David Hall vs. John J. Ford, Jr. Collecting vs. Investing

DCW

Posts: 7,646 ✭✭✭✭✭

DCW

Posts: 7,646 ✭✭✭✭✭

I'm sure many of you have seen the below video, but it's worth introducing to our newer members as well as others who may enjoy it again:

(Safe link through COINWeek)

https://youtu.be/1N4PJ5Mtkwo?si=Zh8NMQpDcvApOXpQ

https://youtu.be/1N4PJ5Mtkwo?si=Zh8NMQpDcvApOXpQ

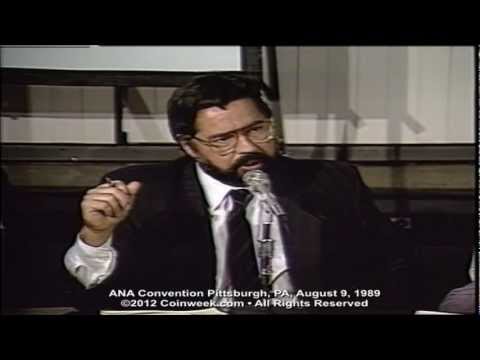

35 years ago this week, founding father of PCGS, David Hall, and numismatic titan, John J. Ford, Jr., went toe to toe at the ANA Convention in Pittsburgh to discuss grading, slabbing, and the age old question of collecting vs. investing. Some decent points from both sides.

It's a short clip but very spirited.

Dead Cat Waltz Exonumia

"Coin collecting for outcasts..."

9

Comments

Would absolutely love to hear from @homerunhall if he would share his recollection of that debate with us!

Dead Cat Waltz Exonumia

"Coin collecting for outcasts..."

You can never win a debate against a guy wearing a bolo.

I have investments which provide me decent income in my retirement. They enable me to engage in my hobbies, which are totally different. Speculative in nature perhaps, but not investments. I LMAO at people who buy Rolex watches as safe queens and follow the value charts. I wear mine and I don't give a Tinker's Cuss what the stinking "market price" is. I enjoy my life and don't wallow in the cesspool of fear and greed.

Thank you for posting this!

Dealing in Canadian and American coins and historical medals.

The irony of John Ford criticizing the slabbing companies for greed and not being on the collector's side.

"Look up, old boy, and see what you get." -William Bonney.

Thanks for posting! I’ve watched and enjoyed a lot of these old videos, but never have I seen this one before.

The only thing that Ford said that resonated with me is when he said that ‘the collector understands, appreciates and loves his holdings more than the investor’.

But David Hall Was right and made more accurate statements when he said that ‘quality will always command a premium’ And that ‘It’s not a flash in the pan. The market has gone up and down, but it is on an upward trend in the long run’. I also like that Hall said that ‘the market is the ultimate arbitrator of value’.

That is very TRUE!

Sometimes, it’s better to be LUCKY than good. 🍀 🍺👍

My Full Walker Registry Set (1916-1947):

https://www.ngccoin.com/registry/competitive-sets/16292/

Thanks for posting the video. What I find interesting is the timing, I'm pretty sure the market crash started at the Pittsburgh ANA. Ford was right about what was coming in the investor market. A lot of coins have never recovered. HRH was also right because over time the market has shown that quality does matter. Great video.

Interesting bit of history. Thanks for posting it!

A couple of strong opinions. I hope I am not the last investor to buy.

I happen to think every collector that buys a coin for more than face value is an investor to some degree. It shouldn't be a dirty word.

I also (at least from the clip, there could be more dialog cut out) didn't hear Ford imply that quality wouldn't bring a premium. He was a very famous coin dealer. Most assuredly, he did not sell VF coins and Mint state examples for the same price. What he did say was that there was a fixation on grade at the detriment of appreciating history and rarity. I'm assuming he meant this more for MS68 common date Morgan dollara than 1870-cc quarters.

Of course, in the end David Hall was ahead of his time and certainly leveled the playing field for collectors and investors who never bothered to learn to grade for themselves.

(Which somewhat proved Ford's original point.)

Dead Cat Waltz Exonumia

"Coin collecting for outcasts..."

Didn't Mr. Ford have some choice words on the show business in general?

Bump for the 35th anniversary of this convention. August 9, 1989.

Time flies

Dead Cat Waltz Exonumia

"Coin collecting for outcasts..."

Speaking as someone with a well thumbed copy of The Franklin Hoard codex, hearing JJF speak of "manufactured rarity" was, haha, a bit rich? But he's not wrong. It's just been taken to the next level.

But he's not wrong. It's just been taken to the next level.

They are both discounting the weight of a thinly traded market on valuation.

"We enjoy the comfort of opinion without the discomfort of thought".