Sure, picking up furniture at the local Walmart might again become the norm because of shipping/taxes etc. But small or light retail items can still be transacted on eBay.

Sure, there will always be stuff that transacts successfully on Ebay. Will it be enough though.

Recall driving by a shuttered Performance Bicycle shop with a lady friend recently. The chain had gone bust in the last year or two. I explained that they had lost a fair amount of business to online sellers.

She said correctly that most people still want to by a bike locally. That is true, but you don't have to lose 100% or 50% of your business to go bust. 10-15% can do it.

@jmlanzaf said:

The only tight margin business on eBay that you are thinking about is coins. That's the party you keep ignoring. Sure, eBay coin businesses MIGHT be doomed. That still leaves the other 97.5% of their business.

And even then- I'm not paying ten bucks to deliver Nikes. I can ship a 1 oz. coin across the country for about 40 cents. What does it cost Amazon to do the same?

@jmlanzaf said:

But small or light retail items can still be transacted on eBay.

@jmlanzaf said:

The only tight margin business on eBay that you are thinking about is coins. That's the party you keep ignoring. Sure, eBay coin businesses MIGHT be doomed. That still leaves the other 97.5% of their business.

And even then- I'm not paying ten bucks to deliver Nikes. I can ship a 1 oz. coin across the country for about 40 cents. What does it cost Amazon to do the same?

Yes, the biggest threat to coins on eBay is not B&M estabishments, it's the numerous tax cheats at coin shows. Hopefully the States will start cracking down on them to level the playing field further.

All comments reflect the opinion of the author, even when irrefutably accurate.

Sure, picking up furniture at the local Walmart might again become the norm because of shipping/taxes etc. But small or light retail items can still be transacted on eBay.

Sure, there will always be stuff that transacts successfully on Ebay. Will it be enough though.

Recall driving by a shuttered Performance Bicycle shop with a lady friend recently. The chain had gone bust in the last year or two. I explained that they had lost a fair amount of business to online sellers.

She said correctly that most people still want to by a bike locally. That is true, but you don't have to lose 100% or 50% of your business to go bust. 10-15% can do it.

Interestingly, your anecdote cuts both ways. The local bike store had SUCCESSFUL competition from online competitors.

It is also worth considering the fundamental difference between the two operations. An online business on eBay has larger incremental costs. A B&M has larger fixed costs. For low volume businesses, the online business will be more successful.

All comments reflect the opinion of the author, even when irrefutably accurate.

@Coinstartled said:

Question is, which one survives...

No reason both can't.

Coke - Pepsi

McDonald's - Burger King

Hilton - Marriot

Lowe's - Home Depot

and to keep it coin related,

NGC - PCGS

Fair enough, but both companies also compete with Wal-Mart and Target and Best Buy and Barnes and Noble and Apple and Home Depot and Kohl's, though there certainly is some cross marketing overlap.

Tax collection has closed the online advantage dramatically over the B&M's.

Huge advantage of AMXN over Ebay is the shipping. They can deliver a pair of Nike's for a couple box while the schlub on Ebay is paying ten bucks.

In a tight margin business which is most of what is transacted on Ebay, the seller- patient won't survive.

But the fast Amazon fulfillment/shipping comes out of the margin, which as you say is tight. Sellers are paying $40 a month (or $1/item) plus about $3-$10 per item in Amazon fulfillment fees. Plus the costs to ship the items to Amazon in the first place and storage fees. Of course this is in addition to the normal about 8-15% fee just for the listing/sale. There's no free lunch for sellers. But Amazon has tons of users, so most sellers put up with it.

@Davideo said:

Sellers are paying $40 a month (or $1/item) plus about $3-$10 per item in Amazon fulfillment fees. Plus the costs to ship the items to Amazon in the first place and storage fees.

Aside from listing fees, sellers are paying a minimum of $4 per item to Amazon in addition to shipping costs?

L & C Coins has an 1880-S Morgan, graded PCGS MS64, on eBay for $95. They have the same coin for sale on Amazon for $104.50. If you're a buyer, which website would you prefer to use?

@Davideo said:

Sellers are paying $40 a month (or $1/item) plus about $3-$10 per item in Amazon fulfillment fees. Plus the costs to ship the items to Amazon in the first place and storage fees.

Aside from listing fees, sellers are paying a minimum of $4 per item to Amazon in addition to shipping costs?

It's not quite so straight-forward. Fulfillment by Amazon fees depend on size and weight and the cheapest is about $2.50. This fee covers the cost to ship to the end buyer. This does not include storage fees or the cost to ship the item to Amazon.

@MasonG said:

L & C Coins has an 1880-S Morgan, graded PCGS MS64, on eBay for $95. They have the same coin for sale on Amazon for $104.50. If you're a buyer, which website would you prefer to use?

At a hundred bucks for a $55 coin, I prefer Bendover.com

@MasonG said:

L & C Coins has an 1880-S Morgan, graded PCGS MS64, on eBay for $95. They have the same coin for sale on Amazon for $104.50. If you're a buyer, which website would you prefer to use?

At a hundred bucks for a $55 coin, I prefer Bendover.com

@Coinstartled said:

Huge advantage of AMXN over Ebay is the shipping. They can deliver a pair of Nike's for a couple box while the schlub on Ebay is paying ten bucks.

That happens because Amazon has those sneakers in several dozen warehouses around the country and it may just be a local trip for the last mile. The eBay seller has product in ONE location and ALWAYS has to drop it with USPS or UPS or FedEx for delivery.

I ordered a new UPS on Thursday night at 9pm. Free delivery between 4:30am and 8am... because it was in stock in a local warehouse.

-----Burton ANA 50+ year/Life Member (now "Emeritus") Author: 3rd Edition of the SampleSlabs book, https://sampleslabs.info/

@dontippet said:

Just found out that Illinois is going to institute their state sales tax on online purchases starting next year. IIRC, precious metals are exempt from Illinois state sales tax. Does anyone know how you go about getting the taxes that ebay collects back?

Don, just spent a few days waiting on ebays' reply have none. 37 states have some sort of exemption's not just ILL-NOISE.

If we call the State Atty General that may work, buy once the blood suckers in Springfield get wind of how much $ it is, you can bet the exemption will be voted out.

Wonder if ebay even turns in tax on exempted items ..... ?

Looks like they fixed this. Just added a bullion to cart no tax then I added a silver dollar to cart no tax. Dollar was in coin dollar category

Oh ya...then I added a manzier and I was charged tax. 😉

@dontippet said:

Just found out that Illinois is going to institute their state sales tax on online purchases starting next year. IIRC, precious metals are exempt from Illinois state sales tax. Does anyone know how you go about getting the taxes that ebay collects back?

Don, just spent a few days waiting on ebays' reply have none. 37 states have some sort of exemption's not just ILL-NOISE.

If we call the State Atty General that may work, buy once the blood suckers in Springfield get wind of how much $ it is, you can bet the exemption will be voted out.

Wonder if ebay even turns in tax on exempted items ..... ?

The Illinois Numismatic Association is, and always will be, against any attempt by the politicians to tax coins, currency, and bullion in our state and also any attempt to regulate the coin business where such laws hinder both dealers and collectors. Add to the fact that Chicago is a major trading center for precious metals and a tax would cause investment firms to relocate to more tax friendly states and cities. I don't think for now that the state wants to "kill the goose that lays golden eggs". I have a post in the US and World Currency section under Heritage want to charge tax on their coins and currency.

DORAN COINS - On Facebook, Instagram, X (formerly Twitter), & www.dorancoins.net - UPCOMING SHOWS (tentative dates)- 12/7/2025 - Mattoon, IL.

You can add Michigan to the list of states that Ebay is collecting sales tax for. After a long phone conversation I ended up with a commitment to “send a note to our tax team”. I offered a link to the Michigan tax law shown below. We’ll see.

GENERAL SALES TAX ACT (EXCERPT)

Act 167 of 1933

205.54s Sale of investment coins and bullion; exemptions; definitions.

Sec. 4s.

(1) A sale of investment coins and bullion is exempt from the tax under this act.

(2) As used in this section:

(a) "Bullion" means gold, silver, or platinum in a bulk state, where its value depends on its content rather than its form, with a purity of not less than 900 parts per 1,000.

(b) "Investment coins" means numismatic coins or other forms of money and legal tender manufactured of gold, silver, platinum, palladium, or other metal and issued by the United States government or a foreign government with a fair market value greater than the face value of the coins.

Comments

It does not. Nexus is based on where the buyer is , not the seller.

All comments reflect the opinion of the author, even when irrefutably accurate.

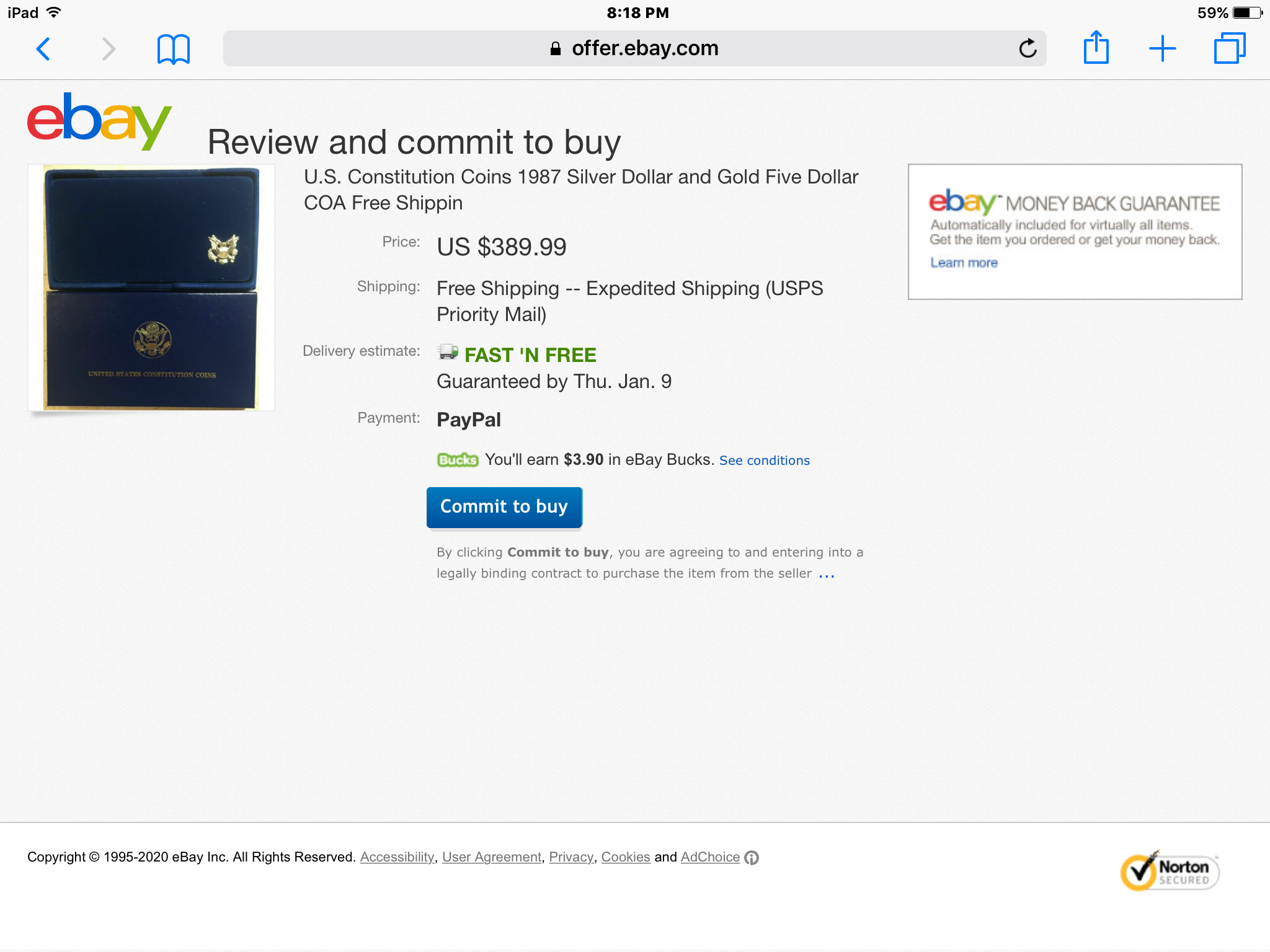

This is in commemorative gold coin section. I don't see tax

Sure, there will always be stuff that transacts successfully on Ebay. Will it be enough though.

Recall driving by a shuttered Performance Bicycle shop with a lady friend recently. The chain had gone bust in the last year or two. I explained that they had lost a fair amount of business to online sellers.

She said correctly that most people still want to by a bike locally. That is true, but you don't have to lose 100% or 50% of your business to go bust. 10-15% can do it.

And even then- I'm not paying ten bucks to deliver Nikes. I can ship a 1 oz. coin across the country for about 40 cents. What does it cost Amazon to do the same?

See above.

Yes, the biggest threat to coins on eBay is not B&M estabishments, it's the numerous tax cheats at coin shows. Hopefully the States will start cracking down on them to level the playing field further.

All comments reflect the opinion of the author, even when irrefutably accurate.

Interestingly, your anecdote cuts both ways. The local bike store had SUCCESSFUL competition from online competitors.

It is also worth considering the fundamental difference between the two operations. An online business on eBay has larger incremental costs. A B&M has larger fixed costs. For low volume businesses, the online business will be more successful.

All comments reflect the opinion of the author, even when irrefutably accurate.

But the fast Amazon fulfillment/shipping comes out of the margin, which as you say is tight. Sellers are paying $40 a month (or $1/item) plus about $3-$10 per item in Amazon fulfillment fees. Plus the costs to ship the items to Amazon in the first place and storage fees. Of course this is in addition to the normal about 8-15% fee just for the listing/sale. There's no free lunch for sellers. But Amazon has tons of users, so most sellers put up with it.

Aside from listing fees, sellers are paying a minimum of $4 per item to Amazon in addition to shipping costs?

L & C Coins has an 1880-S Morgan, graded PCGS MS64, on eBay for $95. They have the same coin for sale on Amazon for $104.50. If you're a buyer, which website would you prefer to use?

It's not quite so straight-forward. Fulfillment by Amazon fees depend on size and weight and the cheapest is about $2.50. This fee covers the cost to ship to the end buyer. This does not include storage fees or the cost to ship the item to Amazon.

At a hundred bucks for a $55 coin, I prefer Bendover.com

Prefer Bendover.com.......

That happens because Amazon has those sneakers in several dozen warehouses around the country and it may just be a local trip for the last mile. The eBay seller has product in ONE location and ALWAYS has to drop it with USPS or UPS or FedEx for delivery.

I ordered a new UPS on Thursday night at 9pm. Free delivery between 4:30am and 8am... because it was in stock in a local warehouse.

ANA 50+ year/Life Member (now "Emeritus")

Author: 3rd Edition of the SampleSlabs book, https://sampleslabs.info/

It doesn't sound like it, not that you'd hear that from some who seem to think so highly of Amazon.

Don, just spent a few days waiting on ebays' reply have none. 37 states have some sort of exemption's not just ILL-NOISE.

If we call the State Atty General that may work, buy once the blood suckers in Springfield get wind of how much $ it is, you can bet the exemption will be voted out.

Wonder if ebay even turns in tax on exempted items ..... ?

Go to checkout. You'll see the tax then.

>

Successful transactions on the BST boards with rtimmer, coincoins, gerard, tincup, tjm965, MMR, mission16, dirtygoldman, AUandAG, deadmunny, thedutymon, leadoff4, Kid4HOF03, BRI2327, colebear, mcholke, rpcolettrane, rockdjrw, publius, quik, kalinefan, Allen, JackWESQ, CON40, Griffeyfan2430, blue227, Tiggs2012, ndleo, CDsNuts, ve3rules, doh, MurphDawg, tennessebanker, and gene1978.

Looks like they fixed this. Just added a bullion to cart no tax then I added a silver dollar to cart no tax. Dollar was in coin dollar category

Oh ya...then I added a manzier and I was charged tax. 😉

The Illinois Numismatic Association is, and always will be, against any attempt by the politicians to tax coins, currency, and bullion in our state and also any attempt to regulate the coin business where such laws hinder both dealers and collectors. Add to the fact that Chicago is a major trading center for precious metals and a tax would cause investment firms to relocate to more tax friendly states and cities. I don't think for now that the state wants to "kill the goose that lays golden eggs". I have a post in the US and World Currency section under Heritage want to charge tax on their coins and currency.

Can we change the subject line to "EBay is one of the companies that Illinois is gonna start taxing as of January 1"?

+1

All comments reflect the opinion of the author, even when irrefutably accurate.

You can add Michigan to the list of states that Ebay is collecting sales tax for. After a long phone conversation I ended up with a commitment to “send a note to our tax team”. I offered a link to the Michigan tax law shown below. We’ll see.

GENERAL SALES TAX ACT (EXCERPT)

Act 167 of 1933

205.54s Sale of investment coins and bullion; exemptions; definitions.

Sec. 4s.

(1) A sale of investment coins and bullion is exempt from the tax under this act.

(2) As used in this section:

(a) "Bullion" means gold, silver, or platinum in a bulk state, where its value depends on its content rather than its form, with a purity of not less than 900 parts per 1,000.

(b) "Investment coins" means numismatic coins or other forms of money and legal tender manufactured of gold, silver, platinum, palladium, or other metal and issued by the United States government or a foreign government with a fair market value greater than the face value of the coins.

History: Add. 1999, Act 105, Imd. Eff. July 7, 1999 ;-- Am. 2004, Act 173, Eff. Sept. 1, 2004

Source:

http://www.legislature.mi.gov/(S(asgwxplozyrbcyppr2htoqz1))/mileg.aspx?page=getObject&objectName=mcl-205-54s

Retrieved: January 17, 2020

"A penny hit by lightning is worth six cents". Opie Taylor