'Big Beautiful Bill" 1099k changes

I seen where part of the bill was to reset the threshold to the old limits of 200 transactions/$20,000.

Does anyone know if that resets for this year or starts with the 2026 tax year?

1970's Steelers, Vintage Indians

0

Comments

.

Since the bill just became law as of yesterday, I wonder if ebay has changed it on their site from $2500 to 20,000 for 2025?

Terry Bradshaw was AMAZING!!

Ohio State Buckeyes - National Champions

Was wondering as well. Just seen it was part of the bill, but have not seen any videos (youtube), breaking it down like they have before.

You're still required to report the annual income above $600! For those not committing tax evasion the change merely makes it easier for online merchants not for you.

It's the singer not the song - Peter Townshend (1972)

Not even a minute do I buy the whole buh buh buh I'm a man-child japery - Me (2025)

Actually, you are required to report all income. It could be wrong, but I read a 1099k will be generated for $600 in 2025 as planned. The $20,000 and 200 transactions will return in the 2026 tax year.

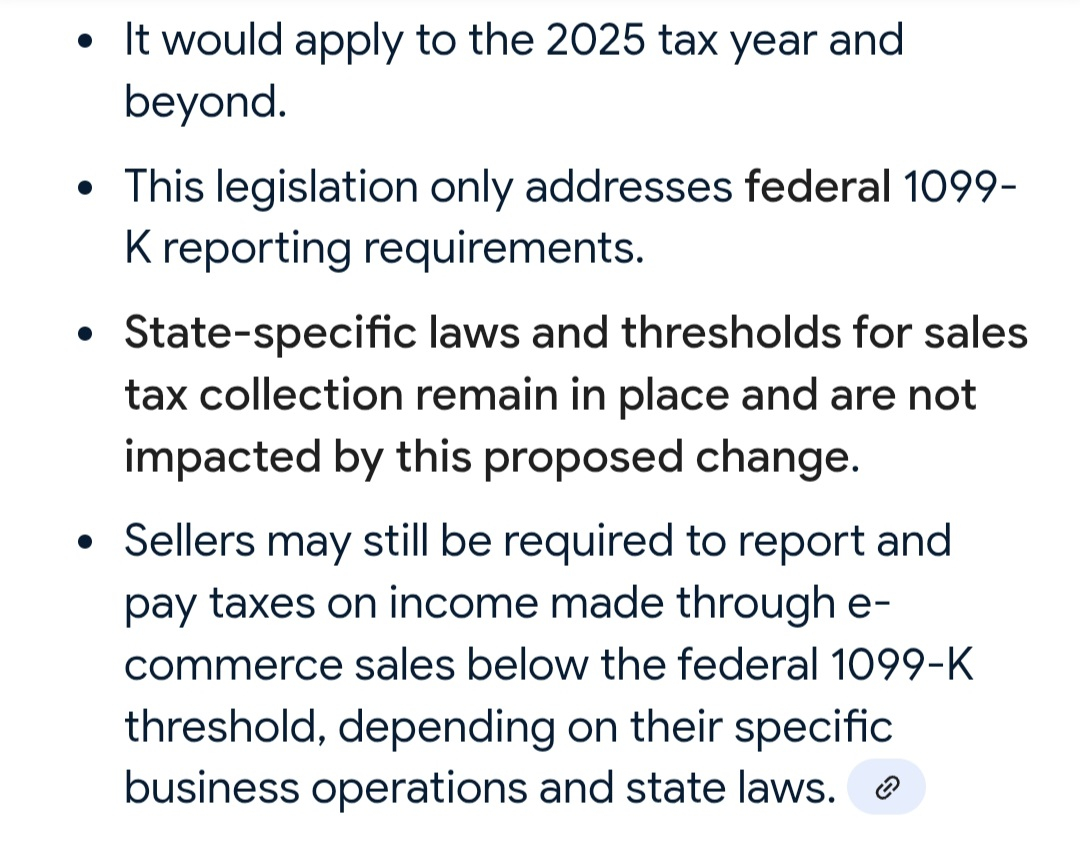

Actually for 2025 it was to drop to $2,500 and in 2026 it would drop to $600. The IRS had a phase in plan.

That has been scrapped now. But is it going to be reset back to $20,000 for 2025 or starting in 2026 is my only question.

Looking like it would be reset Jan. 1 2026.

$2,500 for this year if anyone is interested......or not.

I don't concern myself with what other people are doing.

I don't get why the reporting limits keep changing. At $2500 this year, a seller who sells $2500+ gets an official 1099k with the EXACT amount they have to claim.

Meanwhile, a seller who sells $2499 or less has to calculate the number themself. What if that seller's math doesn't line up exactly with the IRS's numbers? I realize anyone can hire a tax professional, but it just seems backwards that lower volume sellers would be more likely to need to hire a professional to get the correct numbers.

Since all income must be reported, what's the point of even having a reporting limit? Wouldn't you prefer to have an official tax document with the EXACT number so there can be no potential discrepancy, regardless of your sales volume?

Increasing the limit is to help third party platforms like eBay. It’s not for sellers who use the platform.

My 2024 1099K from eBay added sales prices before eBay fees and s&h charges to arrive at the $5,000+ figure. Then, it itemized my expenses as transaction fees and shipping labels, which were deductions from my sales in reporting the income.

Before I received the 1099K, I had assumed I would not meet the threshold unless my sales less commissions exceeded the amount.

Always looking for Mantle cards such as Stahl Meyer, 1954 Dan Dee, 1959 Bazooka, 1960 Post, 1952 Star Cal Decal, 1952 Tip Top Bread Labels, 1953-54 Briggs Meat, and other Topps, Bowman, and oddball Mantles.

To clarify, my charges for S&H were included in in total sales.

Always looking for Mantle cards such as Stahl Meyer, 1954 Dan Dee, 1959 Bazooka, 1960 Post, 1952 Star Cal Decal, 1952 Tip Top Bread Labels, 1953-54 Briggs Meat, and other Topps, Bowman, and oddball Mantles.

I'm sure there are many who believe it to now be Tax Free income if under the threshold. For some it's merely due to ignorance but for most it's due to purposeful evasion.

The actual purpose IMHO of the reporting threshold being moved up is large corporate entities lobbied against it to reduce their expense.

It's the singer not the song - Peter Townshend (1972)

Not even a minute do I buy the whole buh buh buh I'm a man-child japery - Me (2025)

So for tax year 2026, will the limit be 200 transactions AND $25K or will it be either one of them?

I wonder if the government reaches a point of diminishing returns for low revenue sellers. The administration costs to collect $50 in tax revenue is probably a net negative. I was under the reporting threshold last year and didn't receive a 1099 this year but I still reported the sales. I'm sure a percentage not receiving 1099's will do the same. That will lesson the revenue loss further. So I don't think the government will be losing a lot of revenue from increasing the reporting threshold.

As someone who does this work, the people who received 1099-Ks who were not expecting it were less-than-thrilled to have to pay for additional work. I had a mixture of people - a few who got one for legitimately selling household stuff, for which there would be no income, but still had ot show the proceeds and then back it out as sale of houshold goods. I had a few who had sports ticket sales, and a few who were legitimiately selling stuff to make a profit. All of these resulted in little to no tax obligation. So, I agree with you - there were not a lot of tax dollars here for the additional trouble.

I imagine that sooner or later, the IRS will impliment AI technology into their tax reporting software. then it will be katy bar the door for all the tax cheats. it will be VERY VERY difficult to hide ebay revenue or the like then.

George Brett, Roger Clemens and Tommy Brady.

You could just say that you have no idea what AI is or how it works.

how so? the IRS will be using AI to better and more efficiently track unpaid taxes and increase audits.

George Brett, Roger Clemens and Tommy Brady.

The IRS systems are antiquated. With the cut in the workforce and limited resources, I don't think they are anywhere close to implementing AI.

The IRS has been using computer screening for over a decade. That screening uses statistical models to select returns for audit. Most audits are also done by computer as tax returns are well-structured. The world’s fascination and ignorance with regard to artificial intelligence is impressive.

AI, in this context, is nothing more than a buzzword. It means nothing specific and serves no purpose. Multivariable linear regression all day. Statistics wins in that domain.

I believe it's 20K OR 200 transactions..

BBB reinstated pre-ARPA threshold of $20K AND 200 transactions.