Options

On Sale June 5th: American Eagle 2025 One Ounce Gold Uncirculated Coin - Product Limit 7,500

Goldbully

Posts: 17,910 ✭✭✭✭✭

Goldbully

Posts: 17,910 ✭✭✭✭✭

Is this the lowest product limit for an Unc. AGE yet?

Oh, anyone buying?

Looks like $4,170 is the sale price at this point.

Edited to add: With the price of gold at an all time high, and the Mint's profit margin at an all time high, I would suggest a product limit of 4,500 and a HHL of 2. Win Win all around.....Instant sellout and the Mint becomes popular again. ☺️

2

Comments

Except they don't want "instant sellouts" on products in annual series. They also don't want to be popular. They want to stay committed to an excessive precious metals pricing grid, and to sell as much product as possible at those prices.

Their mintage limits, at the prices they charge, are nothing more than wishful thinking. As of 5/26, they sold 8900 22s, 6600 23s, and a whopping 2900 24s. Notice a trend as spot rose and the premium they charge didn't budge? At these all time high prices, they couldn't sell 4500 with no HHL.

They can sell 10K FH as a one-off, and will likely sell out the Superman coins if they don't go crazy with the mintages. But something like AGEs need to be priced closer to the market, which means a small premium to $3,000+ spot. And they just don't want to go there.

So this is what you have. A 7500 mintage limit, and very little interest. No. No one who isn't compulsively continuing a set is buying a $4200 2025 one ounce AGE.

Why is a 30% gross (not net) margin "excessive"? If it weren't PM, no one would consider that margin to be anything but normal.

I disagree I think they want sellouts, no overstock.

4500 or 7500 isn't a low supply for a $3300+ coin, especially approaching this quality.

The only other coins with this "low" supply or higher at this price point approaching this quality are other gold NCLT and US pre-1933 gold. There is no comparability between these two groups of coins.

The mintage is only viewed as "low" because most buyers aren't the same type of collector as those buying all other coins.

Because that is not where the market is for one ounce gold coins. It's not about 30% margins. It's about $4200 gross. 50% margins were not a deal breaker at $1000 spot gold, because the gross price was $1500, not $4200. And 200% gross margins don't stop them from selling 90K silver coins for $91 each.

So, the bottom line is that 30% still equals $900. For a single coin. Which is excessive. Since, other than the cost of the metal, it does not cost any more to manufacture a single gold coin than a single silver coin. Or a single base metal coin, for that matter.

Above and beyond the cost of the PM, why can the Mint produce a burnished ASE for less than $60, yet require $900 to make an AGE without a special finish? GREED!! Not "30% gross (not net) margin." They manage to sell gold bullion for FAR less than a "30% gross (not net) margin."

How? Why? Because they might actually want to sell those coins? Or because it costs $900 per coin to sell them one at a time in a box, when they can sell a set of 20 base metal uncirculated coins for $33, including the nearly $6 in face value? GREED!!!

So they sit. Unsold. Because they incorrectly think the market will support the pricing since it so significantly suppresses mintages. Instead, the coins are simply shunned by the community.

This doesn't just apply to modern numismatic product from the Mint. It also applies to generic classic gold. You know this, so why are you arguing for the sake of arguing?

Because it's not about what "should" be. It is what it is. There is no market for $4200 uncirculated AGEs. Which is why they only sold 2900 last year. And can expect to sell around the same this year, even though they are willing to make 7500. HHL 3. 🤣

Of course they "want" sellouts. But only at their number.

Otherwise, as @Goldbully suggested, they would intentionally under produce, in order to create an instant sellout, and a win for people overpaying for their product. In this case, probably a mintage of 2500, not the 4500 suggested by @Goldbully. Instead, they over produce, which ironically actually further suppresses demand after they don't sellout.

They don't do that because they don't want to lose the revenue from the imaginary 7500 they hope to sell. HHL 3. 🤣

The Mint is in no way obligated to strike up the entire mintage limit of 7,500 2025-W AGE coins lol. They will not.

Just like the Mint was not obligated to strike up the entire mintage limit on the FHG. They did not.

30% isn't GREED, it's the norm, and may just go up for their Numi Gold?

The 1oz AGE-W coins do have a special finish(Burnished), and have been that way since their introduction in 2006. They are priced accordingly, and are a far cry from being std 1oz AGE bullion.

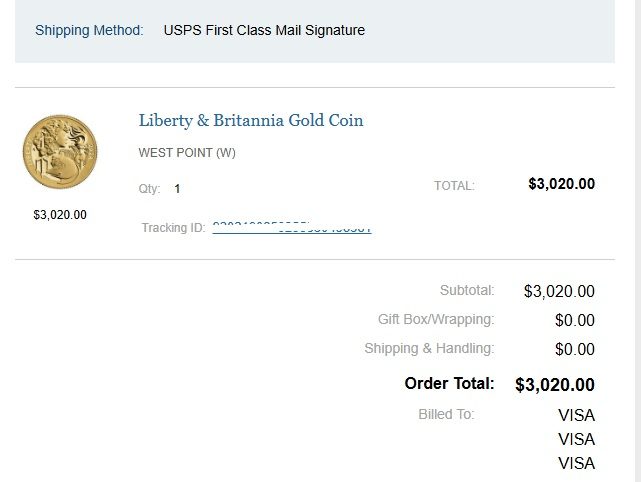

30% margin was the case with the 2024 L&B Gold, and I complained a bit, and bought two anyway on a hunch. Now it doesn't feel too bad, since that premium has vanished.

They gave everyone 30 days to purchase the L&B coins, then they went off sale. They minted to demand for a change, and I complimented Ms Gibson in person at the 2024 ANA for giving it a go. They should do that more often imo...

.

.

Whats an HHL?

God comes first in everything I do. I’m dedicated to serving Him with my whole life. Coin collecting is just a hobby—but even in that, I seek to honor Him. ✝️

(HouseHold Limit), usually the first week or so after a new release, then they lift the limit depending on demand.

They want sellouts, no overstock it appears or very little. Look they have been burned on releases and overstock and I am sure marketing is hearing it from above.

As far as 30% margin that is strong for a bullion coin. The market perceives value accordingly, but of course there are yearly collectors.

It is usually 24 hours after release that it is lifted.

HHL of 3....but if you wait a day, then you can buy more.

It's official......$4,170 is the opening day price.

Remember, no more than 3 coins today. 😊😊😊

One hour to showtime.

Please post your order numbers here!!!

Mint Link

So, anyone buying?

Crickets....I think the mint has now alienating its most loyal customers and really doesn't give a d---. Many of now don't get ANY products from them such as the ridiculous continuing Morgan and Peace dollar series, mint sets, proof sets, eagles (silver and gold and palladium and platinum). I used to get all of these and now get none...

Well, just Love coins, period.

As of 1:05, 2,994 AGE's remain.

Pass

And that's a far higher portion of the maximum mintage than the 20K burnished ASEs. Really tells you all you need to know about the public's interest in something like this at the premium they want. Even with a paltry 7500 mintage.

Which is a shame. Because it's a beautiful coin, and they could sell a lot more, and make a lot more for the US Treasury, if they weren't so greedy.

As of 8:42 EST.....2,882 Unc. AGE's remain unsold.

How many did they start with that were shown remaining is the real question.

I suspect they minted much less than 7,500 to start. Maybe 5,000?

That would put sales at 2,118 so far and seems reasonably close at this early stage to the 2,900 range for the 2024's.

My US Mint Commemorative Medal Set

I'll wait til till the household limit comes off

INYNWHWeTrust-TexasNationals,ajaan,blu62vette

coinJP, Outhaul ,illini420,MICHAELDIXON, Fade to Black,epcjimi1,19Lyds,SNMAN,JerseyJoe, bigjpst, DMWJR , lordmarcovan, Weiss,Mfriday4962,UtahCoin,Downtown1974,pitboss,RichieURich,Bullsitter,JDsCoins,toyz4geo,jshaulis, mustanggt, SNMAN, MWallace, ms71, lordmarcovan

Oh, yippeee I think I will grab at least 5 or 6! LOL.

Well, just Love coins, period.

who's taking the position they didn't mint the limit?

me

will this be on the very next mint report?

Doesn't matter, because they would most certainly make up to the limit if they could sell them. This isn't the FH release, where they are playing games with an item with high demand.

In fact, it very clearly demonstrates what I was trying to say last year. Not making the limit up front, because they don't expect to sell that many, AND refusing to make more if they are wrong, in order to advantage those who got in, is very different from what they usually do in such cases, which is put them on back order and then make more.

Here, at this price, I don't think it's ever going to be an issue. Because no matter how few they made, they will likely never sell them all at around $1,000 above spot.

You'll see sales. You'll never see how many they actually made. At least not until they are declared sold out, at which time you can see how many they sold and draw your own conclusion.

It should be.

The last mint report on 6/1 shows that they sold 700 coins to the AP's before launch day. They placed their orders between 5/23 & 5/27.

On launch day 6/5 before 12:ET there were 3215 in stock.

They have initially struck approx 3915 coins imo, which makes perfect sense given the high price, lower demand, and last year's sales numbers. Striking the entire limit for this coin makes zero sense.

2,601 remain as of 6:07pm EST.

2,563 remain as of 8:32pm EST.

2,506 coins remain.

That's 57 coins sold since June 10th.

walk, do not run....

buy it cause you like it

I like it a lot, I just can't afford it.

You're not missing anything. Gold is at an all-time high, and sales are sluggish because the premium is absolutely insane. They will never be worth the premium to spot that the Mint is selling them for. Unless spot is cut in half, and the market suddenly discovers them due to the low mintage.

Try to wrap your head around $5000 gold. It’s coming……..

So, they may have struck 3,915 according to posts above, and with 2,506 or so remaining that is only 1,409 sold estimated. Then to confirm the June 15th Mint report shows 1,407 sold, so this mintage estimate and remaining coin scenario seems to be correct. These burnished unc. gold are certainly hated by the market, as the premiums have KILLED demand, even by long time collectors. The Mint needs to revise its thinking of how to serve the public IMO. They will probably have to melt 2,000 of these. LOL

My US Mint Commemorative Medal Set

2,494 coins remain at this point.

That's 12(one dozen) coins sold since June 16th.

Issue price: $4,170.00

Today's price......

Mint fatigue.

I knew it would happen.

They are just too expensive compared to the gold price for just another date change. Nothing special about them at all.

The Mint should just quit selling them and stay with proofs for those who like shiny, overpriced things and regular uncirculated bullion for those who like gold for a hedge or speculation.

My US Mint Commemorative Medal Set

Fast forward 100 years.... "Wow, gold was only $4220 an ounce?? I woulda bought a lot if I was there back then!"

Could certainly be! But... if one is gonna buy an ounce of gold..... much better buys out there than what the US Mint is offering!

2,458 coins remain at this point.

That's 36(three dozen) coins sold since June 20th.