knowledge, commercials are more right than wrong (smart money as opposed to dumb money), but this doesn't explain why silver stagnated for over two decades from after the 1980 price crash to the mid 2000's. So no, this doesn't provide the explanation you think.

It's not that I don't understand your explanation. It's that price changes don't have anything to with supposed "fundamentals". People aren't rational individuals using the "fundamentals" as there is no "correct" value. They act on beliefs, whatever they believe.

The price is what it is, and that's it.

.

Take a company like Barrick, for example. Their strategy was to sell forward and drive down the price. The lower gold price allowed them to buy up other gold mining companies cheap. Then the production from those companies could provide the gold for future delivery. At some point, they stopped the forward selling, the price of gold climbed, and the value of all the assets they had accumulated increased.

.

Yes this was the start of the new Bull market. It was also about when the gold and silver ETFs came out, and people switched into trading those and avoiding the mining stocks due to the hedging fiasco.