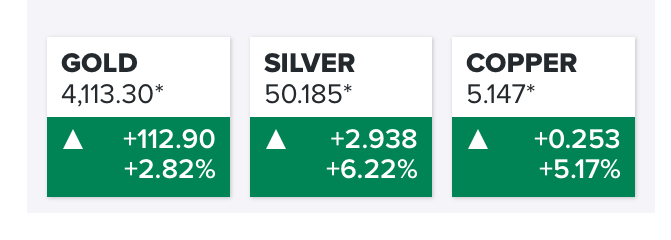

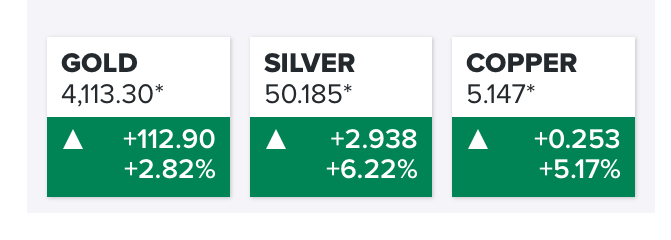

Gold and silver prices skyrocketing today!

safari_dude

Posts: 302 ✭✭✭✭

safari_dude

Posts: 302 ✭✭✭✭

3

safari_dude

Posts: 302 ✭✭✭✭

safari_dude

Posts: 302 ✭✭✭✭

Comments

PM section?

Agree. Wrong forum.

Worry is the interest you pay on a debt you may not owe.

"Paper money eventually returns to its intrinsic value---zero."----Voltaire

"Everything you say should be true, but not everything true should be said."----Voltaire

Exciting times. I read this morning that analystist and B of A are projecting $65 in 2026. This explosion has me seriously considering selling off some of my physical silver which I began buying back in 2004. With three years until my retirement, which is what I've been steadily growing, a few hundred ounce bought in the $7-8 dollar range is a super return to say the least. If I do half will go into stocks and the other as a cash reserve.

I put it here because so many keep commenting on mint premiums……but this shows the premiums are being made up rather quickly. Not sure many even look at the Precious metal forums… I didn’t even realize there was one. Sorry.

Yes it’s a one heck of a bull market for PM - many raising prices on their gold and silver material (especially if slabbed bullion mods in 69 and 70). Others trying acquire more. A bonanza for modern silver and gold Commems too. I like the slabbed ones in 69 and 70. A super RCI double play.

Wonder how much more by end of week? Or is this a long term bull market to some point in time? Yes I can see $65 by 2026 but my gut says higher.

US Coin and Spot Forum:

Silver $52.13

Say a long and welcome goodbye to all those spotted Maples and Eagles!!

Let's get some photos in here. When I sent old worn DE's to Dan to do the Over strikes I didn't think gold would double in such a short time frame. Very rare items with less than 20 sets.

.

.

Successful BST with drddm, BustDMs, Pnies20, lkeigwin, pursuitofliberty, Bullsitter, felinfoel, SPalladino

$5 Type Set https://www.pcgs.com/setregistry/u-s-coins/type-sets/half-eagle-type-set-circulation-strikes-1795-1929/album/344192

CBH Set https://www.pcgs.com/setregistry/everyman-collections/everyman-half-dollars/everyman-capped-bust-half-dollars-1807-1839/album/345572

The key thing for us is what this is doing to the erosion of premiums.

In effect, part of the rise in gold (and silver) is being absorbed by the lower premiums. A coin I am looking at is "only" up about 25% but gold is up 135% since I first put it on my WatchList.

The rise is certainly making some of my AGE’s and ASE’s premium pricing when I purchased them much more palatable now. Unloaded several last year to buy a few want list coins, but now it’s getting even more tempting to unload some more. Heck, even my 2009 High relief that was graded as a 70 that I paid $1200 for could be on the chopping block….. 😉

Many many people are trying to sell, that has caused at least one refinery to stop taking in coins. And dealers are very skittish as some remember the Hunt bros runup and rapid decline and fear a similar event. The upshot is you may have trouble selling anywhere near spot.

My Collection of Old Holders

Never a slave to one plastic brand will I ever be.

I don’t do junk silver. My material is slabbed, one column (on my spreadsheet) which is for MV is CDN CPG. However I may discount some for a large cashflow deal.

This is the time to get rid of common silver and gold coins if you have a good alternative investment for the money generated.

Goodbye.

P.S. Guess I can finally stop wiping them with the Weiman's silver cream. THKS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

Right now everyone wants to pay a steep discount. If the withering demand continues there will be a premium soon enough.

RCI ??

What do you mean a "bonanza for modern silver and gold commemoratives" -- even if you bought cheap (as I did with some of mine) the premium erosion has offset lots of the rise in the PMs. Do you mean buying them NOW is a good deal to BUY because even though gold and silver are up, the premiums are lower ? Or do you mean it's a good time to sell ?

I think when gold rises $300 in a day it'll be the bell ringing.

They shouldn't be skittish.

Back then, silver went up 8-fold in about 14 months. Nothing like that today, it's up about 50% in what....12 months ?

1980 was clearly a bubble. This is a price that will be sustained within 20-30% even if we have a wicked correction in the markets. You're not looking at a 90% decline in coming years or a 50% drop in a few days/weeks.

No disagreement from me, but people are strange animals, and common sense and rational thought are not always the norm when emotions are involved.

My Collection of Old Holders

Never a slave to one plastic brand will I ever be.

Those are some qualities hard to find in a lot of society today.

Paper money eventually returns to its intrinsic value. Zero. Voltaire. Ebay coinbowlllc

.

In 1980 there was only one buyer in the entire world (the Hunt Brothers).

So, of course, that was not sustainable.

Today, even though the American public is a net seller, there are multiple large institutional buyers around the globe.

.