Vegas Dave: The Sports Card Market will Collapse by 2024

https://www.youtube.com/watch?v=GBc5pZvsGaA

https://www.youtube.com/watch?v=GBc5pZvsGaA

Vegas Dave vs Gary Vee, Remember it was me 3 years ago that shook this sports card market by storm and predicted this boom. Everyone laughed at me when I spent $400,000 on a piece of cardboard instead of buying a house or investing it in another opportunity. I made a bold prediction to the world that my Mike Trout rookie card would break the all time Honus Wagner record. 2 years later I executed my vision and the card sold for just under $4,000,000. Not only did this silence the haters and critics, it got the sports card industry to explode. People now viewed cards as a huge money making opportunity and not just a hobby.

Now I am the first person in the world to predict the sports card market will collapse by the end of 2024. This reminds me of the sub prime mortgage industry crash in 2007.

I currently still have money invested in this industry but if what's going on currently in the market does not stop immediately, not only will the card industry die, the hobby will be gone forever as wellAfter watching this video, who do you believe now? Vegas Dave or Gary Vee? Share your thoughts below.

Comments

I wouldn’t be that bummed if we went back to the days of 35 cent packs at 7 eleven. Usually Topps, but every so often Fleer would sneak in there.

Kiss me twice.....let's party.

I have to wait 3 years to get 1983 Topps packs at less than $25?!?!

How many people predicted the world was going to end ?

If you’re into making predictions, you’ll be right every once in a while.

Even a broken clock is right twice a day.

Dave is too focused on today’s prices versus what he paid before (Tatis refractor vs. his Trout refractor example). The equation is simple. Supply of the rare cards is fixed and demand from collector expansion is surging. This means prices will climb until collectors decide to leave in masses. That isn’t happening in the next three years...maybe in 10-15 years, but the kids who grew up collecting in the 80s are here to stay for longer than 3 more years.

He is correct that there will be dips after record sales, but the longer term trajectory is up for the next 15 years. Even his referenced 2007 subprime meltdown lasted only 2 years before giving way to the biggest bull market in history that is still going today (2009-2021). The Fed keeps printing more and more money and interest rates are not going up in the next three years, so cash isn’t an alternative option anytime soon.

Don’t care about Vegas Dave, Gary V, Liberace or Gary Ganu. I don’t need advice about what to buy.

Bitcoin bull run. Dollar soon worthless/ worth less

Traders will trade, spectaculars speculate, collectors will still collect

Does anyone even take this guy seriously?

Collecting 1970s Topps baseball wax, rack and cello packs, as well as PCGS graded Half Cents, Large Cents, Two Cent pieces and Three Cent Silver pieces.

darn. was hoping and praying that VD wouldn't be spread to this board.

Yes, the hobby is falling to pieces. Everyone sell sell sell!! Prices are doomed. In particular, people should stop buying all the cards I'm watching currently. Thanks.

Ripken TT back to $1800. This is great news!

all you really need to know about vegas dave:

Nobody can predict the future and putting it three years out gives this guy plenty of time to hedge his bets.

Does this mean I should sell one of my Bird/Erving/Johnson rookie cards? Unload my hoard of 90 Donruss BB (before they will be worthless, check that, there worthless now so no loss). Asking for a friend.

Lol.

Ok. Im going to agree with this guy. Ill add that everyone who agrees or disagrees will each be able to by 50 T206 Honus wagners, 1000 1952 Topps PSA 9 Mickey Mantles, and why not 1000 1993 SP Upper Deck Jeter PSA 10s for a grand total of $2.50. So lets just make sure everyone who owns these should take $2.50.

Mark my words. We will all have this option by the end date of never.

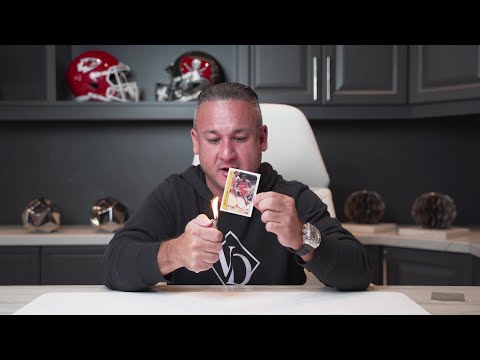

the magic johnson "rookie" burn. pretty sure there's a couple of felonies in there too.

don't worry, you only have to get a minute in or so...

So is he saying modern pack sales or the whole market? What part or all? Or just the cards he burns?

Interesting video, two thoughts:

number one why did this video need subtitles was it because he was yelling the whole time?

And number two do we have any proof that Vegas Dave is not also the Crisser?

Also the market crashing in three years is that a super bold prediction? Is he prediction the prices in three years will be lower than they are today or prices will go up for three years and then come down from there but still be higher than they are today?

Join the Rookie stars on top PSA registry today:

1980-1989 Cello Packs - Rookies

100% Vegas Dave is not the Crisser😀

I'm well versed on financial history regarding bubbles. The Dutch tulip bubble from the 1600s is one of the most famous ones.

I remember first reading about the Dutch tulip bubble as a young kid, and it almost seemed like a work of fiction. I mean why would folks crazily bid up the price of tulips?

Right now, i don't see these baseball card price rises as a bubble. There are a number of discernible reasons for the price rise, and I don't see anything crazy about it.

Not yet anyway.

>

I don’t know, it seems like quite a few of these boxes are checked....

https://www.companisto.com/en/academy/recht-steuern-und-hilfsthemen/so-erkennt-man-eine-spekulationsblase

Very good article. Thanks for the link.

I just briefly scanned over it, and plan to go back to it later when i have more time and absorb it.

I may have missed this in my brief review of it, but i didn't see anything there about "herd mentality" although it may have used different language for that term.

Herd mentality is basically a prerequisite for all bubbles, and there is nobody who can accurately predict herd mentality as to when it will start or when it will end.

I just don't see the situation yet with the baseball card price boom, with everybody and their grandmothers wanting to buy baseball cards.

However if grandma approaches and says to you, "I'd like to sell all my utility stock, and invest in baseball cards", that may be a signal of a bubble about to burst.

The entire basis of that article identifying a "bubble" is hinged on "intrinsic value".

Intrinsically, an asset's price is determined by supply and demand. Currently, there are far more people wanting to buy certain cards/sets than there are sellers/inventory, so the price of these assets is increasing. Due to the incredible size and speed in which these new buyers are entering the market, the "intrinsic" value of these assets is rising exponentially.

But let's say at some point in the future there is a max exodus of buyers and the prices of cards return to pre-runup prices. Even if that were to happen, the hobby would not be affected and it would not be like the card manufacturers would suddenly find themselves bankrupt and forced to close.

This is why the comparisons of this surge in pricing to the housing crash of 2007-2008 are flawed. In the housing crash, it directly affected the overall economy and led to people losing their homes, and drove a stake into the economy as a whole. Is there a chance people could lose significant money by buying these cards? Of course. But there is no difference between these investments or any other "traditional" investment and none are guaranteed.

@BriantheTaxGuy

The primary difference between assets like stocks and commodities versus collectibles is that traditional assets have an intrinsic value. For a stock, the performance of the company. For commodities, the item itself (oil, pork bellies, etc.) has intrinsic value. These valuations are independent of the price at which the asset is trading.

Collectibles have no intrinsic value. Rather, their value derives only from people wanting them, for whatever reason (nostalgia, bragging rights, etc.) This makes it particularly challenging to determine a “reasonable” price and to identify when “irrational exhuberance” has kicked in.

But it’s important to determine why those buyers want to buy the cards and sets. Are they buying them as end users, or to try to flip?

I'm convinced, everything is for sale.

It doesn’t matter. In the housing crisis people were taking out huge loans from the banks. They were bad loans. Lots of people could not repay during the crisis and banks were stuck with the mortgages.

Name one person you know who is getting a loan from a bank to buy cards now ?

I would guess that except for card businesses, the only money driving this market is disposable income.

There are big spenders that have come our way. They sell a few hundred shares of Tesla to get that Mantle rookie.

This card market is on very stable ground. It’s where the rich come to play. The wine and fancy car markets will always do fine too.

Sorry, Dave. Not all of us invested over $4 mil in Derek Carr cards.

I could easily see prices for the big ticket cards coming back down, though not to previous levels. The same thing happened to cards like Roberto Clemente where prices spiked from under $10k to over $100k in a relatively short period of time. There's some question about the legitimacy of the $100k plus 'sales' but the card was legitimately approaching six figures at worst. Today, the card has settled in at $35k-$40k. Still more than 4x the pre-peak market price but 2x to 3x below the peak. I expect the same will happen with relatively common cards like the Jordan RC. The only difference is that he has a stronger international following than Clemente which may keep prices up.

i totally get what you're saying. but very different in regards to the 1600s. imagine eating the blandest stuff forever and then columbus' boat hits the harbor w this new thing called "spice"? guy basically rolls a "wheel" into town. 😉. game changer.

studied these things extensively as well. most important thing to take away is that any and every bubble is completely different and created because the dynamics are either new or the times have changed. for tulip mania, it was like going from no tv straight to color tv. everybody wanted a sea of color in an otherwise dull landscape. it's not like every house could roll into home depot and scroll the paint aisle for your pick of 1000 different colors. walls were either brown or dirt grey. a single tulip in the room was a status symbol. it's easy to look back and laugh because we're talking flowers today and now they're readily available. back then though everybody wanted in, similar to the 80's junkwax boom where every auntie m was going to sams to buy a pallet of topps. things were steadily rising and consistent...until they weren't.

again, i whole heartedly agree with what you said. laughed myself when learning about as a youngster. and even took a while to fully comprehend to understand each unique situation for what it is/was.

300 years from now they'll be laughing about us and prices paid for cardboard, i can assure you.

"children set your borg to 149s.a2. we are going to discuss cardboard mania from the covid era"

This guy just wants to be talked about. Doesn't take a genius to know that your gonna make money buying a Trout RC Superfractor. Aside from that, this guy is just so cringeworthy.

Vegas Dave admitted taking steroids so it’s 50/50 that Andy Pettitte remembers this video.

Atlantic City Crisser?

<<< each unique situation >>>

Enjoyed your post, and you are so right about "each unique situation."

I sincerely doubt if Nostradamus himself could have predicted around the middle of last century that children's playthings retailing for a cent a card, would be worth this kind of money today.

One thing for sure, it will be quite interesting to see where it all goes.

Crisser predicted the collapse in 2020. Dave predicts a collapse in 2023. Too bad they cannot just enjoy this awesome hobby and stop worrying about the monetary value of the cards they claim to love.

I am not paying any attention to a guy that sold Mike Trout cards to “invest” in Derek Carr

going back and taking some time to marinate on venereal dave's video. it's funny because he said all these cards would burn however did anyone notice just how much effort he put into attempting just to get them to burn? it was no easy task. i certainly thought vintage cardboard would go up in smoke alot quicker than that. of course, i dont go around lighting my cards on fire either.

the 86 magic card sat for a solid 30 secs w/ a lighter to it and only really got the bottom corner. he actually burned himself at one point too.

then when the money actually started burning, he panic'd hard. this guy didnt even have the foresight to have a bucket of water nearby knowing he was going to "attempt" to start a fire inside his own house. he can predict a market crash but cant predict he might need some water standing by just in case? hmmm.

the only way this could of went better for me is if his whole house woulda went up in flames. imagine trying to make that insurance claim?

i dont know, the signs are everywhere w/ this guy. and the only word that keeps coming to mind is "clown".

I'm convinced....Buy Everything!!!

YeeHah!

Neil

This guy and a lot of "you tubers" are only in it for profit. Buy a card for $5000 and flip it next week for $10,000. They are not collecting cards as a hobby like most of us. They "create" a frenzy, profit off of it, then when it gets so bloated it crashes... they get out. We will still be looking for cards to complete our collections and they will move on to another area to exploit.

make a few mill on a mike trout card just to lose it on a bad derek carr investment is unbelievable.

i'm a manute bol fan. but i'm not liquidating mantle to corner the market on my main man manute!

Well said. They know nothing about collecting.

I just think the guy is lonely and needs a hug.

not it.

the trolls on his Twitter feed are hilarious omg

I think he's right to an extent on some of the soaring prices especially for modern. People "outside" the hobby are "investing/buying/selling" right now because they can make money here instead of other normal channels. Once they hit the ceiling they will cash out.

why 2024? curious how he derived that particular time slot

He retranslated the Mayan calendar, obviously.

The Mayan calendar is so 2020. Everyone knows the real future of trading cards is hidden within crop circles.

corny. 😉

(literally only)