Gold/silver strength vs currency weakness

The recent run-up in PMs is remarkable and strong. How much do people think is due to real strength in the PM versus weakness in the currencies (inflation spending, etc). I think it’s both but mainly strength for PMs, but curious to hear other takes. It’s cheap to issue more virtual currency or government debt, but physical metal has real value / cost.

Junk silver is 30x face. Gold went from $50/ounce to $500/ounce over 25-30 years, and is well on track to go from $500 to $5,000 over the subsequent 25-30 years. Some of this is inflation, but some seems likely to be real baseline demand for PMs.

4

Comments

I completely agree with what you have typed.....although, there is massive political soap opera/theatre at play.. I used to think $5K was a pipe dream but now appears to be an almost certainty....Heck why not $50K???

I got excited thinking about Quadrupling my investment, although my girls certainly did not. 6 eggs from 12 hens today. Thinking about changing my handle to 50%.

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

gold is simply a reflection of faith in the currency.

Foreign Central Banks Now Own More Gold Than USD

If two brothers can squeeze silver to $50, imagine what a world of stackers is about to do.

Blitz.... sounds like you been skimping on the chicken feed so you can buy more silver!! the girls are protesting!

These days, the rise in Gold is nothing more than dollar weakness.

Silver too, but Industrial purchasing has also been a huge factor.

Keep stacking as the US dollar keeps nose diving.

"“Those who sacrifice liberty for security/safety deserve neither.“(Benjamin Franklin)

"I only golf on days that end in 'Y'" (DE59)

The issuance of debt has the majority latching on like more is better.

``https://ebay.us/m/KxolR5

The current regime has bankrupted everything he's ever touched. Not sure why we would expect anything different with the finances of our country. Stable business guru. LuLZ!

I can't and won't ever pay more than $40 for an ounce gutter so I am sure that is not the problem. Besides this time of year, the girls are mostly free ranging so feed costs are at an absolute minimum. More likely they are protesting the stench of what this once great nation is quickly becoming. RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

More likely they are protesting the stench of what this once great nation is quickly becoming. RGDS!

Reported.

End Systemic Elitism - It Takes All of Us

ANA LM, LSCC, EAC, FUN

THKS!! and SMPR!!!

Edit: LOL you are reporting my supposed protesting chickens??? Cancel culture at its most bizarre. THKS for the laughs. RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

Sorry for my delay. I think PMs are just getting started, especially with all of the inflation coming from virtual currencies and debt management.

And I have no hen in this fight, but I had scrambled eggs for breakfast and chicken for dinner. PMs and agriculture have been a safe play since the beginning of time.

From my observation, inflation is definitely a factor, but I think it’s more demand running up the price than anything.

It’s kind of nice to see $40 although it sucks when you’re still buying!

My YouTube Channel

While a "weak" dollar has been a supportive factor for rising gold and PM prices...it is NOT a direct 1-to-1 relationship. Gold can rise with a falling dollar based on supply and demand factors.

Anybody convinced the dollar is going to hell -- I am NOT one of them -- can buy much better hedges than gold.

We have had free-trading gold for only 50 years in the United States, a period of time DWARFED by fixed prices of $35 and $20.67. So we really don't have lots of data points, especially in an era of floating currencies.

PMs were just getting started everytime a new stacker entered the arena.

If two brothers can squeeze silver to $50, imagine what a world of stackers is about to do.

There are two completely different measures of a weak dollar: It's purchasing power at home and it's purchasing power abroad. Inflation is the measure of dollar weakness at home. The Dollar Index, a comparison with other major currencies, is a measure of purchasing power abroad. 99.999% of Americans could care less about dollar strength abroad. They care what their hard earned dollar will buy in their hometown. Dollar index is irrelevant to most Americans.

Dollar Index and gold tend to have an inverse relationship.

Inflation and gold tend to have a direct relationship.

Dollar has been going to hell (loss of purchasing power) since the Federal Reserve Bank took control of pulling its strings in 1913. Gold is the least risky of dollar hedges. This is why central banks have been recently stuffing their vaults with gold.

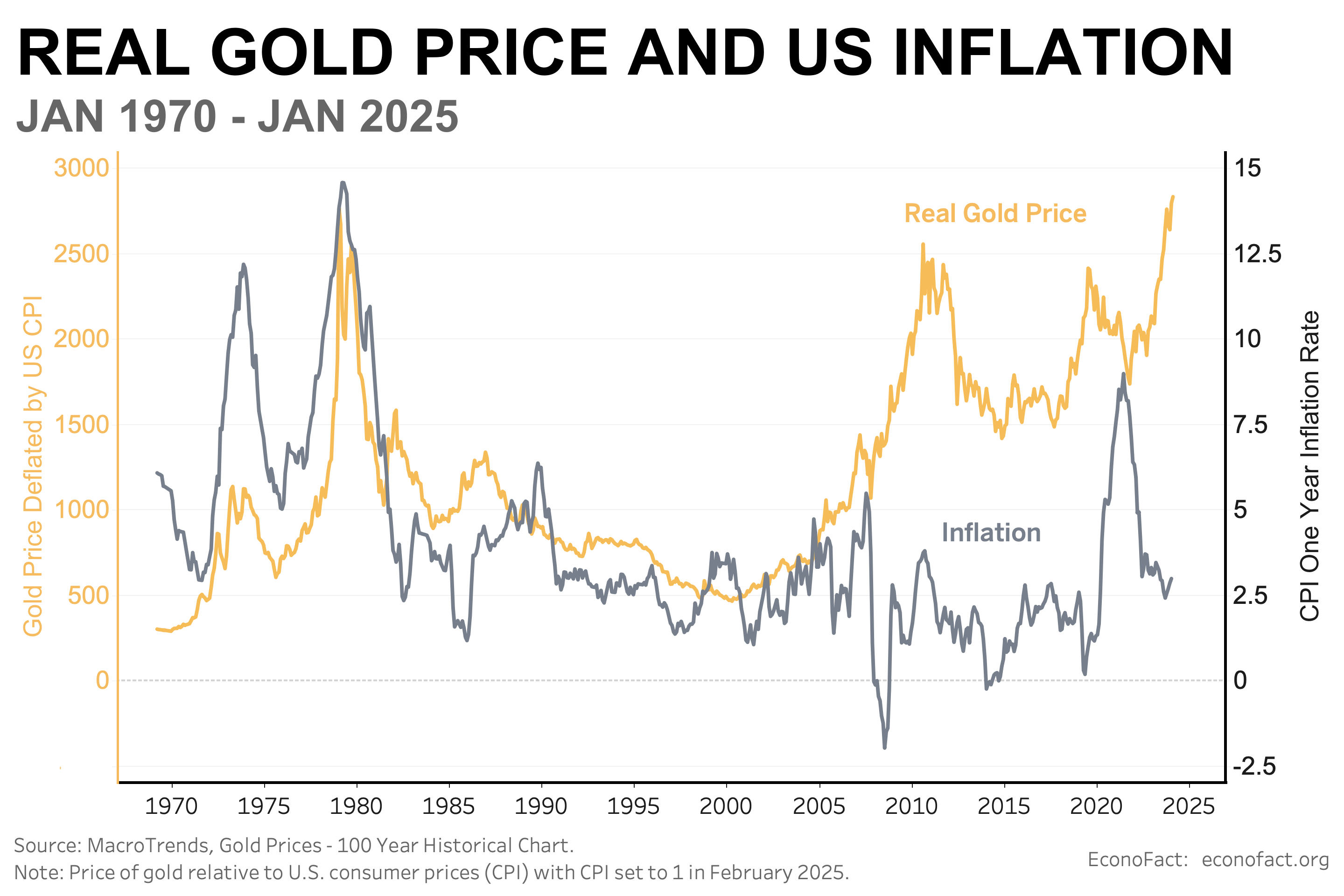

How's this for no "data points" when answering the OP's "Gold/silver strength vs currency weakness" question? Note the sudden change to an inverse relationship in 2008 and then again in 2023. Was the 2023 failure of Silicon Valley Bank, SignatureBank and First Republic the beginning of the next financial crisis that has been temporarily postponed? The continued inverse relationship between gold and our currency might be telling us this is the case.

If two brothers can squeeze silver to $50, imagine what a world of stackers is about to do.

The change in correlation since 2008 is partially due to the US government CPI report being manipulated to show lower inflation than the real cost or higher prices of goods or assets for both political and economic reasons.

My US Mint Commemorative Medal Set

GM, I'm unaware of any change in CPI calculations at that time. The major change was in the early-1980's when an imputed "cost to rent" was used in the Housing component. Hedonics -- taking into account better products for less $$$ (i.e., PC's and semiconductor chips/smartphones) -- has long been debated but is also well-known.

I wouldn't even call previous changes manipulation. They are well-vetted changes....they go through a multi-year peer review process.....and they are based on facts. If they weren't, the bond market and investors would revolt against the use of the information if it weren't valid. You see these doubts with economic statistics in many of the BRIC countries that some here love....also, Argentina pre-Milei.

The "some" here don't love BRICS+ nor do they love China, they are simply smart enough to foresee the danger/affect that they have and will have on king dollar's role on the international stage. It's already happening unless you are in denial.

Does this mean you feel the hurricane forecasters at the weather channel "love" hurricanes? LOL

If two brothers can squeeze silver to $50, imagine what a world of stackers is about to do.

I heard the same Doom-and-Gloom stuff regarding Japan in the 1980's.....Germany in the 1990's....China in the 2000's and 2010's. All turned out to be as disastrous as Y2K.

Our financial markets are the most transparent, deepest, biggest on Planet Earth. If the anti-dollar, pro-silver crowd wants to publish their track record going back decades betting against U.S. financial assets, I am all for it.

Gloom and doom. LOL Are those hurricane warnings also gloom and doom?

Unfortunately that has not been enough to keep the currency strong at home. It's decline in purchasing power bears witness to its weakening. Pro-silver doesn't not equal anti-dollar. My desire for a strong dollar (I too am forced to use them) is not enough to prevent its decline. Like others my PMs are the least risky hedge. Unfortunately "Go America" will not save its currency.

If two brothers can squeeze silver to $50, imagine what a world of stackers is about to do.

Derry, hurricanes show up in size every year. Just the size and quantity is in doubt.

The financial crashes you are predicting, the Black Swan events, are non-existent. They are UNIVESTABLE events like investing based on a coming asteroid crash into Earth.

That is why your gurus have no investment performance worth advertising. I know, I've followed many of them for close to 50 years.

.

In case you hadn't noticed - there is already a "revolt" of sorts against the official numbers and against the fiat currency.

I take great exception to your statement that some people here "love" BRICS.

No one has ever stated anything of the sort (except for making the claim against others, as you have done).

Commenting about a world development is not an endorsement of it.

.

Since 1971 when removed from a gold link the dollar has seen approximately 4% per year currency debasement vs so-called 2%-3% Fed or government CPI numbers. Call it due to hedonics, housing cost to rent type revisions, or whatever you prefer, to me it is manipulation. I see more inflation in real life than the official numbers. Current stock prices and other assets like housing are examples of inflation well above the CPI%.

My US Mint Commemorative Medal Set

.> @GoldFinger1969 said:

The only thing I have been predicting/preaching on this forum is the slow decline in the dollar's purchasing power at home and it's slow demise on the world stage, even explaining the causes and the reasons. Tell me I have been wrong.

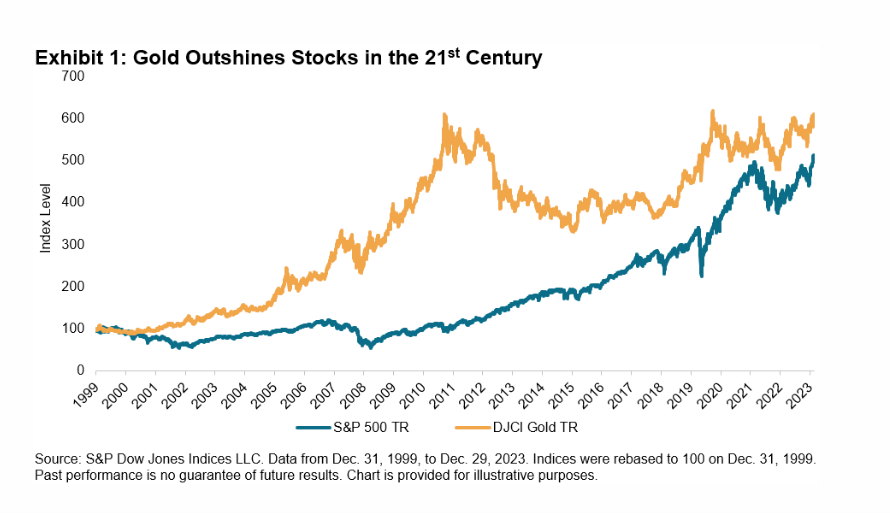

Yet my gurus' result was gold outperforming your gurus' SP500 for the past 25 years. Go figure.

If two brothers can squeeze silver to $50, imagine what a world of stackers is about to do.

@derryb: That chart doesn't include the past 2 years, which would show an even greater outperformance by gold.

I knew it would happen.

Just imagine when these foreign holdings get back to the levels of the late 70's and early 80's.

Anyone who may be Implying the BRICS, and the dozens of other countries who are fed up with our recent US tariffs, sanctions, and basic bullying, are "fake news" and not meaningful to the discussion of future PM pricing, may have a bias towards the US banks, financial markets, and the Treasury.

My US Mint Commemorative Medal Set

The CPI is most certainly doctored to hide what the real rate of inflation is and it started with Arthur Burns, the Federal Reserve chairman during Nixon's presidency. Burns demanded changes in the construction of the CPI because it exposed the real inflation that he and his Fed cronies insisted was not that high. History, of course, has shown that Burns was full of excrement.

https://www.project-syndicate.org/commentary/fed-sanguine-inflation-view-recalls-arthur-burns-by-stephen-s-roach-2021-05

But it does show the massive underperformance over the last 15.

Knowledge is the enemy of fear

yet gold still outperformed since 2000. LOL

If two brothers can squeeze silver to $50, imagine what a world of stackers is about to do.

And under performed since 2005 when you joined the forum. Lol

Knowledge is the enemy of fear

The Guru likes to cherry pick his dates. I love me Au but there is no dispute that my stocks have FAR outperformed The Metal of Kings. RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

Also, with the S&P you’d either be getting dividends or dividend reinvestment. With that included the comparison isn’t particularly close. It also sets the starting point at a high point of the S&P before a large decline.

.

Maybe that is the setup right now ?

.

Certainly possible re: the S&P. In 1999 gold was at a multi-decade low, down more than 50% since 1980. That chart is just the most opportune time period and not factoring that the S&P spins off dividends.

That's how the GuRu's aka metal pumpers/salesmen like to roll. RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

That's how the GuRu's aka metal pumpers/salesmen like to roll. RGDS!

If you really feel that way, why do you hold any gold?

Have you ever considered that the paper pushers of bonds, etfs, and every other dollar-denominated asset want to keep the wool over your eyes while the dollars that those assets are convertible into drop like a rock? Good luck with that.

You denigrate silver and yet you buy the paper version. What's that all about? Do you really think that you can out-maneuver JPM in SLV with your push-button strategy? Good luck with that as well.

Maybe you should be buying 30 year Treasuries from coho. After all, they will provide you with a guaranteed 4.5% return after 30 years. Or maybe you should pile into the time-honored 60/40 portfolio recommended by certified financial planners for the past 45 years.

How about stablecoin? After all, they will be "backed" by US Government Treasuries. What could be better? Do it, man! What's holding you back? Don't you trust the paper pushers at gov.com?

I knew it would happen.

.

That is how Mr. SLV pumper/salesman likes to roll.

SLV has a NEGATIVE 0.5% per year "dividend" (fee).

.

An interesting read:

Why the Hardest Money Always Wins

by Nick Giambruno

French Emperor Napoleon III reserved a special set of aluminum cutlery for only his most honored dinner guests. Ordinary guests had to settle for gold utensils.

In the mid-1800s, aluminum was rarer and more coveted than gold. As a result, aluminum bullion bars were included among France’s national treasures, and aluminum jewelry became a status symbol of the French aristocracy.

Aluminum—element 13 on the periodic table—is abundant in nature, but it’s typically bound up in complex chemical compounds rather than found in its pure metallic form.

Extracting pure aluminum from these compounds was an extremely costly and complex process, making it harder to produce than gold. The price reflected that.

In 1852, aluminum was around $37 per ounce, significantly more expensive than gold at $20.67 per ounce. But aluminum’s story was about to change dramatically.

In 1886, a groundbreaking discovery enabled the mass production of pure aluminum at a fraction of the cost. Before this innovation, global aluminum output was just a few ounces per month. Afterward, America’s leading aluminum company began producing 800 ounces a day. Within two decades, that same company—later known as Alcoa—was churning out over 1.4 million ounces daily.

The price of aluminum collapsed—from a staggering $550 per pound in 1852 to just $12 in 1880. By the early 1900s, a pound of aluminum cost around 20 cents. In just over a decade, aluminum had gone from the world’s most expensive metal to one of its cheapest.

Today, aluminum is no longer a prized metal for imperial feasts or national treasuries. It’s a household material, used in soda cans and kitchen foil.

Aluminum’s dramatic fall from luxury to ubiquity highlights a key monetary principle: “hardness”—the most important quality of a good money.

What Aluminum’s Collapse Reveals About Good Money

Hardness does not mean something that is necessarily tangible or physically hard, like metal. Instead, it means “hard to produce.” By contrast, “easy money” is easy to produce.

The best way to understand hardness is as resistance to debasement—a crucial trait for any good store of value and an essential function of money. Would you trust your life savings to something anyone can create effortlessly? Of course not.

That would be like storing your wealth in arcade tokens, airline miles, aluminum—or government fiat currency. What is desirable in good money is that someone else cannot make it easily. Hardness can be measured by the supply growth rate—the amount of new supply created each year divided by the existing stock. The lower the supply growth rate, the harder the asset.

Historically, gold has been humanity’s hardest asset. Its extremely low and stable supply growth rate has made it the best form of money for thousands of years. According to the World Gold Council, around 6.8 billion ounces of gold have been mined globally, with roughly 117 million ounces added annually. That puts gold’s supply growth rate at just 1.7%, a figure that has remained remarkably consistent over time.

In other words, no matter how hard humans try, they can’t increase the gold supply by more than 1-2% each year, a trivial amount.

No other physical commodity comes close to gold’s low supply growth rate and resistance to debasement. Monetary commodities like gold and silver have relatively low supply growth rates. In contrast, industrial commodities tend to have much higher rates. A high supply growth rate means new production can significantly impact overall supply—and prices. For industrial commodities, annual production often exceeds existing stockpiles, resulting in supply growth rates over 100%. That’s because these stockpiles are consistently depleted by ongoing industrial use.

Take copper, for example. According to the International Copper Study Group, annual production is around 21.9 million tonnes, while stockpiles are just 1.4 million tonnes. In other words, yearly copper output is more than 15 times the size of existing reserves. Because industrial processes consume copper continuously, stockpiles remain low, and new production has an enormous influence on prices.

The bottom line: An asset cannot be a reliable store of value if its price is vulnerable to the whims of ever-changing industrial conditions. That’s why a high supply growth rate disqualifies a commodity from being good money. Three key factors can explain gold's exceptionally low supply growth rate of 1.7%:

First, gold is indestructible. It doesn’t corrode or decay, which means nearly all the gold ever mined still exists and contributes to today’s stockpile.

Second, gold has been mined for thousands of years, unlike platinum and palladium, which have only seen a couple of centuries of production.

Third, industrial processes don't significantly consume gold, unlike other metals. As a result, most of the mined gold remains in circulation.

These three traits mean gold’s existing stockpiles are massive relative to new annual production. No one can arbitrarily flood the market with gold, making it a neutral, reliable store of value. This is what gives gold its unmatched monetary properties.

Don’t Confuse Hardness with Scarcity. It’s important to clarify that hardness is not the same as scarcity; They are related concepts but not the same thing. For instance, platinum and palladium are much scarcer than gold. Roughly 6.8 billion ounces of gold have been mined throughout history. By comparison, since platinum's discovery in 1741, only about 322 million troy ounces have been mined. For palladium, that number is even lower—around 193 million ounces.

There are far fewer ounces of platinum and palladium than gold—so why aren’t they considered better forms of money? Because despite their scarcity, platinum and palladium are not hard assets. Their annual production is high relative to their existing stockpiles. Unlike gold, these metals haven’t benefited from millennia of accumulation. And because industrial uses consume a large share of them, new production plays a far bigger role in pricing. That’s why their supply growth rates—platinum at 178% and palladium at 83%—are so high. These figures underscore their role as industrial, not monetary, metals. It’s no surprise that almost no one uses them as money.

“Hardness” is the most important trait of a good money. All other monetary characteristics are meaningless if money is easy for someone to produce. That’s why, throughout history, the hardest asset has always won. And why gold has always reigned supreme.

My US Mint Commemorative Medal Set

Edited to add, that although bitcoin is not gold, it does have a shrinking supply rate that will provide it with potential upside under this logic. I decided to get a small graded 100K bitcoin clay token that was graded by PCGS. 100K is 0.1 bitcoin.

Just in case for diversification and speculation. LOL

My US Mint Commemorative Medal Set

A quirk of timing bias. You're starting out from a super-depressed multi-decade low (2000) and continuing into the recent rise (2025).

You have to use rolling time periods to eliminate timing bias, Derry.

I started the chart out from when I started out. Rolling time periods do not reflect my performance.

Feel free to compare the two from when you started buying gold. Besides, my comparison for the past 25 years and since the beginning of the century is a relevant timeframe. The fact that it favors gold is irrelevant to anyone wanting a comparison in recent history.

Besides for research, charts are often use to prove an argument/hypothesis/point of view. If I said EXXON gained 85% in the past six years, would a chart that showed the past six years' trading be "biased?"

Interesting how when a relevent chart is posted and it supports one's argument, it is always "biased" or "cherry picked" data to those that can't face the reality of the data. Note that those few here never call it "inaccurate" data - isn't accuracy what matters? Hopefully anyone looking at a chart also considers the timeframe. I view stock charts daily and while daily activity is what is most important to me, all time periods warrant consideration.

If two brothers can squeeze silver to $50, imagine what a world of stackers is about to do.

BitCoin has done even better but that doesn't mean it is a suitable asset classes for most fidicuary investment obligations.

Gold is very volatile, pays no dividend or interest, and is a metal not a real ownership in a business or a debt obligation secured by fixed assets.

the only "fidicuary investment obligation" an individual investor has is to himself.

It's safe to say that buyers of gold know this yet they choose it for a reason over the products those like you sell.

If two brothers can squeeze silver to $50, imagine what a world of stackers is about to do.

Added some more SLV on the post FED dip. RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

AGQ

Yes, if XOM had done nothing in the previous 10 or 15 years. That's why we use ROLLING time periods to eliminate timing bias. Someone could be cherry-picking the start period....or even if they aren't....it could be luck or happenstance that they start just when a bear market in the asset class ended.

Rolling time periods and Total Return are how true investment performances measure suitability.

It's not a question of bias or being fair or unfair. If you were comparing Gold to other PMs, that would be a better analogy because PMs tend to move together and starting and ending points would be less biased for 2 investments that tend to trade in tandem.

When you have gold which often is counter-cyclical to bonds or stocks.... starting or ending points can mean HUGE changes in overall performance. That's why we use rolling time periods.

An investment professional cares about volatility, drawdowns, total return, and other factors over long periods of time. A 1-time measurement is better than nothing but it is NOT as good as 10 or 20 or 30 measurements which is what you get with rolling time periods.

Last I checked -- and I do need to update, since gold has done well -- but stocks were outperforming in 24 of the last 30 years.

Out just before today’s close.