@WCC said:

There is no precedent for a predominantly credit based financial system to hyperinflate it's currency in the fiat money era, and in the gold standard and gold exchange standard era, the connection to gold did not accommodate it in the countries which used it.

We have seen in the past few months that the courts will intervene and dictate what the "government" can or can't do with decreases in spending. The courts have recently disallowed the terminate of federal employees for example, and thus the courts have taken over the role of legislators. If the trust in the fiat currency collapses, so then will its value.

>

The country isn't in an emergency, regardless that some act as it is one. The courts don't have an army, and in a real emergency, all sorts of unexpected things will happen, and public officials will do things no one expected, with the public who is destined to be "thrown under the bus" first being the most surprised.

You're too psychologically committed to rising metals prices. This is apparent in most of your posts. I expect both to rise in anticipation and up to some point in a crisis, but in the scenarios you've brought up in multiple threads, the vast majority of metal advocates aren't going to get rich or escape mostly unscathed either as you seem to think. In the scenario of this thread should it ever happen, the vast majority of Americans would end up poorer or a lot poorer and not just temporarily.

Silver is cheap relative to gold and to my knowledge, most other commodities. Gold is historically overpriced versus most of the things people need to buy. I don't know when it's going to happen, but longer term, I expect gold to lose substantial relative value versus the goods most people need to buy, meaning anyone who owns a disproportionate pct of their wealth in it will be negatively impacted too. There is no "forever" asset which can be bought "forever" and forgotten.

The world isn't populated by a bunch of robots whose behavior can be predicted in advance. Short of "the noose", neither elites nor public officials have the motives implied in any of your posts. or for that matter, virtually any if any of the posts I've read from anyone else either. For starters, by destroying the currency, public officials are likely to destroy their own wealth, possibly the value of their pensions, and whatever they do might not save their elected office either, if elections are even still held. The US isn't a developing country where unstable governments are BAU.

@Overdate said:

Most credit cards charge a variable rate. About 80% of business loans by value carry a variable rate. The only >private credit sector with a predominantly fixed rate is home mortgages, and the proportion of adjustable rate >mortgages is continuing to grow.

Most corporate debt is fixed. Most investment-grade bank loans are fixed. Junky bank loans usually float, yes.

Credit cards irrelevant in big scheme of things.

The long-term interest cycle almost certainly turned in 2020. The last rising cycle lasted from the 40's to 1981. It will take a while but higher interest rates will really "bite" corporate debt because leverage is a lot higher and coverage ratios are substantially artificial for reasons I've given you previously.

Aggregate credit quality is weak or very weak now. Ultimately, I expect rates to "blow out" past the 1981 highs.

Credit card debt isn't material enough to be the source of a credit crisis, and neither is consumer debt collectively. But substantially rising default rates triggering substantially tighter credit conditions have an outsized impact on household finances than reflected in aggregate economic date.

The majority of Americans are either broke or marginal financially. They rely on credit cards and loose auto financing to maintain their often-unaffordable lifestyles, especially during times of higher employment. Most people seem to resist cutting back more than marginally, even when faced with adverse circumstances.

@logger7 said:

I don't know what percentage of the gold run-up is due to weakening of the US dollar but it is substantial. If people >have to raise money because the stock market is weakening, they lose work, or other economic squeezes then >they'll have to sell some of their gold too and prices will fall.

Very little to none. Nobody of size sells gold to raise cash. You have T-bills for that.

Gold is now in strong hands with tight fists. This is adding fuel to the frenzy.

True, but at least the continuous increase in interest paid on the national debt would come to a halt. Right now the interest is over $1 trillion a year and growing uncontrollably, increasing the deficit and adding to the debt itself. It's a vicious circle that can be broken only by either defaulting on the debt or switching to debt-free money. I think debt-free money will lead to a much better outcome.

You mean MMT?

No, because MMT favors large-scale deficit spending to fund various government programs. Debt-free fiat money makes sense even in an economy that is attempting to reduce government spending.

If the US government ever decides to "print" to finance government spending, the first thing I'm doing is sending most of my money out of the country and converting it into another currency. I'll send it elsewhere in anticipation of this occurrence. I won't be the only one.

If the US government ever decides to "print" to finance government spending, the first thing I'm doing is sending most of my money out of the country and converting it into another currency. I'll send it elsewhere in anticipation of this occurrence. I won't be the only one.

If? Whoa! What do think has been happening for the past 60 years? Which country do you think hasn't been deficit financing?

Q: Are You Printing Money? Bernanke: Not Literally

@MsMorrisine said:

i can imagine technical default

perhaps the fed stops asking for interest payments, then when they're due no principal payments.

You can't do any of these hypothetical, nonsensical solutions.

The Treasury market and the Dollar's Reserve Status would be crippled. It would lead to financial implosions throughout the globe, where tens of TRILLIONS of dollar-based loans exist.

Nobody will be in a "position" to "manage" a US bankruptcy. It's already out of control and it's not getting any better. Just don't be owning any debt instruments when it happens, and don't leave a bunch of cash in the banking system.

Q: Are You Printing Money? Bernanke: Not Literally

My cost basis on silver (and on gold, and on platinum) is a lot lower than yours, and I have zero complaints. I buy on the way up, not at the top. And I stopped playing with paper about 45 years ago. ~~~~

Q: Are You Printing Money? Bernanke: Not Literally

@derryb said:

and what does over $1T in interest payments to the public say about the interest collected (debt) from the public? >the banks are not being generous with their own money, they are taking it from another portion of the public (at a >higher interest rate), and profiting in the process. Round and Round goes the leveraged banking wheel.

Meanwhile, no bank other than JPM among the money centers has made a new high since the GFC.

So the evidence says you are wrong about them "profiting."

@MsMorrisine said:

i can imagine technical default

perhaps the fed stops asking for interest payments, then when they're due no principal payments.

You can't do any of these hypothetical, nonsensical solutions.

The Treasury market and the Dollar's Reserve Status would be crippled. It would lead to financial implosions throughout the globe, where tens of TRILLIONS of dollar-based loans exist.

.

And that is the PROBLEM: "tens of TRILLIONS of dollar-based loans exist".

The Federal Reserve and other banks fostered the situation [so as to profit from it].

@jmski52 said: how do you propose we file bankruptcy then?

Nobody will be in a "position" to "manage" a US bankruptcy. It's already out of control and it's not getting any better. Just don't be owning any debt instruments when it happens, and don't leave a bunch of cash in the banking system.

And every other country as well has large debts but not like the unfunded liabilities in the USA. I once commented to Gary North on his site that at one point I was 100% invested in gold and other less precious metals and he thought that was "crazy".

@logger7 said:

I don't know what percentage of the gold run-up is due to weakening of the US dollar but it is substantial. If people >have to raise money because the stock market is weakening, they lose work, or other economic squeezes then >they'll have to sell some of their gold too and prices will fall.

Very little to none. Nobody of size sells gold to raise cash. You have T-bills for that.

Gold is now in strong hands with tight fists. This is adding fuel to the frenzy.

You don't actually know that.

I know it as a buyer and as a seller.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

True, but at least the continuous increase in interest paid on the national debt would come to a halt. Right now the interest is over $1 trillion a year and growing uncontrollably, increasing the deficit and adding to the debt itself. It's a vicious circle that can be broken only by either defaulting on the debt or switching to debt-free money. I think debt-free money will lead to a much better outcome.

You mean MMT?

No, because MMT favors large-scale deficit spending to fund various government programs. Debt-free fiat money makes sense even in an economy that is attempting to reduce government spending.

If the US government ever decides to "print" to finance government spending, the first thing I'm doing is sending most of my money out of the country and converting it into another currency. I'll send it elsewhere in anticipation of this occurrence. I won't be the only one.

Why? Do you think Treasury bonds "backing" our money makes it more sound? If unbacked fiat money has no “real value”, then fiat money backed by a bond redeemable only in that same fiat money can have no “real value” either. How can a promise to pay in a currency that has no “real value” realistically serve as backing for the currency itself?

the banks that need frn put up collateral. the fed holds collateral for a bank debt. that's different that holding treas where they are interchangeable

ps. even the gold the treas has noted to the fed res to cover some frn is just a paper promise as collateral

@Overdate said:

Right now the interest is over $1 trillion a year and growing uncontrollably

The mother of all stimulus packages. Who wants to give that up?

The U.S. public owns only around 25% of the total national debt, either individually or in mutual funds or ETFs. The interest is not a "stimulus" to them, since they can get an interest rate that is comparable or better by investing in bank CDs or highly rated corporate bonds.

The rate on CDs and savings accoubts is what it is because of the rate on treasuries. Lower treasuries yield and Cd rates drop also. Higher rates are a Stimulus and increased income to anyone who has savings. M2 money supply shows about $25 trillion in savings, Cds, money markets and other short term instruments. This amounts to potentially over $1 trillion in interest payments (stimulus) to the US public.

No it doesn't, and here's why. Total non-federal debt in the U.S. amounts to $63 trillion, or 250% of savings. Interest on this debt is also tied to treasury rates. If $1 trillion in interest payments to the U.S. public is a "stimulus", then it is overwhelmed by a $2.5 trillion "anti-stimulus" attributable to the treasury rate.

Not an accurate example as you're trying to lump everyone together.

So are you. You said, "This amounts to potentially over $1 trillion in interest payments (stimulus) to the US public." I simply pointed out that the net effect on the US public (lumping everyone together) is an "anti-stimulus" of $1.5 trillion.

But you didn't, as pointed out by others. Most debt is fixed rate. And where did this $63 trillion come from? Total household is about $18 trillion of which 12 trillion is mortgages of which half are below 4%.

Are you including corporate debt? That's almost all fixed also and I could show you a 100,000 issues with coupons under 4%.

Higher interest paid on savings is/was a massive stimulus that kept us out of recession when Fed was hiking rates. So take those rates down to 2% (as one would demand) and consumer spending will evaporate and when coupled with much higher import prices will result in a recession.

@dcarr said:

And that is the PROBLEM: "tens of TRILLIONS of dollar-based loans exist".

The Federal Reserve and other banks fostered the situation [so as to profit from it].

No they didn't and they don't "profit" from it. You don't understand how the Eurodollar markets work.

@Overdate said:

Right now the interest is over $1 trillion a year and growing uncontrollably

The mother of all stimulus packages. Who wants to give that up?

The U.S. public owns only around 25% of the total national debt, either individually or in mutual funds or ETFs. The interest is not a "stimulus" to them, since they can get an interest rate that is comparable or better by investing in bank CDs or highly rated corporate bonds.

The rate on CDs and savings accoubts is what it is because of the rate on treasuries. Lower treasuries yield and Cd rates drop also. Higher rates are a Stimulus and increased income to anyone who has savings. M2 money supply shows about $25 trillion in savings, Cds, money markets and other short term instruments. This amounts to potentially over $1 trillion in interest payments (stimulus) to the US public.

No it doesn't, and here's why. Total non-federal debt in the U.S. amounts to $63 trillion, or 250% of savings. Interest on this debt is also tied to treasury rates. If $1 trillion in interest payments to the U.S. public is a "stimulus", then it is overwhelmed by a $2.5 trillion "anti-stimulus" attributable to the treasury rate.

Not an accurate example as you're trying to lump everyone together.

So are you. You said, "This amounts to potentially over $1 trillion in interest payments (stimulus) to the US public." I simply pointed out that the net effect on the US public (lumping everyone together) is an "anti-stimulus" of $1.5 trillion.

But you didn't, as pointed out by others. Most debt is fixed rate. And where did this $63 trillion come from? Total household is about $18 trillion of which 12 trillion is mortgages of which half are below 4%.

Are you including corporate debt? That's almost all fixed also and I could show you a 100,000 issues with coupons under 4%.

Higher interest paid on savings is/was a massive stimulus that kept us out of recession when Fed was hiking rates. So take those rates down to 2% (as one would demand) and consumer spending will evaporate and when coupled with much higher import prices will result in a recession.

And what about the other side of that equation? Thanks in great part to the Fed’s increase in rates, annual interest on the national debt more than doubled from about $2700 per household in 2021 to $7100 per household in 2024. It now takes 50% of all personal federal income taxes collected just to pay interest on the national debt. This is money that could have been used for tax relief or deficit reduction. And all for a “massive stimulus” of 1% above the current rate of inflation.

@dcarr said:

And that is the PROBLEM: "tens of TRILLIONS of dollar-based loans exist".

The Federal Reserve and other banks fostered the situation [so as to profit from it].

No they didn't and they don't "profit" from it. You don't understand how the Eurodollar markets work.

.

Are you saying that "tens of trillions of dollar loans" is not a problem ?

And banks don't profit from making loans and collecting interest ?

Why? Do you think Treasury bonds "backing" our money makes it more sound? If unbacked fiat money has no “real value”, then fiat money backed by a bond redeemable only in that same fiat money can have no “real value” either. How can a promise to pay in a currency that has no “real value” realistically serve as backing for the currency itself?

If this existed today, then my choices would then be to participate directly in history's greatest bubble. Yes, the one we have now. If I wanted to do that, I'd already be doing it.

Or I could hold USD as a non-interest-bearing asset while still paying the inflation tax I pay now. How would I be better off with that?

Under your alternative, maybe the inflation tax would be lower or maybe it wouldn't. But I do know that I'm not interested in lending to anyone else in history's greatest bubble or indirectly to the USG for free.

I don't own private debt, other than minimal bank balances, because it's almost entirely of garbage quality. Under your scenario, I suppose I could lend my "money" to a bank, but then if you don't believe in USG debt, why would you believe in government deposit insurance either?

If being 37 Trillion dollars in debt isn't an emergency, then I don't know what is.

It will be perceived as an emergency when the majority of the population's living standard's decline enough to generate political "blowback" and the USG can't do anything about it.

The turn in the interest rate cycle in 2020 should be enough to do that.

On paper, median net worth is increasing, but I'm dubious it's actually increasing measured by "real" value, and not specifically because of manipulations to the CPI. It's that the CPI index isn't an actual cost of living index.

Similar idea for median income. Last I checked, it's supposedly increased marginally in the 21st century, but I'm dubious about this too.

@logger7 said:

I don't know what percentage of the gold run-up is due to weakening of the US dollar but it is substantial. If people >have to raise money because the stock market is weakening, they lose work, or other economic squeezes then >they'll have to sell some of their gold too and prices will fall.

Very little to none. Nobody of size sells gold to raise cash. You have T-bills for that.

Gold is now in strong hands with tight fists. This is adding fuel to the frenzy.

You don't actually know that.

I know it as a buyer and as a seller.

I'm not referring to you.

I'm referring to everyone in the aggregate, not specifically to you.

No, you don't know it. You assume it, that those who bought it are financially capable of keeping it under adverse financial circumstances.

Prices are set by the marginal buyer, both on the way up and on the way down. It doesn't take that many marginal buyers or sellers to move the price substantially. Gold buyers are presumably far more "strong hands" than silver buyers due to the cost of entry, but that's not saying much at all.

@jmski52 said: If the US government ever decides to "print" to finance government spending, the first thing I'm doing is sending most of my money out of the country and converting it into another currency. I'll send it elsewhere in anticipation of this occurrence. I won't be the only one.

If? Whoa! What do think has been happening for the past 60 years? Which country do you think hasn't been deficit financing?

There is a difference between "printing" which is actually borrowing versus the type of printing to directly finance government spending.

I'm not in favor of either.

What matters most with any "printing" is whether it mostly stays in the financial system or ends up in the "real economy". Yes, I am aware there is some "slippage" between the two. It's still completely different than if the US had actually printed $37T in additional FRNs to circulate in the "real" economy.

That's Zimbabwe because it's not a credit-based economy, not the United States.

@Overdate said:

Right now the interest is over $1 trillion a year and growing uncontrollably

The mother of all stimulus packages. Who wants to give that up?

The U.S. public owns only around 25% of the total national debt, either individually or in mutual funds or ETFs. The interest is not a "stimulus" to them, since they can get an interest rate that is comparable or better by investing in bank CDs or highly rated corporate bonds.

The rate on CDs and savings accoubts is what it is because of the rate on treasuries. Lower treasuries yield and Cd rates drop also. Higher rates are a Stimulus and increased income to anyone who has savings. M2 money supply shows about $25 trillion in savings, Cds, money markets and other short term instruments. This amounts to potentially over $1 trillion in interest payments (stimulus) to the US public.

No it doesn't, and here's why. Total non-federal debt in the U.S. amounts to $63 trillion, or 250% of savings. Interest on this debt is also tied to treasury rates. If $1 trillion in interest payments to the U.S. public is a "stimulus", then it is overwhelmed by a $2.5 trillion "anti-stimulus" attributable to the treasury rate.

Not an accurate example as you're trying to lump everyone together.

So are you. You said, "This amounts to potentially over $1 trillion in interest payments (stimulus) to the US public." I simply pointed out that the net effect on the US public (lumping everyone together) is an "anti-stimulus" of $1.5 trillion.

But you didn't, as pointed out by others. Most debt is fixed rate. And where did this $63 trillion come from? Total household is about $18 trillion of which 12 trillion is mortgages of which half are below 4%.

Are you including corporate debt? That's almost all fixed also and I could show you a 100,000 issues with coupons under 4%.

Higher interest paid on savings is/was a massive stimulus that kept us out of recession when Fed was hiking rates. So take those rates down to 2% (as one would demand) and consumer spending will evaporate and when coupled with much higher import prices will result in a recession.

And what about the other side of that equation? Thanks in great part to the Fed’s increase in rates, annual interest on the national debt more than doubled from about $2700 per household in 2021 to $7100 per household in 2024. It now takes 50% of all personal federal income taxes collected just to pay interest on the national debt. This is money that could have been used for tax relief or deficit reduction. And all for a “massive stimulus” of 1% above the current rate of inflation.

And there is your transfer of wealth from public to private. The public (govt) is paying interest to the private. The more they pay, the greater the transfer of wealth. Works with Congreesional approved and Executive signed spending projects as well.

If the Govt would stop spending, then the transfer of wealth stops.

That's Zimbabwe because it's not a credit-based economy, not the United States.

If we can't raise more debt to pay the bills for our credit based economy, then the credit based economy crashes. There is no protection simply because it is credit based, we had the financial crisis exactly because too much credit was doled out to people who couldn't afford it.

@Overdate said:

Right now the interest is over $1 trillion a year and growing uncontrollably

The mother of all stimulus packages. Who wants to give that up?

The U.S. public owns only around 25% of the total national debt, either individually or in mutual funds or ETFs. The interest is not a "stimulus" to them, since they can get an interest rate that is comparable or better by investing in bank CDs or highly rated corporate bonds.

The rate on CDs and savings accoubts is what it is because of the rate on treasuries. Lower treasuries yield and Cd rates drop also. Higher rates are a Stimulus and increased income to anyone who has savings. M2 money supply shows about $25 trillion in savings, Cds, money markets and other short term instruments. This amounts to potentially over $1 trillion in interest payments (stimulus) to the US public.

No it doesn't, and here's why. Total non-federal debt in the U.S. amounts to $63 trillion, or 250% of savings. Interest on this debt is also tied to treasury rates. If $1 trillion in interest payments to the U.S. public is a "stimulus", then it is overwhelmed by a $2.5 trillion "anti-stimulus" attributable to the treasury rate.

Not an accurate example as you're trying to lump everyone together.

So are you. You said, "This amounts to potentially over $1 trillion in interest payments (stimulus) to the US public." I simply pointed out that the net effect on the US public (lumping everyone together) is an "anti-stimulus" of $1.5 trillion.

But you didn't, as pointed out by others. Most debt is fixed rate. And where did this $63 trillion come from? Total household is about $18 trillion of which 12 trillion is mortgages of which half are below 4%.

Are you including corporate debt? That's almost all fixed also and I could show you a 100,000 issues with coupons under 4%.

Higher interest paid on savings is/was a massive stimulus that kept us out of recession when Fed was hiking rates. So take those rates down to 2% (as one would demand) and consumer spending will evaporate and when coupled with much higher import prices will result in a recession.

And what about the other side of that equation? Thanks in great part to the Fed’s increase in rates, annual interest on the national debt more than doubled from about $2700 per household in 2021 to $7100 per household in 2024. It now takes 50% of all personal federal income taxes collected just to pay interest on the national debt. This is money that could have been used for tax relief or deficit reduction. And all for a “massive stimulus” of 1% above the current rate of inflation.

And there is your transfer of wealth from public to private. The public (govt) is paying interest to the private. The more they pay, the greater the transfer of wealth. Works with Congreesional approved and Executive signed spending projects as well.

If the Govt would stop spending, then the transfer of wealth stops.

It's not a transfer of wealth, it's a transfer of debt to the American public. Only 25% of the annual interest paid on the national debt is returned to private individuals in the US. Much of the rest of this "wealth" is exported. Meanwhile, the national debt itself is exploding, now $36.7 trillion dollars. The number of households in the US is 133 million. So each household's share of the debt is $278,000 and rising rapidly. Tell me how this is making the private sector wealthier.

Why? Do you think Treasury bonds "backing" our money makes it more sound? If unbacked fiat money has no “real value”, then fiat money backed by a bond redeemable only in that same fiat money can have no “real value” either. How can a promise to pay in a currency that has no “real value” realistically serve as backing for the currency itself?

If this existed today, then my choices would then be to participate directly in history's greatest bubble. Yes, the one we have now. If I wanted to do that, I'd already be doing it.

Or I could hold USD as a non-interest-bearing asset while still paying the inflation tax I pay now. How would I be better off with that?

Under your alternative, maybe the inflation tax would be lower or maybe it wouldn't. But I do know that I'm not interested in lending to anyone else in history's greatest bubble or indirectly to the USG for free.

I don't own private debt, other than minimal bank balances, because it's almost entirely of garbage quality. Under your scenario, I suppose I could lend my "money" to a bank, but then if you don't believe in USG debt, why would you believe in government deposit insurance either?

It doesn't make sense to hold more than a modest amount of depreciating dollars in cash, with or without deposit insurance, and regardless of whether those dollars are debt-backed or unbacked. But if all the dollars were unbacked, there would be no national debt, and no taxpayer-funded interest to be paid on that debt. Instead of being set by the Fed, interest rates in a free market would find their natural level, determined mainly by the riskiness of each loan and the expected rate of inflation.

@Overdate said:

Right now the interest is over $1 trillion a year and growing uncontrollably

The mother of all stimulus packages. Who wants to give that up?

The U.S. public owns only around 25% of the total national debt, either individually or in mutual funds or ETFs. The interest is not a "stimulus" to them, since they can get an interest rate that is comparable or better by investing in bank CDs or highly rated corporate bonds.

The rate on CDs and savings accoubts is what it is because of the rate on treasuries. Lower treasuries yield and Cd rates drop also. Higher rates are a Stimulus and increased income to anyone who has savings. M2 money supply shows about $25 trillion in savings, Cds, money markets and other short term instruments. This amounts to potentially over $1 trillion in interest payments (stimulus) to the US public.

No it doesn't, and here's why. Total non-federal debt in the U.S. amounts to $63 trillion, or 250% of savings. Interest on this debt is also tied to treasury rates. If $1 trillion in interest payments to the U.S. public is a "stimulus", then it is overwhelmed by a $2.5 trillion "anti-stimulus" attributable to the treasury rate.

Not an accurate example as you're trying to lump everyone together.

So are you. You said, "This amounts to potentially over $1 trillion in interest payments (stimulus) to the US public." I simply pointed out that the net effect on the US public (lumping everyone together) is an "anti-stimulus" of $1.5 trillion.

But you didn't, as pointed out by others. Most debt is fixed rate. And where did this $63 trillion come from? Total household is about $18 trillion of which 12 trillion is mortgages of which half are below 4%.

Are you including corporate debt? That's almost all fixed also and I could show you a 100,000 issues with coupons under 4%.

Higher interest paid on savings is/was a massive stimulus that kept us out of recession when Fed was hiking rates. So take those rates down to 2% (as one would demand) and consumer spending will evaporate and when coupled with much higher import prices will result in a recession.

And what about the other side of that equation? Thanks in great part to the Fed’s increase in rates, annual interest on the national debt more than doubled from about $2700 per household in 2021 to $7100 per household in 2024. It now takes 50% of all personal federal income taxes collected just to pay interest on the national debt. This is money that could have been used for tax relief or deficit reduction. And all for a “massive stimulus” of 1% above the current rate of inflation.

And there is your transfer of wealth from public to private. The public (govt) is paying interest to the private. The more they pay, the greater the transfer of wealth. Works with Congreesional approved and Executive signed spending projects as well.

If the Govt would stop spending, then the transfer of wealth stops.

It's not a transfer of wealth, it's a transfer of debt to the American public. Only 25% of the annual interest paid on the national debt is returned to private individuals in the US. Much of the rest of this "wealth" is exported. Meanwhile, the national debt itself is exploding, now $36.7 trillion dollars. The number of households in the US is 133 million. So each household's share of the debt is $278,000 and rising rapidly. Tell me how this is making the private sector wealthier.

That's the narrative but I don't owe $278,000 and neither do you.

Very little of the debt was spent overseas. It was spend right here in the USA and everyone benefitted. It was a transfer. Asset values, employment, technological advancement...all reflect this transfer.

Think about it this way. If the US hadn't spent $36 trillion keeping the train a running, where would asset values, employment and technology be today?

@Overdate said:

Right now the interest is over $1 trillion a year and growing uncontrollably

The mother of all stimulus packages. Who wants to give that up?

The U.S. public owns only around 25% of the total national debt, either individually or in mutual funds or ETFs. The interest is not a "stimulus" to them, since they can get an interest rate that is comparable or better by investing in bank CDs or highly rated corporate bonds.

The rate on CDs and savings accoubts is what it is because of the rate on treasuries. Lower treasuries yield and Cd rates drop also. Higher rates are a Stimulus and increased income to anyone who has savings. M2 money supply shows about $25 trillion in savings, Cds, money markets and other short term instruments. This amounts to potentially over $1 trillion in interest payments (stimulus) to the US public.

No it doesn't, and here's why. Total non-federal debt in the U.S. amounts to $63 trillion, or 250% of savings. Interest on this debt is also tied to treasury rates. If $1 trillion in interest payments to the U.S. public is a "stimulus", then it is overwhelmed by a $2.5 trillion "anti-stimulus" attributable to the treasury rate.

Not an accurate example as you're trying to lump everyone together.

So are you. You said, "This amounts to potentially over $1 trillion in interest payments (stimulus) to the US public." I simply pointed out that the net effect on the US public (lumping everyone together) is an "anti-stimulus" of $1.5 trillion.

But you didn't, as pointed out by others. Most debt is fixed rate. And where did this $63 trillion come from? Total household is about $18 trillion of which 12 trillion is mortgages of which half are below 4%.

Are you including corporate debt? That's almost all fixed also and I could show you a 100,000 issues with coupons under 4%.

Higher interest paid on savings is/was a massive stimulus that kept us out of recession when Fed was hiking rates. So take those rates down to 2% (as one would demand) and consumer spending will evaporate and when coupled with much higher import prices will result in a recession.

And what about the other side of that equation? Thanks in great part to the Fed’s increase in rates, annual interest on the national debt more than doubled from about $2700 per household in 2021 to $7100 per household in 2024. It now takes 50% of all personal federal income taxes collected just to pay interest on the national debt. This is money that could have been used for tax relief or deficit reduction. And all for a “massive stimulus” of 1% above the current rate of inflation.

And there is your transfer of wealth from public to private. The public (govt) is paying interest to the private. The more they pay, the greater the transfer of wealth. Works with Congreesional approved and Executive signed spending projects as well.

If the Govt would stop spending, then the transfer of wealth stops.

It's not a transfer of wealth, it's a transfer of debt to the American public. Only 25% of the annual interest paid on the national debt is returned to private individuals in the US. Much of the rest of this "wealth" is exported. Meanwhile, the national debt itself is exploding, now $36.7 trillion dollars. The number of households in the US is 133 million. So each household's share of the debt is $278,000 and rising rapidly. Tell me how this is making the private sector wealthier.

That's the narrative but I don't owe $278,000 and neither do you.

Very little of the debt was spent overseas. It was spend right here in the USA and everyone benefitted. It was a transfer. Asset values, employment, technological advancement...all reflect this transfer.

Think about it this way. If the US hadn't spent $36 trillion keeping the train a running, where would asset values, employment and technology be today?

I had no idea that the secret to our prosperity was massive government borrowing and deficit spending. I must have read the wrong economics books.

I wonder how we managed to increase asset values, employment, and technological advancement prior to 1913.

@Overdate said:

Right now the interest is over $1 trillion a year and growing uncontrollably

The mother of all stimulus packages. Who wants to give that up?

The U.S. public owns only around 25% of the total national debt, either individually or in mutual funds or ETFs. The interest is not a "stimulus" to them, since they can get an interest rate that is comparable or better by investing in bank CDs or highly rated corporate bonds.

The rate on CDs and savings accoubts is what it is because of the rate on treasuries. Lower treasuries yield and Cd rates drop also. Higher rates are a Stimulus and increased income to anyone who has savings. M2 money supply shows about $25 trillion in savings, Cds, money markets and other short term instruments. This amounts to potentially over $1 trillion in interest payments (stimulus) to the US public.

No it doesn't, and here's why. Total non-federal debt in the U.S. amounts to $63 trillion, or 250% of savings. Interest on this debt is also tied to treasury rates. If $1 trillion in interest payments to the U.S. public is a "stimulus", then it is overwhelmed by a $2.5 trillion "anti-stimulus" attributable to the treasury rate.

Not an accurate example as you're trying to lump everyone together.

So are you. You said, "This amounts to potentially over $1 trillion in interest payments (stimulus) to the US public." I simply pointed out that the net effect on the US public (lumping everyone together) is an "anti-stimulus" of $1.5 trillion.

But you didn't, as pointed out by others. Most debt is fixed rate. And where did this $63 trillion come from? Total household is about $18 trillion of which 12 trillion is mortgages of which half are below 4%.

Are you including corporate debt? That's almost all fixed also and I could show you a 100,000 issues with coupons under 4%.

Higher interest paid on savings is/was a massive stimulus that kept us out of recession when Fed was hiking rates. So take those rates down to 2% (as one would demand) and consumer spending will evaporate and when coupled with much higher import prices will result in a recession.

And what about the other side of that equation? Thanks in great part to the Fed’s increase in rates, annual interest on the national debt more than doubled from about $2700 per household in 2021 to $7100 per household in 2024. It now takes 50% of all personal federal income taxes collected just to pay interest on the national debt. This is money that could have been used for tax relief or deficit reduction. And all for a “massive stimulus” of 1% above the current rate of inflation.

And there is your transfer of wealth from public to private. The public (govt) is paying interest to the private. The more they pay, the greater the transfer of wealth. Works with Congreesional approved and Executive signed spending projects as well.

If the Govt would stop spending, then the transfer of wealth stops.

It's not a transfer of wealth, it's a transfer of debt to the American public. Only 25% of the annual interest paid on the national debt is returned to private individuals in the US. Much of the rest of this "wealth" is exported. Meanwhile, the national debt itself is exploding, now $36.7 trillion dollars. The number of households in the US is 133 million. So each household's share of the debt is $278,000 and rising rapidly. Tell me how this is making the private sector wealthier.

That's the narrative but I don't owe $278,000 and neither do you.

Very little of the debt was spent overseas. It was spend right here in the USA and everyone benefitted. It was a transfer. Asset values, employment, technological advancement...all reflect this transfer.

Think about it this way. If the US hadn't spent $36 trillion keeping the train a running, where would asset values, employment and technology be today?

I had no idea that the secret to our prosperity was massive government borrowing and deficit spending. I must have read the wrong economics books.

I wonder how we managed to increase asset values, employment, and technological advancement prior to 1913.

Well, obviously TARIFFS!! LOL

And I know you didn't know, that's why I explained it to you.

@Overdate said:

Right now the interest is over $1 trillion a year and growing uncontrollably

The mother of all stimulus packages. Who wants to give that up?

The U.S. public owns only around 25% of the total national debt, either individually or in mutual funds or ETFs. The interest is not a "stimulus" to them, since they can get an interest rate that is comparable or better by investing in bank CDs or highly rated corporate bonds.

The rate on CDs and savings accoubts is what it is because of the rate on treasuries. Lower treasuries yield and Cd rates drop also. Higher rates are a Stimulus and increased income to anyone who has savings. M2 money supply shows about $25 trillion in savings, Cds, money markets and other short term instruments. This amounts to potentially over $1 trillion in interest payments (stimulus) to the US public.

No it doesn't, and here's why. Total non-federal debt in the U.S. amounts to $63 trillion, or 250% of savings. Interest on this debt is also tied to treasury rates. If $1 trillion in interest payments to the U.S. public is a "stimulus", then it is overwhelmed by a $2.5 trillion "anti-stimulus" attributable to the treasury rate.

Not an accurate example as you're trying to lump everyone together.

So are you. You said, "This amounts to potentially over $1 trillion in interest payments (stimulus) to the US public." I simply pointed out that the net effect on the US public (lumping everyone together) is an "anti-stimulus" of $1.5 trillion.

But you didn't, as pointed out by others. Most debt is fixed rate. And where did this $63 trillion come from? Total household is about $18 trillion of which 12 trillion is mortgages of which half are below 4%.

Are you including corporate debt? That's almost all fixed also and I could show you a 100,000 issues with coupons under 4%.

Higher interest paid on savings is/was a massive stimulus that kept us out of recession when Fed was hiking rates. So take those rates down to 2% (as one would demand) and consumer spending will evaporate and when coupled with much higher import prices will result in a recession.

And what about the other side of that equation? Thanks in great part to the Fed’s increase in rates, annual interest on the national debt more than doubled from about $2700 per household in 2021 to $7100 per household in 2024. It now takes 50% of all personal federal income taxes collected just to pay interest on the national debt. This is money that could have been used for tax relief or deficit reduction. And all for a “massive stimulus” of 1% above the current rate of inflation.

And there is your transfer of wealth from public to private. The public (govt) is paying interest to the private. The more they pay, the greater the transfer of wealth. Works with Congreesional approved and Executive signed spending projects as well.

If the Govt would stop spending, then the transfer of wealth stops.

It's not a transfer of wealth, it's a transfer of debt to the American public. Only 25% of the annual interest paid on the national debt is returned to private individuals in the US. Much of the rest of this "wealth" is exported. Meanwhile, the national debt itself is exploding, now $36.7 trillion dollars. The number of households in the US is 133 million. So each household's share of the debt is $278,000 and rising rapidly. Tell me how this is making the private sector wealthier.

That's the narrative but I don't owe $278,000 and neither do you.

Very little of the debt was spent overseas. It was spend right here in the USA and everyone benefitted. It was a transfer. Asset values, employment, technological advancement...all reflect this transfer.

Think about it this way. If the US hadn't spent $36 trillion keeping the train a running, where would asset values, employment and technology be today?

I had no idea that the secret to our prosperity was massive government borrowing and deficit spending. I must have read the wrong economics books.

I wonder how we managed to increase asset values, employment, and technological advancement prior to 1913.

Well, obviously TARIFFS!! LOL

And I know you didn't know, that's why I explained it to you.

I see. So if we double the tariff rate and double the national debt, we should become twice as rich, do I have this right?

@Overdate said:

Right now the interest is over $1 trillion a year and growing uncontrollably

The mother of all stimulus packages. Who wants to give that up?

The U.S. public owns only around 25% of the total national debt, either individually or in mutual funds or ETFs. The interest is not a "stimulus" to them, since they can get an interest rate that is comparable or better by investing in bank CDs or highly rated corporate bonds.

The rate on CDs and savings accoubts is what it is because of the rate on treasuries. Lower treasuries yield and Cd rates drop also. Higher rates are a Stimulus and increased income to anyone who has savings. M2 money supply shows about $25 trillion in savings, Cds, money markets and other short term instruments. This amounts to potentially over $1 trillion in interest payments (stimulus) to the US public.

No it doesn't, and here's why. Total non-federal debt in the U.S. amounts to $63 trillion, or 250% of savings. Interest on this debt is also tied to treasury rates. If $1 trillion in interest payments to the U.S. public is a "stimulus", then it is overwhelmed by a $2.5 trillion "anti-stimulus" attributable to the treasury rate.

Not an accurate example as you're trying to lump everyone together.

So are you. You said, "This amounts to potentially over $1 trillion in interest payments (stimulus) to the US public." I simply pointed out that the net effect on the US public (lumping everyone together) is an "anti-stimulus" of $1.5 trillion.

But you didn't, as pointed out by others. Most debt is fixed rate. And where did this $63 trillion come from? Total household is about $18 trillion of which 12 trillion is mortgages of which half are below 4%.

Are you including corporate debt? That's almost all fixed also and I could show you a 100,000 issues with coupons under 4%.

Higher interest paid on savings is/was a massive stimulus that kept us out of recession when Fed was hiking rates. So take those rates down to 2% (as one would demand) and consumer spending will evaporate and when coupled with much higher import prices will result in a recession.

And what about the other side of that equation? Thanks in great part to the Fed’s increase in rates, annual interest on the national debt more than doubled from about $2700 per household in 2021 to $7100 per household in 2024. It now takes 50% of all personal federal income taxes collected just to pay interest on the national debt. This is money that could have been used for tax relief or deficit reduction. And all for a “massive stimulus” of 1% above the current rate of inflation.

And there is your transfer of wealth from public to private. The public (govt) is paying interest to the private. The more they pay, the greater the transfer of wealth. Works with Congreesional approved and Executive signed spending projects as well.

If the Govt would stop spending, then the transfer of wealth stops.

It's not a transfer of wealth, it's a transfer of debt to the American public. Only 25% of the annual interest paid on the national debt is returned to private individuals in the US. Much of the rest of this "wealth" is exported. Meanwhile, the national debt itself is exploding, now $36.7 trillion dollars. The number of households in the US is 133 million. So each household's share of the debt is $278,000 and rising rapidly. Tell me how this is making the private sector wealthier.

That's the narrative but I don't owe $278,000 and neither do you.

Very little of the debt was spent overseas. It was spend right here in the USA and everyone benefitted. It was a transfer. Asset values, employment, technological advancement...all reflect this transfer.

Think about it this way. If the US hadn't spent $36 trillion keeping the train a running, where would asset values, employment and technology be today?

I had no idea that the secret to our prosperity was massive government borrowing and deficit spending. I must have read the wrong economics books.

I wonder how we managed to increase asset values, employment, and technological advancement prior to 1913.

Well, obviously TARIFFS!! LOL

And I know you didn't know, that's why I explained it to you.

I see. So if we double the tariff rate and double the national debt, we should become twice as rich, do I have this right?

That's exactly what they are trying to do and supported by many folk. Doesn't make any sense does it?

@Overdate said:

Right now the interest is over $1 trillion a year and growing uncontrollably

The mother of all stimulus packages. Who wants to give that up?

The U.S. public owns only around 25% of the total national debt, either individually or in mutual funds or ETFs. The interest is not a "stimulus" to them, since they can get an interest rate that is comparable or better by investing in bank CDs or highly rated corporate bonds.

The rate on CDs and savings accoubts is what it is because of the rate on treasuries. Lower treasuries yield and Cd rates drop also. Higher rates are a Stimulus and increased income to anyone who has savings. M2 money supply shows about $25 trillion in savings, Cds, money markets and other short term instruments. This amounts to potentially over $1 trillion in interest payments (stimulus) to the US public.

No it doesn't, and here's why. Total non-federal debt in the U.S. amounts to $63 trillion, or 250% of savings. Interest on this debt is also tied to treasury rates. If $1 trillion in interest payments to the U.S. public is a "stimulus", then it is overwhelmed by a $2.5 trillion "anti-stimulus" attributable to the treasury rate.

Not an accurate example as you're trying to lump everyone together.

So are you. You said, "This amounts to potentially over $1 trillion in interest payments (stimulus) to the US public." I simply pointed out that the net effect on the US public (lumping everyone together) is an "anti-stimulus" of $1.5 trillion.

But you didn't, as pointed out by others. Most debt is fixed rate. And where did this $63 trillion come from? Total household is about $18 trillion of which 12 trillion is mortgages of which half are below 4%.

Are you including corporate debt? That's almost all fixed also and I could show you a 100,000 issues with coupons under 4%.

Higher interest paid on savings is/was a massive stimulus that kept us out of recession when Fed was hiking rates. So take those rates down to 2% (as one would demand) and consumer spending will evaporate and when coupled with much higher import prices will result in a recession.

And what about the other side of that equation? Thanks in great part to the Fed’s increase in rates, annual interest on the national debt more than doubled from about $2700 per household in 2021 to $7100 per household in 2024. It now takes 50% of all personal federal income taxes collected just to pay interest on the national debt. This is money that could have been used for tax relief or deficit reduction. And all for a “massive stimulus” of 1% above the current rate of inflation.

And there is your transfer of wealth from public to private. The public (govt) is paying interest to the private. The more they pay, the greater the transfer of wealth. Works with Congreesional approved and Executive signed spending projects as well.

If the Govt would stop spending, then the transfer of wealth stops.

It's not a transfer of wealth, it's a transfer of debt to the American public. Only 25% of the annual interest paid on the national debt is returned to private individuals in the US. Much of the rest of this "wealth" is exported. Meanwhile, the national debt itself is exploding, now $36.7 trillion dollars. The number of households in the US is 133 million. So each household's share of the debt is $278,000 and rising rapidly. Tell me how this is making the private sector wealthier.

That's the narrative but I don't owe $278,000 and neither do you.

Very little of the debt was spent overseas. It was spend right here in the USA and everyone benefitted. It was a transfer. Asset values, employment, technological advancement...all reflect this transfer.

Think about it this way. If the US hadn't spent $36 trillion keeping the train a running, where would asset values, employment and technology be today?

I wonder how we managed to increase asset values, employment, and technological advancement prior to 1913.

Hard work and innovation. Something we handed over to China in the 1970's. Maybe someone should try to retrieve it.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

@Overdate said:

Right now the interest is over $1 trillion a year and growing uncontrollably

The mother of all stimulus packages. Who wants to give that up?

The U.S. public owns only around 25% of the total national debt, either individually or in mutual funds or ETFs. The interest is not a "stimulus" to them, since they can get an interest rate that is comparable or better by investing in bank CDs or highly rated corporate bonds.

The rate on CDs and savings accoubts is what it is because of the rate on treasuries. Lower treasuries yield and Cd rates drop also. Higher rates are a Stimulus and increased income to anyone who has savings. M2 money supply shows about $25 trillion in savings, Cds, money markets and other short term instruments. This amounts to potentially over $1 trillion in interest payments (stimulus) to the US public.

No it doesn't, and here's why. Total non-federal debt in the U.S. amounts to $63 trillion, or 250% of savings. Interest on this debt is also tied to treasury rates. If $1 trillion in interest payments to the U.S. public is a "stimulus", then it is overwhelmed by a $2.5 trillion "anti-stimulus" attributable to the treasury rate.

Not an accurate example as you're trying to lump everyone together.

So are you. You said, "This amounts to potentially over $1 trillion in interest payments (stimulus) to the US public." I simply pointed out that the net effect on the US public (lumping everyone together) is an "anti-stimulus" of $1.5 trillion.

But you didn't, as pointed out by others. Most debt is fixed rate. And where did this $63 trillion come from? Total household is about $18 trillion of which 12 trillion is mortgages of which half are below 4%.

Are you including corporate debt? That's almost all fixed also and I could show you a 100,000 issues with coupons under 4%.

Higher interest paid on savings is/was a massive stimulus that kept us out of recession when Fed was hiking rates. So take those rates down to 2% (as one would demand) and consumer spending will evaporate and when coupled with much higher import prices will result in a recession.

And what about the other side of that equation? Thanks in great part to the Fed’s increase in rates, annual interest on the national debt more than doubled from about $2700 per household in 2021 to $7100 per household in 2024. It now takes 50% of all personal federal income taxes collected just to pay interest on the national debt. This is money that could have been used for tax relief or deficit reduction. And all for a “massive stimulus” of 1% above the current rate of inflation.

And there is your transfer of wealth from public to private. The public (govt) is paying interest to the private. The more they pay, the greater the transfer of wealth. Works with Congreesional approved and Executive signed spending projects as well.

If the Govt would stop spending, then the transfer of wealth stops.

It's not a transfer of wealth, it's a transfer of debt to the American public. Only 25% of the annual interest paid on the national debt is returned to private individuals in the US. Much of the rest of this "wealth" is exported. Meanwhile, the national debt itself is exploding, now $36.7 trillion dollars. The number of households in the US is 133 million. So each household's share of the debt is $278,000 and rising rapidly. Tell me how this is making the private sector wealthier.

That's the narrative but I don't owe $278,000 and neither do you.

Very little of the debt was spent overseas. It was spend right here in the USA and everyone benefitted. It was a transfer. Asset values, employment, technological advancement...all reflect this transfer.

Think about it this way. If the US hadn't spent $36 trillion keeping the train a running, where would asset values, employment and technology be today?

I wonder how we managed to increase asset values, employment, and technological advancement prior to 1913.

Hard work and innovation. Something we handed over to China in the 1970's. Maybe someone should try to retrieve it.

I believe we are far too late for that. All our society cares about anymore are big macs, tick tocks and tweeters. RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

@Overdate said:

Right now the interest is over $1 trillion a year and growing uncontrollably

The mother of all stimulus packages. Who wants to give that up?

The U.S. public owns only around 25% of the total national debt, either individually or in mutual funds or ETFs. The interest is not a "stimulus" to them, since they can get an interest rate that is comparable or better by investing in bank CDs or highly rated corporate bonds.

The rate on CDs and savings accoubts is what it is because of the rate on treasuries. Lower treasuries yield and Cd rates drop also. Higher rates are a Stimulus and increased income to anyone who has savings. M2 money supply shows about $25 trillion in savings, Cds, money markets and other short term instruments. This amounts to potentially over $1 trillion in interest payments (stimulus) to the US public.

No it doesn't, and here's why. Total non-federal debt in the U.S. amounts to $63 trillion, or 250% of savings. Interest on this debt is also tied to treasury rates. If $1 trillion in interest payments to the U.S. public is a "stimulus", then it is overwhelmed by a $2.5 trillion "anti-stimulus" attributable to the treasury rate.

Not an accurate example as you're trying to lump everyone together.

So are you. You said, "This amounts to potentially over $1 trillion in interest payments (stimulus) to the US public." I simply pointed out that the net effect on the US public (lumping everyone together) is an "anti-stimulus" of $1.5 trillion.

But you didn't, as pointed out by others. Most debt is fixed rate. And where did this $63 trillion come from? Total household is about $18 trillion of which 12 trillion is mortgages of which half are below 4%.

Are you including corporate debt? That's almost all fixed also and I could show you a 100,000 issues with coupons under 4%.

Higher interest paid on savings is/was a massive stimulus that kept us out of recession when Fed was hiking rates. So take those rates down to 2% (as one would demand) and consumer spending will evaporate and when coupled with much higher import prices will result in a recession.

And what about the other side of that equation? Thanks in great part to the Fed’s increase in rates, annual interest on the national debt more than doubled from about $2700 per household in 2021 to $7100 per household in 2024. It now takes 50% of all personal federal income taxes collected just to pay interest on the national debt. This is money that could have been used for tax relief or deficit reduction. And all for a “massive stimulus” of 1% above the current rate of inflation.

And there is your transfer of wealth from public to private. The public (govt) is paying interest to the private. The more they pay, the greater the transfer of wealth. Works with Congreesional approved and Executive signed spending projects as well.

If the Govt would stop spending, then the transfer of wealth stops.

It's not a transfer of wealth, it's a transfer of debt to the American public. Only 25% of the annual interest paid on the national debt is returned to private individuals in the US. Much of the rest of this "wealth" is exported. Meanwhile, the national debt itself is exploding, now $36.7 trillion dollars. The number of households in the US is 133 million. So each household's share of the debt is $278,000 and rising rapidly. Tell me how this is making the private sector wealthier.

That's the narrative but I don't owe $278,000 and neither do you.

Very little of the debt was spent overseas. It was spend right here in the USA and everyone benefitted. It was a transfer. Asset values, employment, technological advancement...all reflect this transfer.

Think about it this way. If the US hadn't spent $36 trillion keeping the train a running, where would asset values, employment and technology be today?

I wonder how we managed to increase asset values, employment, and technological advancement prior to 1913.

Hard work and innovation. Something we handed over to China in the 1970's. Maybe someone should try to retrieve it.

What will we make and who will we sell it to?

Automobiles to Europe? They don't want US vehicles. We don't even want them. Take out pickups and foreign manufactures sell more vehicles to US consumers. Europe doesn't want pickups. They don't want to pay $150 per fuel fill up. There is a reason VW, Mercedes, Volvo don't make pickups. You think Europeans want rather a Chevy Malibu over a VW jetty?

We gonna export more agriculture? That barn door has slammed shut. China won't buy our grains now they we are giving them Africa via our withdrawal of power and control in humanitarian aid and closure of embassies.

Maybe we make solar panels and wind mills? Probably not a bad idea as most are made overseas, but we've been told they kill birds and cause cancer and we've been canceling solar and wind projects so a nothingburger there. Let's stock with mining coal. That's a career we strive for. Lol

What will we make here that we can export around the globe in an efficient and profitable manner that will increase the standard of living for US citizens? What does the world want that we can make better and more cost effective while providing high paying jobs for Americans?

No. The price would not collapse if we defaulted. On the contrary. Our debt and gold prices have been delinked for about a hundred years. The days we had no debt. That’s why gold is near $4000 instead of remaining at $20. , as it was in ‘33. In ‘86 the treasury made an adjustment to $50 for NCLT gold (non circulating legal tender). for collectors. Of course they added a few more grams to standardize the ounce. And we see what that turned into. $4290 for a gold ounce proof coin, today and $3300. For the $50 bullion eagle. A default or reset ? Won’t matter. Gold has been too expensive since we violated/ changed article ten of the constitution. Collapse ? We did that long ago. Funny math. Funny banking rules.

Why? Do you think Treasury bonds "backing" our money makes it more sound? If unbacked fiat money has no “real value”, then fiat money backed by a bond redeemable only in that same fiat money can have no “real value” either. How can a promise to pay in a currency that has no “real value” realistically serve as backing for the currency itself?

If this existed today, then my choices would then be to participate directly in history's greatest bubble. Yes, the one we have now. If I wanted to do that, I'd already be doing it.

Or I could hold USD as a non-interest-bearing asset while still paying the inflation tax I pay now. How would I be better off with that?

Under your alternative, maybe the inflation tax would be lower or maybe it wouldn't. But I do know that I'm not interested in lending to anyone else in history's greatest bubble or indirectly to the USG for free.

I don't own private debt, other than minimal bank balances, because it's almost entirely of garbage quality. Under your scenario, I suppose I could lend my "money" to a bank, but then if you don't believe in USG debt, why would you believe in government deposit insurance either?

It doesn't make sense to hold more than a modest amount of depreciating dollars in cash, with or without deposit insurance, and regardless of whether those dollars are debt-backed or unbacked. But if all the dollars were unbacked, there would be no national debt, and no taxpayer-funded interest to be paid on that debt. Instead of being set by the Fed, interest rates in a free market would find their natural level, determined mainly by the riskiness of each loan and the expected rate of inflation.

There is no free market in "money". There isn't any more of a reason to believe the USG will give up interest rate mismanagement than it will give up the fiat currency monopoly.

The only reason I can see that what you're proposing will ever happen is to fund another form of MMT. They will "print" to pay for unsustainable government spending instead of borrowing.

Current government spending is unsustainable and it's just not because of interest payments on the debt or that taxes are supposedly too low. It's that US society has experienced extended social decay. This is the root cause behind US fiscal policy. It's a combination of society falling apart and a side consequence of the mania which leads politicians and the clueless voters who elect them to believe that there really is something for nothing.

There is never something for nothing. The implicit belief I read even on this forum that the US (and any other country) can live beyond its means to this extent for decades can escape declining living standards is a delusion.

There is no escaping it. The longer it lasts, the worse the hangover. The majority of Americans are destined to become poorer or a lot poorer and unlike developing countries who are used to instability and doing without a lot more than US society, it's going to get ugly.

That's Zimbabwe because it's not a credit-based economy, not the United States.

If we can't raise more debt to pay the bills for our credit based economy, then the credit based economy crashes. There is no protection simply because it is credit based, we had the financial crisis exactly because too much credit was doled out to people who couldn't afford it.

I never claimed what you stated.

I'm telling you that there is absolutely no evidence for your premise that government officials will turn on the "printing press" as the first solution to a future crisis. That's what you and everyone taking the inflation position who I've ever read claim or imply. Anyone who believes it attributes motives to those who are in a position to make it happen which they don't actually have.

Hyperinflation isn't a random event of nature. It's a conscious political choice taken by committees of actual human beings who have conflicting motives. They may take it this path, but they don't have to. The only thing anyone has to do is die, literally. Anything else is a choice.

As long as the US or any other country can borrow at "reasonable" rates, what you're implying will never happen. No government or central bank will destroy the currency while they have access to the credit markets the US currently possesses.

Since most "money" is actually debt, there is also absolutely nothing any government or central bank can do to prevent the US financial system as it's currently designed from collapsing into a deflationary black hole first. Anyone who claims otherwise is writing about mindless robots who just sit around and watch as their wealth is destroyed and don't so anything.

I've also tried to explain that the sequence of events also matters to financial planning. I've only read metal advocates assume the US is immediately headed to much higher or hyper-inflation. There is no reason to assume that other than because the one assuming it ignores how human beings actually act.

Ultimately, inflation and deflation are both psychological, not a mechanical outcome. That's why we can't definitively know the outcome in advance.

I'm telling you that there is absolutely no evidence for your premise that government officials will turn on the "printing press" as the first solution to a future crisis.

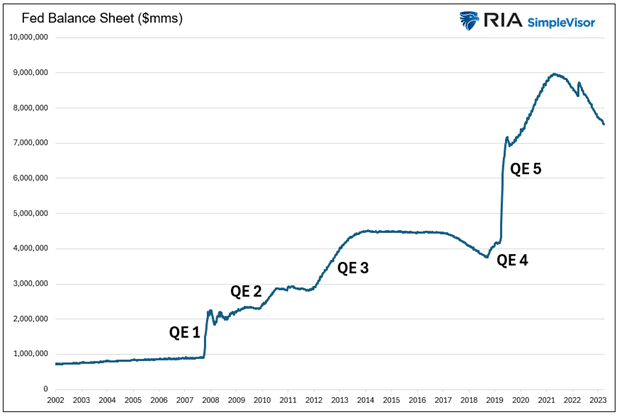

They've turned on the printing press at every crisis since 2008. They've learned their lesson? LOL

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

Comments

>

The country isn't in an emergency, regardless that some act as it is one. The courts don't have an army, and in a real emergency, all sorts of unexpected things will happen, and public officials will do things no one expected, with the public who is destined to be "thrown under the bus" first being the most surprised.

You're too psychologically committed to rising metals prices. This is apparent in most of your posts. I expect both to rise in anticipation and up to some point in a crisis, but in the scenarios you've brought up in multiple threads, the vast majority of metal advocates aren't going to get rich or escape mostly unscathed either as you seem to think. In the scenario of this thread should it ever happen, the vast majority of Americans would end up poorer or a lot poorer and not just temporarily.

Silver is cheap relative to gold and to my knowledge, most other commodities. Gold is historically overpriced versus most of the things people need to buy. I don't know when it's going to happen, but longer term, I expect gold to lose substantial relative value versus the goods most people need to buy, meaning anyone who owns a disproportionate pct of their wealth in it will be negatively impacted too. There is no "forever" asset which can be bought "forever" and forgotten.

The world isn't populated by a bunch of robots whose behavior can be predicted in advance. Short of "the noose", neither elites nor public officials have the motives implied in any of your posts. or for that matter, virtually any if any of the posts I've read from anyone else either. For starters, by destroying the currency, public officials are likely to destroy their own wealth, possibly the value of their pensions, and whatever they do might not save their elected office either, if elections are even still held. The US isn't a developing country where unstable governments are BAU.

The long-term interest cycle almost certainly turned in 2020. The last rising cycle lasted from the 40's to 1981. It will take a while but higher interest rates will really "bite" corporate debt because leverage is a lot higher and coverage ratios are substantially artificial for reasons I've given you previously.

Aggregate credit quality is weak or very weak now. Ultimately, I expect rates to "blow out" past the 1981 highs.

Credit card debt isn't material enough to be the source of a credit crisis, and neither is consumer debt collectively. But substantially rising default rates triggering substantially tighter credit conditions have an outsized impact on household finances than reflected in aggregate economic date.

The majority of Americans are either broke or marginal financially. They rely on credit cards and loose auto financing to maintain their often-unaffordable lifestyles, especially during times of higher employment. Most people seem to resist cutting back more than marginally, even when faced with adverse circumstances.

You don't actually know that.

If the US government ever decides to "print" to finance government spending, the first thing I'm doing is sending most of my money out of the country and converting it into another currency. I'll send it elsewhere in anticipation of this occurrence. I won't be the only one.

If the US government ever decides to "print" to finance government spending, the first thing I'm doing is sending most of my money out of the country and converting it into another currency. I'll send it elsewhere in anticipation of this occurrence. I won't be the only one.

If? Whoa! What do think has been happening for the past 60 years? Which country do you think hasn't been deficit financing?

I knew it would happen.

how do you propose we file bankruptcy then?

how do you propose we file bankruptcy then?

Nobody will be in a "position" to "manage" a US bankruptcy. It's already out of control and it's not getting any better. Just don't be owning any debt instruments when it happens, and don't leave a bunch of cash in the banking system.

I knew it would happen.

Your gutter metal was -50% non-inflation adjusted since 2011. Call it Jim's 14 lost years. Almost a decade and a half. THKS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

My cost basis on silver (and on gold, and on platinum) is a lot lower than yours, and I have zero complaints. I buy on the way up, not at the top. And I stopped playing with paper about 45 years ago. ~~~~

I knew it would happen.

Meanwhile, no bank other than JPM among the money centers has made a new high since the GFC.

So the evidence says you are wrong about them "profiting."

.

And that is the PROBLEM: "tens of TRILLIONS of dollar-based loans exist".

The Federal Reserve and other banks fostered the situation [so as to profit from it].

.

And every other country as well has large debts but not like the unfunded liabilities in the USA. I once commented to Gary North on his site that at one point I was 100% invested in gold and other less precious metals and he thought that was "crazy".

I know it as a buyer and as a seller.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

If being 37 Trillion dollars in debt isn't an emergency, then I don't know what is.

1T interest per year and a multiTril budget deficit proposed

how are we going to file bankruptcy?

Why? Do you think Treasury bonds "backing" our money makes it more sound? If unbacked fiat money has no “real value”, then fiat money backed by a bond redeemable only in that same fiat money can have no “real value” either. How can a promise to pay in a currency that has no “real value” realistically serve as backing for the currency itself?

the frn are not backed by anything

the banks that need frn put up collateral. the fed holds collateral for a bank debt. that's different that holding treas where they are interchangeable

ps. even the gold the treas has noted to the fed res to cover some frn is just a paper promise as collateral

frn is just fiat debt

Don't know about that because the number increased by more than a days worth of expenses.

Knowledge is the enemy of fear

But you didn't, as pointed out by others. Most debt is fixed rate. And where did this $63 trillion come from? Total household is about $18 trillion of which 12 trillion is mortgages of which half are below 4%.

Are you including corporate debt? That's almost all fixed also and I could show you a 100,000 issues with coupons under 4%.

Higher interest paid on savings is/was a massive stimulus that kept us out of recession when Fed was hiking rates. So take those rates down to 2% (as one would demand) and consumer spending will evaporate and when coupled with much higher import prices will result in a recession.

Knowledge is the enemy of fear

No they didn't and they don't "profit" from it. You don't understand how the Eurodollar markets work.

And what about the other side of that equation? Thanks in great part to the Fed’s increase in rates, annual interest on the national debt more than doubled from about $2700 per household in 2021 to $7100 per household in 2024. It now takes 50% of all personal federal income taxes collected just to pay interest on the national debt. This is money that could have been used for tax relief or deficit reduction. And all for a “massive stimulus” of 1% above the current rate of inflation.

.

Are you saying that "tens of trillions of dollar loans" is not a problem ?

And banks don't profit from making loans and collecting interest ?

.

If this existed today, then my choices would then be to participate directly in history's greatest bubble. Yes, the one we have now. If I wanted to do that, I'd already be doing it.

Or I could hold USD as a non-interest-bearing asset while still paying the inflation tax I pay now. How would I be better off with that?

Under your alternative, maybe the inflation tax would be lower or maybe it wouldn't. But I do know that I'm not interested in lending to anyone else in history's greatest bubble or indirectly to the USG for free.

I don't own private debt, other than minimal bank balances, because it's almost entirely of garbage quality. Under your scenario, I suppose I could lend my "money" to a bank, but then if you don't believe in USG debt, why would you believe in government deposit insurance either?

It will be perceived as an emergency when the majority of the population's living standard's decline enough to generate political "blowback" and the USG can't do anything about it.

The turn in the interest rate cycle in 2020 should be enough to do that.

On paper, median net worth is increasing, but I'm dubious it's actually increasing measured by "real" value, and not specifically because of manipulations to the CPI. It's that the CPI index isn't an actual cost of living index.