Do You Believe? - An Update to the Budget Outlook: 2020 to 2030 - from the CBO

MsMorrisine

Posts: 36,878 ✭✭✭✭✭

MsMorrisine

Posts: 36,878 ✭✭✭✭✭

CBO projects a federal budget deficit of $3.3 trillion in 2020, more than triple the shortfall recorded in 2019, mostly because of the economic disruption caused by the 2020 coronavirus pandemic and the enactment of legislation in response.

Current maintainer of Stone's Master List of Favorite Websites // My BST transactions

0

Comments

I think it is already much higher. isn't the amount of stimulus already over $3Tril?

"Official" $2.9T but "actual" $4.2T. Our gooberments addiction to debt is reminiscent of a heroin junkie on skid row. Semper Fi!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

mostly because of the economic disruption caused by the 2020 coronavirus pandemic and the enactment of legislation in response

FIFY:

mostly because the politicians have no concern about how their decisions affect people who work and save - as long as they can dish out goodies for votes

I knew it would happen.

And increasing spending while reducing revenues. Dummies.

Deficit will be much higher than predicted every year

Knowledge is the enemy of fear

This madness is obviously unsustainable. Low interest rates are obviously not a forever thing, but debts are. Politicians don't even pretend to care any more.

Here's a warning parable for coin collectors...

Governments these days, with their laws and their processes and their collecting of taxes and issuing and spending of money.

Harumph!

Liberty: Parent of Science & Industry

And increasing spending while reducing revenues. Dummies.

Deficit will be much higher than predicted every year

Hey, we agree. Go figure.

I wonder how long MMT can remain in play before as Jim Morrison once said, "before the whole ----house goes up in flames"

Got metals?

This madness is obviously unsustainable. Low interest rates are obviously not a forever thing, but debts are. Politicians don't even pretend to care any more.

Got metals?

Governments these days, with their laws and their processes and their collecting of taxes and issuing and spending of money.

Harumph!

You said it, man. Note that they are spending other people's money, not their own.

Got metals?

I feel sometimes as if I repeat myself.

I feel sometimes as if I repeat myself.

Got metals?

I knew it would happen.

I do think "risk-free" low interest rates are here to stay. As it is, the interest rates are generally inversely proportional to the perceived Risk the lender takes that the borrower will default, and the recoverable recourse.

Cash on deposit to an established bank earns practically nothing, as should be. Something like an insured house can be foreclosed upon, fairly low rate, to a qualified borrower. A used car loan, or credit card higher rate. Payday loans and other borrowing from Loan sharks highest rates.

Makes sense.

Liberty: Parent of Science & Industry

_I do think "risk-free" low interest rates are here to stay. _

Baley, you are a bight, informed person, and I do respect your points of view.

But honestly: do you really believe that anything (low interest rates, rap music, backwards baseball hats, tofu burgers, SnapChat posts) are "here to stay?" And that the particulars of "perceived risk" are "here to stay" as well?

Now, I grant that Covid has required massive infusions of cash to stave off an equally massive Depression, but I'm genuinely and honestly gobsmacked that punitively informed people believe that the consequences are, well, inconsequential, and we can just grow our way out of...what is it now...a 23 trillion dollar debt.

Here's a warning parable for coin collectors...

26.7 trillion and climbing

Out of curiosity, I googled the debt clock. I wondered if I could hold my breath long enough to run up $1,000,000.

Evidently, a million bucks doesn't go as far as it used to go, because I made it past $3 million.

I knew it would happen.

Equivalence of fashion fads to economics?

Inferring inconsequentiality?

Unsure where to begin, since none of that was said, so will end with, a question: when do you think bank deposits will pay more than say, one percent?

Hell, others are talking about negative interest rates for large, safe bank deposits in other threads. Growing one's money involves risk. Protecting ones money involves opportunity cost.

I'm sure discussions of definitions of the words safe and risk are sure to follow, since they're debating terms like bullion, insurance, and investment in other topics like no one knows what the words mean.

I did say interest rates are higher for riskier loans, is that controversial too?

Liberty: Parent of Science & Industry

Don't forget about the massive tax cut enacted in 2017. The one that would pay for itself. Notice how the party in the White House and Senate stopped being deficit hawks.

"I just wish her well, frankly. I've met her numerous times over the years...I just wish her well, whatever it is." -- Donald Trump on convicted sex-trafficker Ghislane Maxwell.

Asked about a pardon for Maxwell, Trump said: "I'll take a look at it ... I will speak to the DOJ," Trump said. "I wouldn't consider it or not consider it"

Hey, what's another bankrupt casino? Run it into the ground and start all over. We'll be back. lol Semper Fi!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

The economy will totally unravel when the FRB loses control over interest which should happen when they have to choose to either defend the USD or let it crash. My bet is the USD will be defended, the economy and public be damned.

It's coming but we are not quite there yet. Even with a $26T+ national debt, still "only" about $16T which needs to be financed, excluding FRB holdings and government "trust funds". It's supportable at current low interest rates as long as GDP can mostly recover to pre-COVID levels.

how could they defend it?

Deficits do not matter when you own the printing press. What matters is "can the inflation caused by printing be indefinitely contained?"

The East Is Buying Gold. The West Is Buying Time.

Contract bank reserves to raise interest rates. Unwind QE to the extent necessary to do the same thing.

Federal government can and I believe will implement all kinds of policies to do so when deemed necessary. Examples include: foreign exchange and capital controls, mandating purchases of US government bonds by at minimum pensions and retirement accounts, tax increases especially on "out of favor" assets, force Americans and US residents to repatriate their foreign assets or get charged with a felony (FACTA anyone?). You get the idea? They can make it very unappealing (even if not illegal) to hold assets they don't want Americans or US residents to own.

Most metal advocates (including on this forum) either implicitly or explicitly believe central banks or governments will "print" to infinity to support the welfare state and if not, at least bail out the oligarch elite.

My prediction is that when the "rubber meets the road", both of these groups will be "thrown under the bus". The American imperial project or (as I call it) empire is a lot more important to those with the most power than placating voters. The elite are also not monolithic and those who are the best known to the public don't necessarily have the most influence either. Many of the most influential are part of social networks (for a lack of a better term) which precede the rise to riches of the celebrity wealthy most people know by multiple decades or even centuries.

I also have an old article by Jeffrey Rogers Hummel (economics professor at Fresno State University) where he outlined the unthinkable, where the US government might actually selectively default on the national debt. I can try to dig up the link if anyone is interested. I agree with him that it's plausible that sinking both the currency and ruining the government's credit are actually worse than just defaulting. The USD as global reserve currency is one of the pillars of American power. It isn't going to be voluntarily abandoned for the reasons most metal bugs believe.

they've already tried to unwind QE and then they had to re-implement it.

a lot of the other stuff is not under the fed res control.

I didn't say all of it was under the FRB control . That's irrelevant, since the FRB is ultimately part of the US government anyway. The decision to reverse QE was a political one. This current QE can be reversed just as it was before. No one "had" to do anything. It was a deliberate choice where any of us can infer different motives for doing it but reimplementing QE now hardly means it will be continued at any cost.

US, using military muscle/threat, forced the dollar on others. Just ask the most decorated marine in US history.

The East Is Buying Gold. The West Is Buying Time.

I didn't read your link but consider this partially true. The examples I gave before are policy measures I expect to be used domestically to defend it's value later, regardless of the cost to the public which if it happens will expose the lie that the government will print endlessly to support the welfare state or the financial parasites. Most of the latter lack most of the political influence ascribed to them anyway and will ultimately end up being huge economic losers. They were irrelevant prior to the bubble and that's where they will mostly revert to later.

Because it's shilling and disinformation from bots and bad faith actors. I'm pretty sure anyone who has a decent grasp on the reality in front of them can see that this is not sustainable. None of this can be repaired. Student loans and renting are gonna snap in half. Health insurance, lol. Auto insurance nobody is using. All the garbage people aren't buying, the flights they aren't taking, birthdays and holidays missed, medical debt incurred.

Something is very broken when a whole generation of people avoid buying homes and having kids. You can slice it all however you want, but a generation that makes 3% of what our most prosperous generation did is terrible. Like how badly does a society have to fail to have a generation not wanna have kids? And said generation gets blamed for not trying hard enough? Lol. What??

Over half of people under 30 live with their parents but Boomers cry about millennials, for example. There are a very many number of things people accept as reality and just don't see the real world in front of them.

How do you arrive at this 3% number? What is the most prosperous generation?

I believe you are trying to say that millennials are not buying houses, but that is completely wrong.

https://www.nar.realtor/research-and-statistics/research-reports/home-buyer-and-seller-generational-trends

Millennials still made up the largest share of home buyers at 38%: Older Millennials at 25% and Younger Millennials at 13% of the share of home buyers. Eighty-six percent of Younger Millennials and 52% of Older Millennials were first-time home buyers, more than other age groups

Millennials are not choosing to not have kids, but are waiting until later in life. Average age of a first time mother has risen from 21 to 26. And quite frankly, i think thats a good thing, and is certainly not representative of a failing society.

Knowledge is the enemy of fear

The level of debt is certainly a measure of a failing society, by my definition at least. It sure isn't indicative of sustainable prosperity or because most people are in good shape financially and can afford current consumption levels. "Wealth" is at record levels, but only because of the asset mania. It has little if any correlation to an actually wealthier society.

The current economy is totally fake, smoke and mirrors. It's totally dependent upon artificially cheap credit and absurdly lax credit standards. "Growth" since the 2009 low in the GFC correlates very closely with the increase in the federal debt. If the annual deficit since 2009 were the same as even 2000-2007, there would have been little if any "growth" in the last 11+ years.

Same story with credit availability and it's cost. The current and recent credit standards are the lowest in the history of civilization. Only in a unprecedented financial mania would anyone lend to such marginal borrowers (most governments, businesses and individuals) and feel confident about it.

Add it all up and it leads to one outcome. The future standard of living of the typical American is going decline and for most, noticeably. Same outcome in most of the rest of the world.

I didn't anticipate COVID but I have said that I thought that the US (and other developed economies) could probably handle one more economic contraction before the wheels start falling off. I'm sticking with this conclusion. It isn't just COVID that led to what we see now but all the cumulative economic distortions from the bubble, going back decades. If it hadn't been COVID, it would have been something else.

Where I differ from some others here is that I expect credit deflation and a market crash first before there is noticeably higher price inflation. No one can prevent this from happening, not any central bank and no government. Inflation and deflation are ultimately psychological but in a credit dominated financial system, there isn't a single precedent where a deflationary credit contraction didn't happen first, not even one.

In the last 40 years, most inflation has been in asset prices. It's also possible that any unwinding will lead to the worst combination, a simultaneous financial market crash with concurrent spiking prices for essentials.

Collapse Is A Process, Not An Event

The East Is Buying Gold. The West Is Buying Time.

We have trillions .... pity there's a minus sign in front if it all. Smart money managers.

``https://ebay.us/m/KxolR5

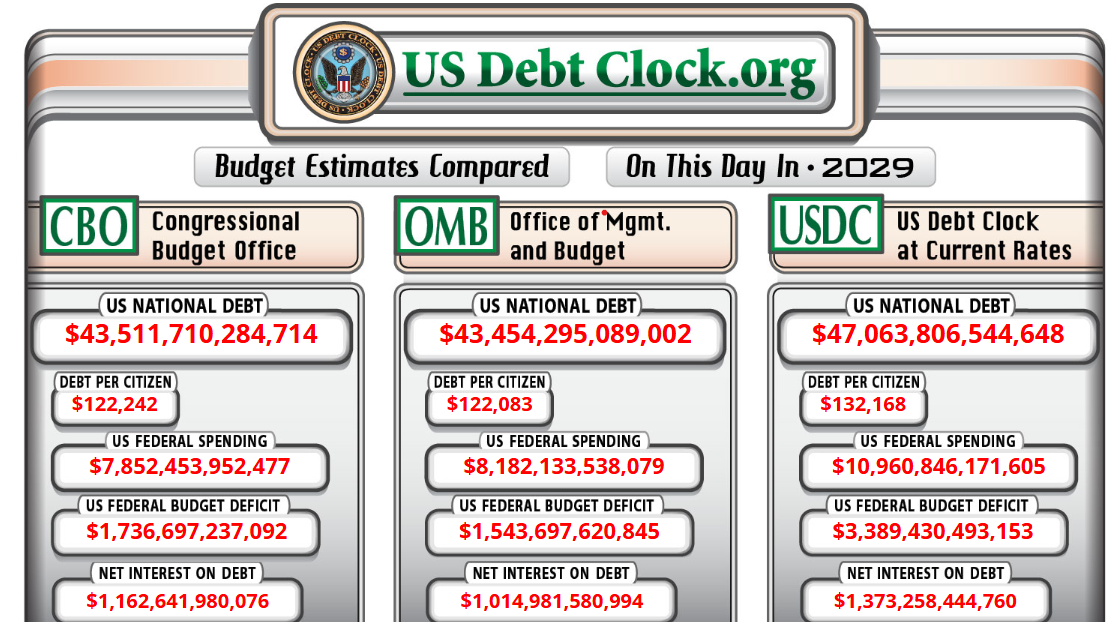

Keep holding your breath, just under 5 years and we have added another $10.5T. BOOMIN!™ RGDS!!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

https://www.cbo.gov/publication/60870#:~:text=In CBO's projections, the federal budget deficit in fiscal year,percent of GDP in 1946.

Updated projections for the next decade.

But of course tariffs will cover this. Lol

Knowledge is the enemy of fear

>

This is the projection 4 years from now using the debt clock "time machine". It is easily possible we could add another $10 trillion to the current number again in even less than 5 more years.

My US Mint Commemorative Medal Set

excuse me