Options

CHINA Announces they will Set Gold Price by years end...

China Will Set Price of Gold (Link)

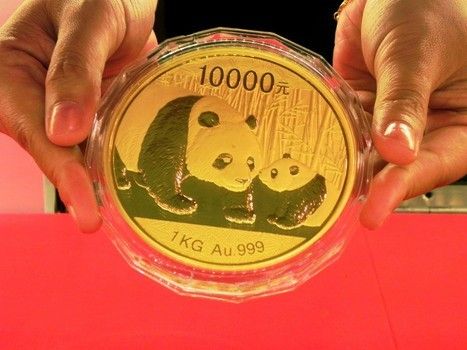

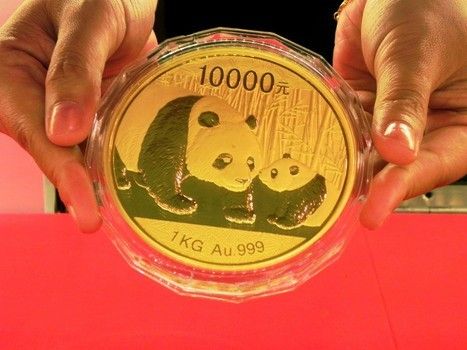

On June 25, a representative from the Shanghai Gold Exchange announced that they are planning on establishing a new physical gold price mechanism by the end of the year that will compete with London and the U.S. Comex. Expected to be denominated in Yuan, this new gold price platform comes less than 10 days after China became the first Asian country invited to be a part of the London gold fix, and unlike the U.S. Comex, will deal in direct physical gold sales rather than in paper futures and derivative contracts.

When the Shanghai Gold Exchange (SGE) opened in 2014, it set out to usurp the West's control over gold and their pricing of gold through the paper markets. And in less than a year, the SGE has created the world's largest gold fund, and is now ready to take over pricing and price discovery for the monetary metal. In fact, sources claim that right now premiums on large sales of gold bullion are ranging as high as $600 over the current paper spot price.

On June 25, a representative from the Shanghai Gold Exchange announced that they are planning on establishing a new physical gold price mechanism by the end of the year that will compete with London and the U.S. Comex. Expected to be denominated in Yuan, this new gold price platform comes less than 10 days after China became the first Asian country invited to be a part of the London gold fix, and unlike the U.S. Comex, will deal in direct physical gold sales rather than in paper futures and derivative contracts.

When the Shanghai Gold Exchange (SGE) opened in 2014, it set out to usurp the West's control over gold and their pricing of gold through the paper markets. And in less than a year, the SGE has created the world's largest gold fund, and is now ready to take over pricing and price discovery for the monetary metal. In fact, sources claim that right now premiums on large sales of gold bullion are ranging as high as $600 over the current paper spot price.

References:Coinsarefun,DerryB,Bloodman,Zubie,Gerard,Skyman,Bestclser1,Lakesammman,Yellowkid,PerryHall,Piecesofme,HTubbs,grote15

Coinfame,Kaelasdad,Type2,UNLVino,MICHAELDIXON

Justacommeman,tydye,78saen,123cents,blue62vette,Segoja,Nibanny

Coinfame,Kaelasdad,Type2,UNLVino,MICHAELDIXON

Justacommeman,tydye,78saen,123cents,blue62vette,Segoja,Nibanny

0

Comments

<< <i>And you can still get slabbed Saints for WAY less than a $600 premium. >>

^ that's rudimentary and key. People might open their eyes to this statement and jump in soon.

Coinfame,Kaelasdad,Type2,UNLVino,MICHAELDIXON

Justacommeman,tydye,78saen,123cents,blue62vette,Segoja,Nibanny

Keep an open mind, or get financially repressed -Zoltan Pozsar

Keep an open mind, or get financially repressed -Zoltan Pozsar

<< <i>And you can still get slabbed Saints for WAY less than a $600 premium. >>

Lol, don't think they have any interest in saints, and they rarely if ever pay a premium for gold...

What happens is that the market participants start buying up whatever supplies they can at higher than A's or B's buy prices and start sending them to C. The market flow will be to C (China/India) until they get their fill.

Dealer's A and B start raising their buy and sell prices. How much gold can the Chinese central bank and the populations of China and India buy? (2.5 BILL people).

<< <i>

<< <i>And you can still get slabbed Saints for WAY less than a $600 premium. >>

Lol, don't think they have any interest in saints, and they rarely if ever pay a premium for gold... >>

Just talking what I am doing. I can't beat China.

I ...can.... anticipate SDB rules and the draconian controls that will come with any parabolic rise in gold.

Is that imminent? Dunno. But I'm set for it if it does.

Seems like there have been more than a few articles posted here and on the web over the past couple of years about someone wanting delivery from the COMEX. The stories just evaporate as does the demand for delivery as the contracts are settled for USD's instead. COMEX delivery is not the same as repatriating physical ala Deutchland, Venezuela, et al. It seems that the COMEX has devolved into a paper market backed by a too small to cover inventory of actual metal. Maybe Texas got it right by setting up its own depository. One thing for sure, the paper boys will wet their pants if gold starts trading physical for Yuan on the world markets while people here are playing with paper gold in USD at the COMEX. There have been a number of articles about China acquiring gold, gold mines, physical deposits of the metal over the last two or three years...read Sun Tzu.

Recommendation: Keep your stash, this is going to get better...and hold out for some of those 24K SLQ's.

Coinfame,Kaelasdad,Type2,UNLVino,MICHAELDIXON

Justacommeman,tydye,78saen,123cents,blue62vette,Segoja,Nibanny

<< <i>I was just thinking of converting my traditional 401 K to Roth IRA and take out the money to buy as much gold as i can before this happens. What do you guys think? Or would this be tantamount to shooting myself in the foot? >>

My crystal ball can't help you on this one....

My own take on it is that it is usually better to diversify rather than place a large one sided bet..... ..... but to each their own.

<< <i>I was just thinking of converting my traditional 401 K to Roth IRA and take out the money..... >>

You don't have to convert it to take it out. Just be sure to hold on to enough to pay the taxes + penalty on the withdrawal.

Too many positive BST transactions with too many members to list.

Liberty: Parent of Science & Industry

<< <i>

<< <i>I was just thinking of converting my traditional 401 K to Roth IRA and take out the money..... >>

You don't have to convert it to take it out. Just be sure to hold on to enough to pay the taxes + penalty on the withdrawal. >>

and probably with a quarterly estimated tax payment to avoid a penalty for waiting until the end of the year on a high amount. The estimate doesn't have to be accurate it all balances out when you file at the end of the year.

Keep an open mind, or get financially repressed -Zoltan Pozsar

Coinfame,Kaelasdad,Type2,UNLVino,MICHAELDIXON

Justacommeman,tydye,78saen,123cents,blue62vette,Segoja,Nibanny

Liberty: Parent of Science & Industry

Maybe it will create what I would've like to have had all along, a true PHYSICAL market price. There will still be the manipulated paper market which is bogus and misleading to follow, but having a true physcal market value would be a good thing and would make it mirror true supply and demand, not what a piece of paper says someone has in hand.

I agree with the above two comments. There will come a point at which arbitrage between the physical market in China vs. the paper market in New York will seriously burn some of the players. Some numbnuts in a financial district will figure out a straddle position between the two markets using ETFs or futures contracts, and someone is gonna want their stuff when it never existed in the first place. China wouldn't be playing in this game if they didn't think they would win it. New York thinks they can do whatever they want. It could be interesting, I hope it doesn't result in more confrontation, but it probably will.

I knew it would happen.

So, if someone buys a 100 oz contract then there is no way for it to be delivered? In that case, it's just a paper play with no anticipation of delivery? All these questions.

<< <i>I hope they don't set it much lower than we've set it

Ahem , 100 years ago gold did not have a price in dollars , dollars had a price in gold

Knowledge is the enemy of fear

Imagine a market where the final consumer got excited about a weekend special on tiny little 1/10 oz shiny yellow coins. Sounds like a strong and vibrant market to me. Haha

Knowledge is the enemy of fear

<< <i>Maybe it will create what I would've like to have had all along, a true PHYSICAL market price. There will still be the manipulated paper market which is bogus and misleading to follow, but having a true physcal market value would be a good thing and would make it mirror true supply and demand, not what a piece of paper says someone has in hand. >>

????????? You have a true phyzz market here??? MTB, Apmex, Prov, Gmart, JM, GainesV, and many more...

What prices in China stays in China...

Gas anyone????

<< <i>". . . premiums on large sales of gold bullion are ranging as high as $600 over the current paper spot price." >>

Who would pay a 50% premium over the offering price of .999 gold coins for bars of gold bullion? Couldn't they save or make a bundle just buying up these coins in quantity and melting them into bars? Just asking.

My Adolph A. Weinman signature

Keep an open mind, or get financially repressed -Zoltan Pozsar

<< <i>China's savers have put aside $21 trillion dollars. With a crashing Chinese stock market and a government that encourages gold ownership look for their personal metal demand to exceed their record sovereign demand. Foreign markets will also benefit as the Chinese look for the best investments. >>

Yup. It's called inflation.

From a Bloomberg article...Text “If they’re going to be gradually opening up to be like the U.S., then vast amounts of money are going to flow overseas,” said David Dollar, who served as U.S. Treasury attache in China and is now a senior fellow at the Brookings Institution in Washington. “I would speculate that it favors the U.S. over everything else.”

The Chinese people love America and want a piece of it. Got stocks? Got real estate?

Gold, just as in this country, will always be the "other" asset class. Attracting money when all the other assets are already gobbled up and unaffordable. Dang relative valuation theory.

Knowledge is the enemy of fear

One that isn't so tied to the admitted manipulated NY market. One where you actually have to have the physical to sell the paper, not say you have it, you actually have to have it if the owner of the contracts actually wants the physical.

I get what you're saying...the mentioned places have it in hand, but their price is tied to the manipulated NY paper market. That's the difference I'm speaking to.

<< <i>????????? You have a true phyzz market here??? MTB, Apmex, Prov, Gmart, JM, GainesV, and many more

One that isn't so tied to the admitted manipulated NY market. One where you actually have to have the physical to sell the paper, not say you have it, you actually have to have it if the owner of the contracts actually wants the physical.

I get what you're saying...the mentioned places have it in hand, but their price is tied to the manipulated NY paper market. That's the difference I'm speaking to. >>

true, but I question this 600 number.

Step 1, don't buy a lot of it at once, take it out under 600 by hitting these places. Sure, it's more trouble, but at a 50% markup per ounce, the trouble gets paid for.

And what moron pays a 50% markup? The only possible explanation is perhaps there is a huge import tax in China and that is the main reason for the mark up? But that is not the way the article is written. it is written that the order was so large for physical that the premium was so high. (the us mint buys like 1 million ounces of gold over the course of a year, btw)

This article I place in the same category as the fake 400oz tungsten story. I think China is trying to manipulate their way into being a player in the market by scaring the world into believing they are the go to place. Wow. We are being soaked. We could sell for $600 more.

Well, they can take delivery on futures contracts and prove what the rumors are. If the gold is not there, the price will skyrocket on its own. Perhaps it is too soon for that for them, as one of their top imports is gold. They still want to buy it cheaply. Funny how that works, huh? The real price is $600 higher, but heaven forbiid the market price actually gets there.

Just another BS story in an attempt to guide gold traders to trading with China. Well, I don't like their tactics and find them fishy. It makes me less prone to doing business with them instead of more. If we want fishy tactics we have the futures markets here and the "London fix" to deal with already.

Oh, and if they are going to, ahem, "set" the price and gold is a top 5 import, will they be inclined to set it high or low?

<< <i>I hope They are able to "price" gold higher so I can sell some... or, alternatively, I hope they price it lower so I can buy some, or, if They do not do either of those, I hope They keep gold the same so I can hold this amount. >>

good strategy.

Liberty: Parent of Science & Industry

<< <i>

true, but I question this 600 number.

Step 1, don't buy a lot of it at once, take it out under 600 by hitting these places. Sure, it's more trouble, but at a 50% markup per ounce, the trouble gets paid for.

And what moron pays a 50% markup? The only possible explanation is perhaps there is a huge import tax in China and that is the main reason for the mark up? But that is not the way the article is written. it is written that the order was so large for physical that the premium was so high. (the us mint buys like 1 million ounces of gold over the course of a year, btw)

This article I place in the same category as the fake 400oz tungsten story. I think China is trying to manipulate their way into being a player in the market by scaring the world into believing they are the go to place. Wow. We are being soaked. We could sell for $600 more.

Well, they can take delivery on futures contracts and prove what the rumors are. If the gold is not there, the price will skyrocket on its own. Perhaps it is too soon for that for them, as one of their top imports is gold. They still want to buy it cheaply. Funny how that works, huh? The real price is $600 higher, but heaven forbiid the market price actually gets there.

Just another BS story in an attempt to guide gold traders to trading with China. Well, I don't like their tactics and find them fishy. It makes me less prone to doing business with them instead of more. If we want fishy tactics we have the futures markets here and the "London fix" to deal with already.

Oh, and if they are going to, ahem, "set" the price and gold is a top 5 import, will they be inclined to set it high or low? >>

If someone wanted it so much that they were willing to pay a 50% markup then they want it to insure against a failure of a currency.

In a failure of currency a 50% markup is trivial . Why worry about it ? especially if you know that the currency you are paying in only has value in the moment.

They are by all accounts delivering physical at this exchange. They don't deliver physical over here in large amounts. Two different markets , why shouldn't pricing be different ?

Lets just wait and see if this has legs then it will probably become obvious that if you want real delivery you go to China and if you want to masturbate over charts and shave pennies over imaginary gold you go to COMEX.

Physical is never going to cost less than paper , who is to say how much more it should cost ?

<< <i> Physical is never going to cost less than paper , who is to say how much more it should cost ? >>

Though this may ring true for you and the avg retail buyer, as a rule it is false... I'm surprised you don't know this or maybe just overlooked it...

<< <i>

<< <i> Physical is never going to cost less than paper , who is to say how much more it should cost ? >>

Though this may ring true for you and the avg retail buyer, as a rule it is false... I'm surprised you don't know this or maybe just overlooked it... >>

I was thinking of large amounts like you would take delivery of from an exchange . I've never taken delivery of any 400 oz bars though so I don't know what it actually costs.

I know if I buy gold coins from my dealer he paid less than the paper price for them when they walked through his door.

But it is true that technically those costs would place that true cost over spot.

Stamping or pouring a bar and having the overhead paid for the shipping, SG&A and all means physical typically costs more than futures prices.

<< <i>

<< <i> Physical is never going to cost less than paper , who is to say how much more it should cost ? >>

Though this may ring true for you and the avg retail buyer, as a rule it is false... I'm surprised you don't know this or maybe just overlooked it... >>

Got a link for a 400 oz good for delivery bar that is priced under the front month paper price?

I'll let you beat the June 2016 quote off CME of 1179.70

Folks that deal in these deal in quantity and average out the per-ounce handling price.

A single bar is a novelty, and quite illiquid all by it's lonesome.

Needs a lot of logistics to ship and insure that will cost the "taker of delivery" quite a bit of extra cash money to get people to spend their PT (precious time) doing.

Liberty: Parent of Science & Industry

For example, a few 1/10 and 1/4 and half and ounce gold coins: very liquid at any coin, pawn, and most jewelry stores worldwide, in exchange for local legal tender you can spend on lunch, a room for the night, or a travel ticket to somewhere else. A 400 oz gold bar? not so liquid! Who can buy it from you or "make change"? They need an assay, they need all these other assurances of authenticity, your legal ownership and therefore "right" to sell it (could be stolen, or otherwise Owned in whole or part by someone else other than you, they need to provide security and insurance and transport and find a buyer, the number of people or business prepared to make you ANY kind of offer, much less a "fair" one, is vanishingly small, almost everywhere, worldwide.

Another example, an "illegal" or borderline legal one in some jurisdictions: A dime bag, eighth ounce, or "lid" (0z.) of marijuana, you can buy or sell almost anywhere in the world. A duffel bag full? not so much.

Or my latest hobby that I'm just starting to get a renewed interest in: edged weapons. A decent repro sword in a historically accurate style is somewhat liquid for $100-200. A "real" museum or advanced collector piece "worth" $10k? Not So Much! Got to go to a relatively major antique store or auction venue. Same thing with firearms: got a decent revolver or auto? easy to sell. Got a full-auto M60 or BMG50? good luck!

Liberty: Parent of Science & Industry

<< <i>Lol, Ms M your linear thinking won't be able to figure it out... >>

if you are talking outside the assumed thinking of a physical buy price and talking about overall costs of trades of "never to be delivered" paper gold v. only trading what you have physical, then I can see your where you are coming from.

<< <i>It's kind of counter-intuitive, but [relatively] large denomination "things" are less liquid and therefore less practical "stores of wealth" than you'd expect, certainly less liquid and convenient than smaller ones.

For example, a few 1/10 and 1/4 and half and ounce gold coins: very liquid at any coin, pawn, and most jewelry stores worldwide, in exchange for local legal tender you can spend on lunch, a room for the night, or a travel ticket to somewhere else. A 400 oz gold bar? not so liquid! Who can buy it from you or "make change"? They need an assay, they need all these other assurances of authenticity, your legal ownership and therefore "right" to sell it (could be stolen, or otherwise Owned in whole or part by someone else other than you, they need to provide security and insurance and transport and find a buyer, the number of people or business prepared to make you ANY kind of offer, much less a "fair" one, is vanishingly small, almost everywhere, worldwide.

Another example, an "illegal" or borderline legal one in some jurisdictions: A dime bag, eighth ounce, or "lid" (0z.) of marijuana, you can buy or sell almost anywhere in the world. A duffel bag full? not so much.

Or my latest hobby that I'm just starting to get a renewed interest in: edged weapons. A decent repro sword in a historically accurate style is somewhat liquid for $100-200. A "real" museum or advanced collector piece "worth" $10k? Not So Much! Got to go to a relatively major antique store or auction venue. Same thing with firearms: got a decent revolver or auto? easy to sell. Got a full-auto M60 or BMG50? good luck! >>

if someone is full of BS and saying "large quantity" is being bought at close to $600 over, then 400 oz is plenty liquid. But if gold were in such tight supply that a "large quantity" can't be purchased but for a 50% markup, where is the global gold bullion disruption -- for the first time I've seen this apparently Sounth African 1oz gold bar and the mint is not on allocation -- besides all the other things I've previously talked about.

Expectation of a currency run? No way. It can be rationalized like the fake 400 oz bar story(stories) and people can find ways for it to sound plausible, but that doesn't make it true. I think that car with the jato units strapped to it traveled 300 feet before hitting the stone embankment. Is the backorder status of the Jackie Kennedy proof (just the proof) going to be the market disruption caused by the $600 over order?

The fake 400oz bar story and this $600 over story are pure bs. quack quack.

(notice in the FY2013 mint annual report that the gold working stock bars pictured are on the order of 400 oz each. The mint uses the Treasury's gold to mint and open market buys the re-stocking amount when they make sales. Yet the bars pictured aren't 1 oz'ers, they are 400 ozers. And they do about 1 million toz a year. Yeah... that $600 over purcase was so hard to fill that every mint in the world went on gold allocation. right.)

I don't travel in these circles but I know a couple of people and one is a friend that have 400oz bars in the safe. My friend bought his at a little over 100 large -- he wouldn't miss his. If he got crunched he'd sell it back to MTB.

I knew it would happen.

Keep an open mind, or get financially repressed -Zoltan Pozsar

Take all the gold we own ?

I am.